Recent real effective exchange rate movements (summer 2013 database update)

We have updated the monthly database up to July 2013, which is downloadable form the website of the working paper.

Bruegel Working Paper 2012/06 includes annual consumer price index based real effective exchange rate data for 178 countries and the euro area, while the monthly database includes 153 countries and the euro area.

We have updated the monthly database up to July 2013, which is downloadable from the website of the working paper.

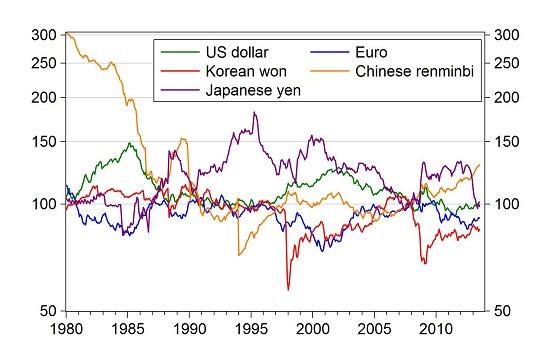

Let us highlight one figure here, which is updated from our earlier blog post assessing the implications of the weakening Yen. Our conclusion remained broadly the same: while the speed of yen depreciation has been rather fast since the autumn 2012, the depreciation has only corrected the yen’s appreciation since the global financial crisis erupted. The current value of the yen’s REER is similar to its value in 1980. In contrast, Korea’s REER is still much weaker now than it was both in 2007 and in 1980. The Chinese renminbi continued to appreciate during the past 12 months by gaining 9 percent in real effective terms, and the euro also appreciated by 7 percent during the 12 months. The latter will make it much more difficult for euro-area members to achieve a sustainable intra-euro rebalancing. The US dollar appreciated by only 2 percent in real effective terms during the past 12 months, despite the talks about QE exit.

Monthly CPI-based real effective exchange rates, January 1980 – July 2013 (December 2007=100)

Source: our updated database for 1995-2013; in the pre-1995 period, the OECD’s REER for the US, Euro area, Japan and Korea, and the IMF’s REER for China are chained backward.

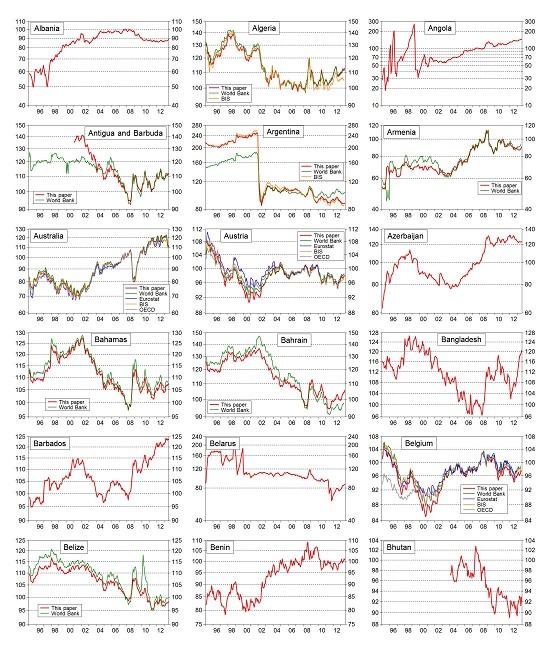

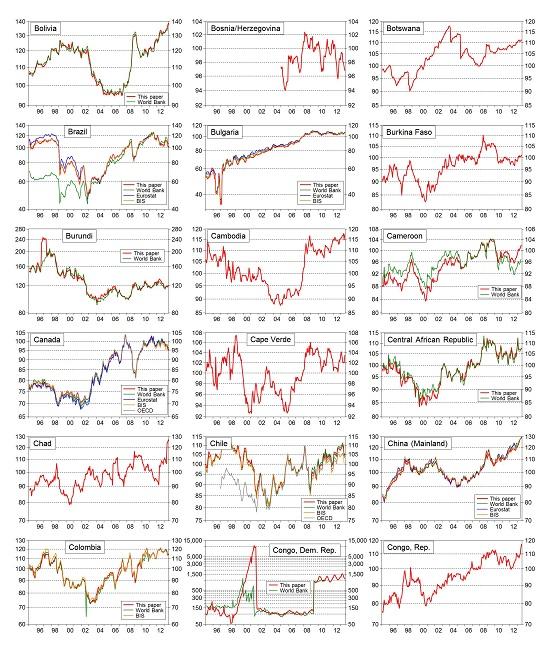

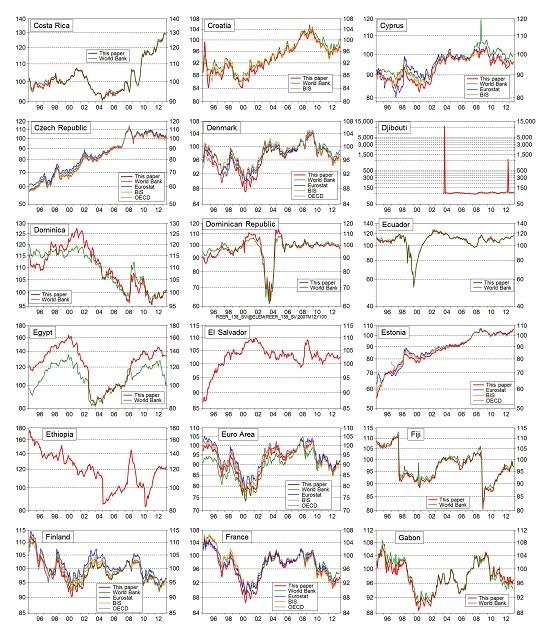

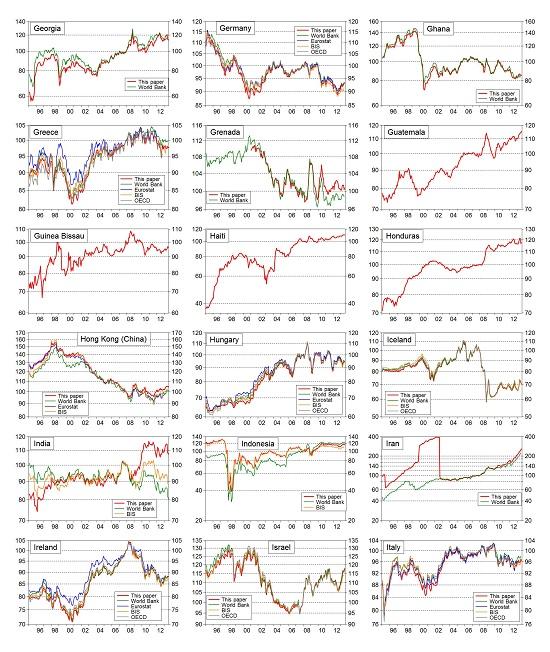

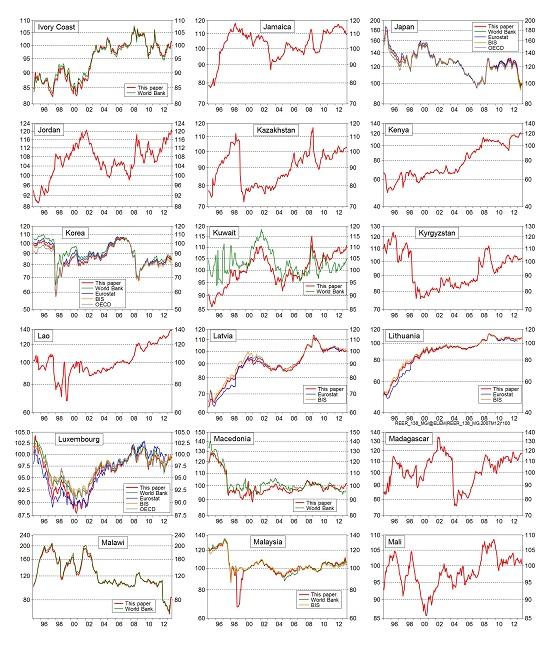

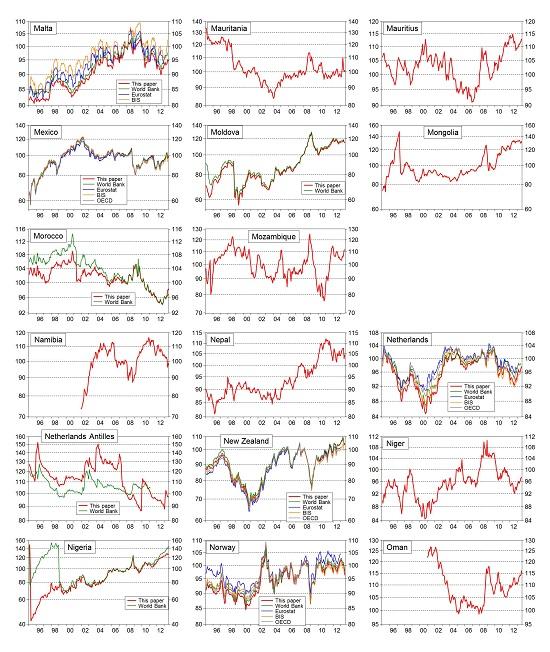

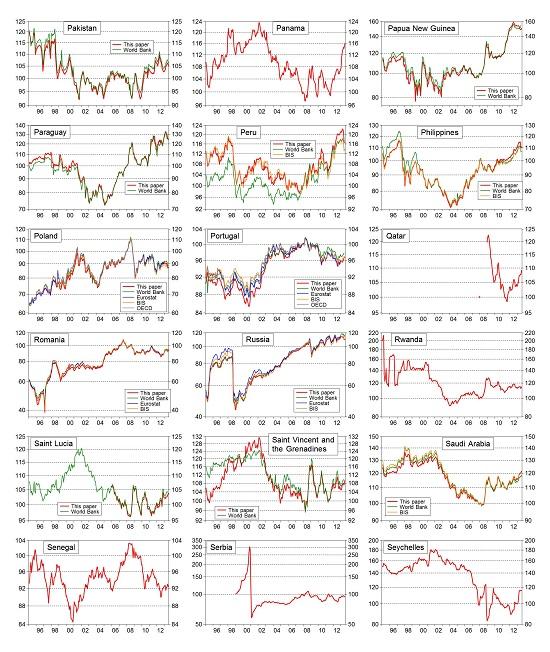

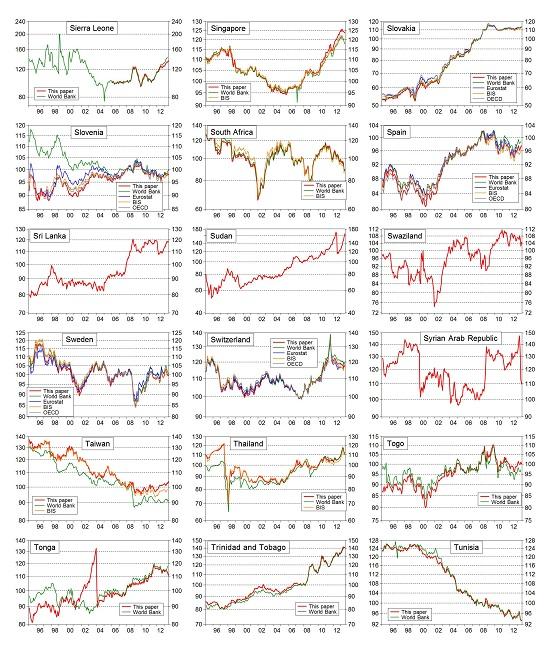

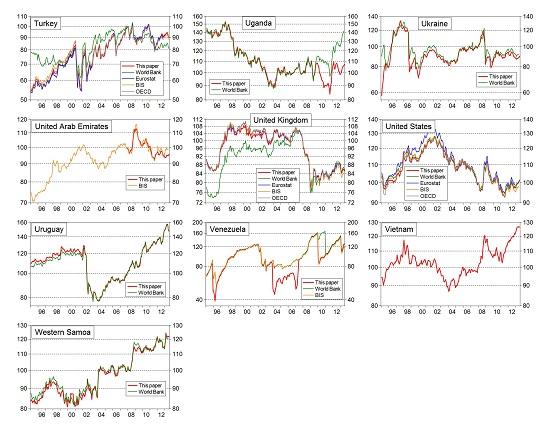

The figure below shows our updated monthly REER series for all countries included in our database* for January 1995-July 2013, in comparison with data from World Bank, Eurostat, BIS and OECD (whenever available). Note that our indicator is calculated against 138 trading partners, many more than in any of the other databases.

a: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

b: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

c: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

d: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

e: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

f: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

g: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

h: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

i: Monthly CPI-based real effective exchange rates, January 1995 – July 2013 (December 2007 = 100)

* For the time being, we removed Myanmar from the database, because Myanmar maintained a multiple exchange rate system and we do not have a consistent time series for the exchange rate. We will report again data for Myanmar when we obtain such a consistent time series.