New EC spring forecasts: high uncertainty dominates outlook for Cyprus

Last Friday the European Commission released the spring update on their economic forecasts for European Union member states and some other advanced ec

Last Friday the European Commission released the spring update on their economic forecasts for European Union member states and some other advanced economies (see the report here and the database here). Negative growth forecasts for the EU and the euro area reflect weakness in the periphery as well as in the core countries. The 2013 growth forecasts for the big European economies were all revised down. Major changes were made to the economic forecasts for Cyprus.

The Commission lowered their real GDP forecast for the EU from 0.1% to -0.1% in 2013. For the euro area they expect -0.4% growth in 2013 (previously -0.3%). Growth is anticipated to “to turn positive gradually in the second half of the year before gaining some traction in 2014” (European Commission 2013). As a result, real GDP is expected to grow by 1.4% in 2014 (previously 1.6%) in the EU and by 1.2% (previously 1.4%) in the euro area.

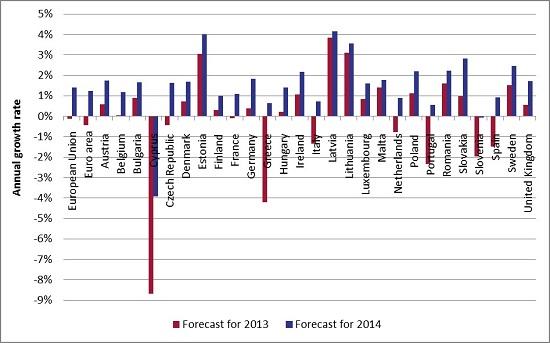

The figure below shows the new forecasts by the EC. The Commission expects nine European economies (Cyprus, Czech Republic, France, Greece, Italy, Netherlands, Portugal, Slovenia and Spain) to be in recession in 2013. Seven of them are projected to return to growth next year.

Figure 1: Real GDP forecasts

Source: AMECO database.

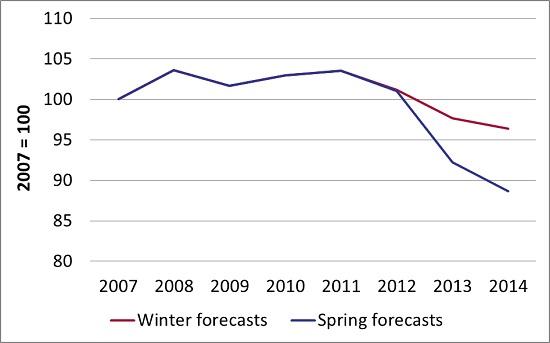

While the latest batch of EC forecasts overall is slightly more cautious, the by far largest changes were made to the Cypriot outlook. Real GDP is expected to collapse by -8.7% in 2013 and by -3.9% in 2014. The following figure illustrates the massive revisions that were made to the winter real GDP projections for Cyprus as released in February.

Figure 2: Real GDP forecast for Cyprus

Source: AMECO database.

Overall the economy is expected to shrink by around 14% in 2012-2014. The Commission expects this as a result of the fast restructuring of the banking sector, fiscal consolidation and generally high economic uncertainty (European Commission 2013). Additionally, the report stresses the negative impact on growth of the temporary imposition of capital controls and the expected decline in private consumption and investment due to the bail-in of uninsured depositors; measures that obviously were not taken into account in the winter forecast. It does not come as a surprise that the unemployment rate is expected to push to unprecedented levels in turn.

The economic projections for Cyprus look similarly painful as the Greek recession in 2011 (real GDP -7.1%). However, bear in mind that for Greece 2011 was only one of several years with negative growth and the Greek economy did not have to cope with the side effects of capital controls and a bail-in of uninsured depositors. These factors make an even faster contraction in the case of Cyprus very likely. One thing is for sure however, they add to the high degree of uncertainty that these forecasts come with. It does not surprise that the Commission sees significant downside risks to their projections due to the implementation of the agreed macroeconomic adjustment programme. In their latest World Economic Outlook (see the report here), the IMF decided to simply exclude any projections for Cyprus due to the high degree of uncertainty that the on-going crisis comes with. The forecasts of the EC for the Cypriot economy have to be handled very carefully. Substantial downside risks exist. Neither of the institutions gives any indication on when the Cypriot economy will return to growth.

References

European Commission (2013), ‘European Economic Forecast Spring 2013’, European Economy, 2/2013.

International Monetary Fund (2013), ‘Hopes, Realities, and Risks’, World Economic Outlook, April 2013.