Deposit flight and deleveraging of the Cypriot banking system – an update

We documented the initial deposit flight from Cypriot banks after the country’s rescue package. The central bank of Cyprus released today data on depo

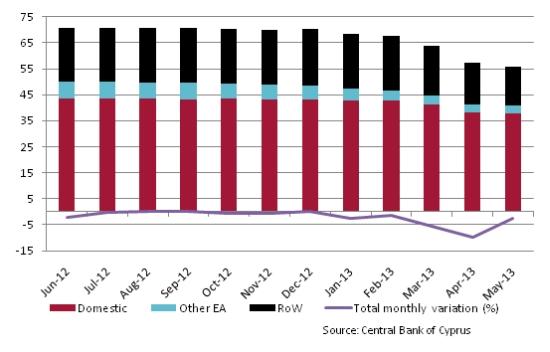

We documented the initial deposit flight from Cypriot banks after the country’s rescue package. The central bank of Cyprus released today data on deposits in Cypriot banks by non-banks at the end of May. These declined by 1.4 bn EUR from a month earlier, i.e. by 2.5 %. This brings the cumulated decline February–May to 17.1 %. In this post we examine the evolution of the balance sheet of Cypriot banks a bit more thoroughly, by inspecting also the evolution of assets and other liabilities than deposits. We also attempt to clear some of the issues with Cypriot data.

Figure 1 and Table 1 break down the decline in deposits based on residency. Foreigners have drawn a considerably larger share of their funds than domestic residents. Many outlets publish figures on Cypriot deposit flight based on ECB data, which does not include deposits from outside the euro area. This gives a misleading picture in the case of Cyprus because its banks had substantial extra-euro area deposits, in particular from Russia.

Figure 1: Total deposits in Cypriot banks by residence (bn EUR) and monthly variation (%) (06/2012–05/2013).

Table 1: Change in amount of deposits outstanding in Cypriot banks.

|

Domestic |

Other EA |

RoW |

Total |

|

|||||

|

Change in bn EUR |

|||||||||

|

Feb-Mar |

-1.3 |

-0.5 |

-1.9 |

-3.8 |

|||||

|

Mar-Apr |

-3.0 |

-0.3 |

-3.1 |

-6.3 |

|||||

|

Apr-May |

-0.6 |

-0.1 |

-0.7 |

-1.4 |

|||||

|

Feb-May |

-4.8 |

-0.9 |

-5.8 |

-11.5 |

|||||

|

Change (%) |

|

||||||||

|

Feb-Mar |

-3.1 |

-12.8 |

-9.3 |

-5.6 |

|

||||

|

Mar-Apr |

-7.2 |

-8.8 |

-16.2 |

-10.0 |

|

||||

|

Apr-May |

-1.5 |

-4.8 |

-4.6 |

-2.5 |

|

||||

|

Feb-May |

-11.4 |

-24.2 |

-27.4 |

-17.1 |

|

||||

Source: Central Bank of Cyprus

The decline in March–April is influenced by the 2.8bn haircut on unsecured deposits in the Bank of Cyprus. Therefore the drop does not represent only withdrawals. Accounting for this, the haircut-corrected decline in March–April was 5.6 %. On the other hand, the 19th of May bail-in of Laiki depositors, is not yet reflected in the numbers.

Unfortunately, there is no data on the incidence of the haircut by residency of depositors although it probably touched relatively more foreigners. In principle it should be possible to disentangle the effects of the haircut by studying the difference in changes in outstanding amounts and net transactions. However, this does not work with the Cypriot data because the haircut seems to have been classified as transactions[1].

Deposits by Cypriot households decreased less in relative terms than overall deposits in February–May (5.8 % vs. 17.1 %). On the other hand, deposits by other euro area households (21.8 %) and extra-euro area households (21.7 %) decreased significantly faster. To some degree this probably reflects the higher incidence of haircuts on foreign deposits. Nevertheless, the decline in domestic household deposits is still smaller than the haircut-corrected decline in total deposits (13 %).

Examining more broadly the development of total liabilities and assets indicates whether deposit withdrawals have resulted in deleveraging of the banking system or whether Cypriot banks have managed to substitute deposits with other types of funding. Table 2 presents the evolution of total liabilities of the banking system. These have declined from 126bn to 111bn February–May, a fall of 12 %. Unfortunately, data is available only on a non-consolidated basis. This skews the results because it is not straightforward to attribute the decline in the balance sheet into a drop in intra-banking system liabilities and a decrease in liabilities to non-banks.

Table 2: Total liabilities (EUR bn) of the Cypriot banking system (non-consolidated).

|

Domestic bank deposits |

Other EA bank deposits |

EA res. deposits |

EA gov. deposits |

Debt securities |

Capital and res. |

Extra-EA liab. |

Other liab. |

Total |

|

|

2-13 |

14.8 |

10.6 |

46.4 |

0.1 |

1.7 |

15.2 |

35.1 |

2.5 |

126.4 |

|

3-13 |

15.6 |

4.0 |

44.6 |

0.1 |

1.8 |

13.9 |

34.4 |

2.6 |

117.0 |

|

4-13 |

17.0 |

3.9 |

41.3 |

0.1 |

1.3 |

17.4 |

29.8 |

2.0 |

112.8 |

|

5-13 |

16.9 |

3.7 |

40.5 |

0.2 |

1.3 |

18.6 |

28.3 |

1.9 |

111.3 |

Source: Datastream.

A partial correction can be done by taking into account the sale of branches of Cypriot banks in Greece to Greek MFIs. This was reflected in the decrease in the amount of deposits of other euro area banks in Cypriot banks by 6.9bn in February–May 2013, which accounted for 46 % of the total shrinkage in liabilities. But even taking this into account, Cypriot banks were not able to fully supplement the decline of deposits by alternative funding. The decline in extra-euro area liabilities was almost completely explained by the decline in deposits whereas non-deposit liabilities remained quite stable.

Consequently, Table 3 documents the evolution of the main asset classes to assess how banks deleveraged. In euro terms the largest declines have been in extra euro-area assets (-11.1bn) and euro area non-equity holdings (-3.1bn). These are also the asset classes with the biggest relative declines, -35 and -30 % respectively. Direct loans to residents have decreased relatively little.

Table 3: Total assets (EUR bn) of the Cypriot banking system (non-consolidated).

|

Loans to EA banks |

Loans to EA res. |

Loans to EA gov. |

EA non-equity holdings |

EA equity holdings |

Extra-EA assets |

Fixed + other assets |

Total |

|

|

2-13 |

21.8 |

57.9 |

1.0 |

10.1 |

0.1 |

31.4 |

4.2 |

126.4 |

|

3-13 |

21.9 |

57.1 |

1.0 |

7.0 |

-0.8 |

25.8 |

4.9 |

117.0 |

|

4-13 |

21.5 |

55.8 |

1.0 |

7.2 |

-0.8 |

22.3 |

5.9 |

112.8 |

|

5-13 |

21.4 |

55.4 |

1.0 |

7.0 |

1.3 |

20.4 |

4.9 |

111.3 |

Source: Datastream.

One could say that the restrictions of financial transactions have served their purpose in the sense that even after correcting for the bail-in, the rate of decrease of deposits in the Cypriot financial sector was slower in the April-May period than in the two previous months. But this does not come as a free lunch. It is still too early to determine the possible side effects of capital controls or to disentangle these effects from those of the many policies related to the financial assistance program. Nevertheless, it is well documented how damaging capital controls have been in most cases during history. The controls also violate one of the primary principles of the euro area: the equivalence of a Cypriot and German euro (Wolff 2013).

Until mid-May the Cypriot government was slowly but frequently relaxing the restrictive measures on transactions; but since then, there has been very little loosening. This is quite worrisome since there is no specific timeframe to lift the capital controls and there has been no news in this regard since more than two months ago. Back then a government adviser said that the restriction would be kept in place until the restructuring of Bank of Cyprus is completed, which is not expected to happen before September.

[1] For March–April the change in outstanding amounts is -6.35bn euros, exactly equal to the net transactions in April. If the haircut was not recorded as part of transactions, net transactions should be smaller than change in outstanding amounts by the size of the haircut.