Is the OECD’s promise of better times ahead a credible one?

This week the OECD released its latest biannual Economic Outlook. The world GDP growth forecast for 2013 has been revised down from 3.4 percent in Jun

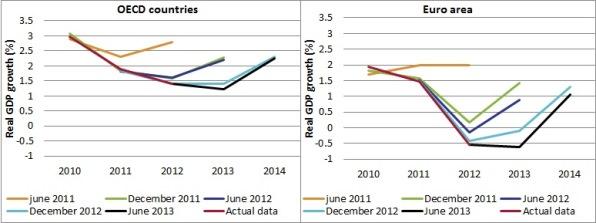

This week the OECD released its latest biannual Economic Outlook. The world GDP growth forecast for 2013 has been revised down from 3.4 percent in June 2012 to 3.1 percent. The group of 34 OECD countries is also expected now to grow slower than projected 6 months ago—from 1.4 to 1.2 percent. But, the OECD projects that the second half of 2013 will see a modest revival of growth and the outlook for 2014 is decidedly better.

Source: OECD

Is the OECD’s promise of better times ahead credible? Consider the euro area: the projection for the euro area was already a bleak contraction of 0.1 percent; the contraction now is expected to be 0.6 percent. But the expectation nevertheless is that growth will be 1.1 percent in 2014. How reliable is the 2014 projection?

In June 2011, the OECD projected that, in effect, the crisis was over. GDP in the euro area was expected to grow at around 2 percent a year. Then, in the fall of 2011, the financial flare-up led to a sharp downward revision of growth forecasts for 2012, but with an expected pick up in 2013. Every six months since then, the growth projections for 2013 have been scaled down.

Thus, from December 2011 when the euro area was expected to be growing by almost 1.5 percent in 2013, the latest forecast is for -0.6 percent, a turnaround of over 2 percent in 18 months.

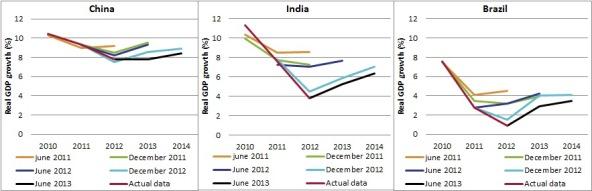

Although such downward revisions have been most pronounced for the euro area, they have been a widespread feature of the forecasts. In particular, the growth projections for emerging economies—Brazil, China, and India—have been similarly scaled down.

To be fair, these persistent downward revisions are not confined to the OECD. The same pattern features in the IMF and European Commission forecasts.

Source: OECD

Are forecasting techniques biased to produce overly optimistic forecast during downturns? Or are the downward revisions the consequence of unexpected negative shocks?

Kahneman and Tversky suggest that human beings have a general tendency to be overoptimistic and to underestimate downside risks. It is possible that policymakers underestimated the contractionary effects of fiscal consolidation and also the spillovers to the global economy from the slowing growth in Europe.

But the large error in 2013 does call for a pause. Unlike in the fall of 2011, when there was a real financial scare, the financial conditions globally have steadily improved. The drag from the fiscal consolidation cannot explain the magnitude of and the repeated occurrence of the downgrading of forecasts. Perhaps, there is more going on? The balance-sheet constraints in the eurozone’s private sector are weighing more heavily than has been recognized? At the same time, emerging economies face greater structural challenges than has been recognized? If so, is there a global growth engine to lift the world economy?

Until we know the answers to these questions, projections will remain suspect. A bounce back in growth may occur in 2014, but don’t count on it.