-15% to +4%: Taylor-rule interest rates for euro area countries

Does one size fit all? Before the crisis, there was a major debate on whether the single interest rate set by the European Central Bank (ECB) would be

Before the crisis, there was a major debate on whether the single interest rate set by the European Central Bank (ECB) would be suitable for all members of the euro area, which have diverse economic conditions. The debate became quieter since the euro-crisis, as there is now widespread recognition that this is not the case. Moreover, financial fragmentation, which has emerged with the crisis, made things even worse.

There is an extensive academic research on monetary policy rules and it is frequently found that a rather simple Taylor-rule, which prescribes the central bank interest rate as a function of inflation and a measure of economic activity, describes reasonably well actual central bank interest rates developments (see John Taylor’s webpage on monetary policy rules here).

In a 2011 FRBSF Economic Letter Fernanda Nechio calculated Taylor-rule recommendations for the euro-area as whole, plus separately for the euro-area core and periphery, basing the rule on core inflation and the unemployment gap. She showed that for the euro-area aggregate the ECB’s interest rate well follows the recommendation of the rule, but the diverse economic developments within the euro-area make the rate suboptimal for the two groups considered separately, and especially for the periphery.

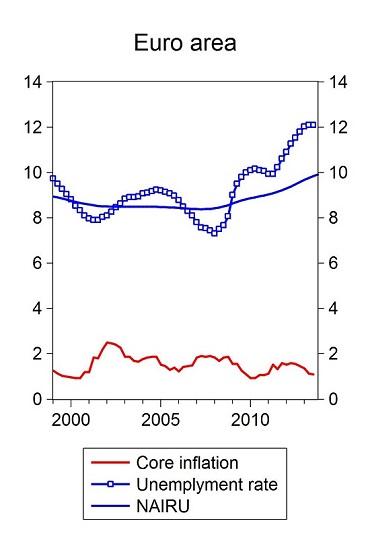

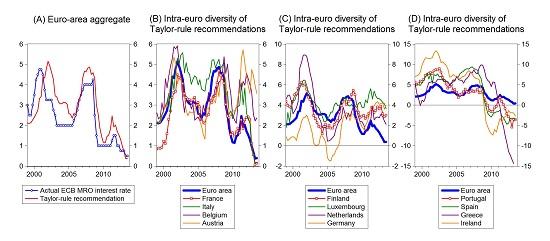

We used Nechio’s version of the Taylor-rule to calculate recommendations for the euro area as a whole, plus for first twelve euro member states individually, over the period 1999Q1-2013Q3. Figure 1 reports our results and Figure 2 the underlying data we use. Panel A of Figure 1 shows the ECB’s actual Main Refinancing Operations (MRO) interest rate and the Taylor-rule recommendation. The two lines are not that far apart, suggesting that this simple Taylor-rule is not a too bad description of actual policies (in most part of the sample period, actual interest rate changes precede the changes in the recommended interest rate, most likely because the ECB’s Governing Council took a forward-looking view and acted in anticipation of future changes in economic conditions).

The next three panels show the recommendations for the twelve countries, in comparison with the euro-area aggregate. The countries are ordered according to the average absolute deviation from the euro-area recommendation in 1999-2013. This ranking is topped by France, suggesting that in this country the developments are the closest to the euro area average. Greece and Ireland are instead the farthest from the euro-area average. The recommendations for Germany, the largest country in the euro area, were also quite apart from the euro-area average but in the opposite direction than in Ireland: the ECB’s policy was too tight for Germany before the crisis, and too loose now, according to the version of the Taylor-rule we adopted.

Figure 1: Taylor-rule recommendations for the central bank interest rate (percent per year), 1999Q1-2013Q3

Notes: Taylor-rule target = 1 + 1.5 x Inflation – 1 x Unemployment gap. Similarly to Mechio (2011), we use core inflation (all items HICP excluding volatile food and energy prices; change relative to the same quarter of the previous year) and the deviation of the actual unemployment rate from the estimated non-accelerating inflation rate of unemployment (NAIRU), as estimated by the OECD. MRO = Main refinancing operations. The 2013Q3 recommendations are based on July-August 2013 inflation rate and the July 2013 unemployment rate.

The most recent recommendations would suggest that conditions in Ireland, Spain, Portugal and Greece are such to warrant even a negative interest rate (minus 15 percent in Greece!), whereas the optimal prescription for Austria, Germany and Luxembourg would be a positive interest rate of about four percent. In theory, such differences can help to rebalance intra-euro price-competitiveness divergences, whereby a boom in Germany increases prices and wages, while the high unemployment in Spain reduces them. But when unemployment is as high as in Spain, increasing unemployment further should not be the way to go and in Germany prices do not increase much despite low unemployment.

Therefore, the other side of the coin is that those countries experiencing the most depressed economic conditions face at present very tight monetary conditions, while countries in which the economic situation is better get loose monetary policy. What is more, the vicious circle linking together banks and sovereigns (whereby banks hold a large amount of debt of the government of their country of residence and are expected to be bailed out by the same government, with negative implication for the debt sustainability of the latter) in some euro-area countries further pushed both banks and governments to the abyss, thereby leading to even larger nominal interest rates.

What’s the solution to this quandary? We note that divergences are not uncommon in other currency areas, like the United States (though certainly less extreme than in the euro area now). In the US, however, the intra-state adjustment capacity, such as labour mobility, is much stronger. Plus there is a large federal budget which helps to smooth regional economic shocks. These would also be the way to go for the euro area: improving cross-country adjustment capacity through rigorous structural reforms, better regulation and proper incentives for cross-country mobility, as well as designing a fiscal capacity for the euro area. Beyond these tasks, the vicious circle between banks and sovereigns should be fully broken. The project of banking union was initially expected to deal with this issue, but to ensure its success a more ambitious banking union would be needed than what is on the cards now. And there is a case, in the first place, to act pre-emptively and limit divergences before they become excessive: the EU’s Macroeconomic Imbalances Procedure aims to do that, and entrusting the ECB with macro-prudential tools – as currently envisaged in the Single Supervisory Mechanism (SSM) proposal – may also help. But these latter tools can only help once the euro-area recovers from the current gloom, which is unfortunately seems to be far off. In the meantime, given the powerlessness of the traditional interest rate channel, other ways to ease the credit conditions in the South of the euro area should be explored, such as improving the access of SMEs to credit, by means for example of a properly designed scheme for targeted central bank lending, after bank balance sheets have been cleaned-up (Darvas, 2013).

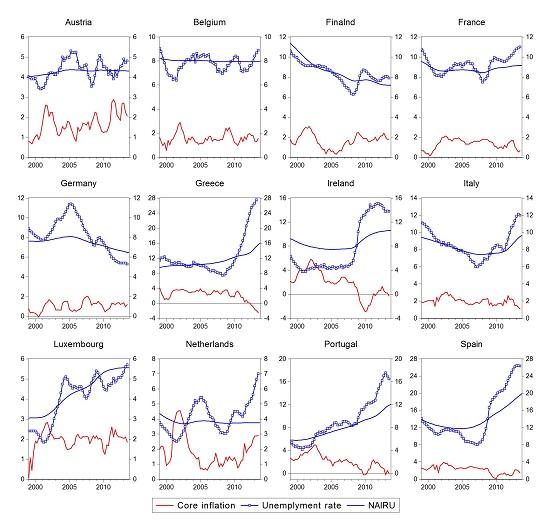

Figure 2: Core inflation, the unemployment rate and the estimated NAIRU (non-accelerating inflation rate of unemployment), percent

Note: the OECD’s NAIRU (non-accelerating inflation rate of unemployment) estimate is available at the annual frequency. We converted it to quarterly frequency by using a filter which assumes smooth change within the year.