Italy’s elections had little impact on TARGET2 balances

We documented early signs of improved market sentiment towards struggling euro members in this post at the end of January. Since then, however, Europe

Normalization of capital flows to southern Europe remains slow

We documented early signs of improved market sentiment towards struggling euro members in this post at the end of January. Since then, however, European economic data has been mostly disappointing. Additionally, the Italian election’s unclear outcome has increased uncertainty about the policy direction. Therefore, in this post we look if recent turbulence has put a halt on the normalization of euro area capital flows.

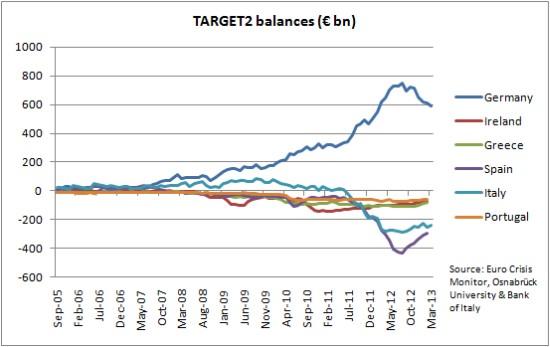

A first indicator are the TARGET2 balances that measure the liabilities of national central banks towards the eurosystem (see here for a clarification of TARGET2). These started to decline after Draghi’s famous speech in June 2012.

The convergence towards balance has broadly continued with net liabilities in February 2013 down by 15–29 % in Portugal, Greece, Spain and Ireland compared to June 2012 levels. Interestingly. Italy released data yesterday for March 2013, which is the first full month since its inconclusive elections. Previously, Italy’s TARGET2 liabilities had declined from 274 bn in June 2012 to 228 bn in January 2013, a reduction of 17 %. They then increased again in February to 256 bn. The March data, however, revealed a decrease in net liabilities back to 243 bn. The surprising election result did not therefore seem to increase the reliance of Italian banks on central bank funding. The effects on government bond yields have also been limited. Although the 10-year yield shot up from 4.4 % to 4.9 % immediately after the results were released, it has since decreased back to the pre-election level.

We have also been tracking private capital flows since the piece by Merler and Pisani-Ferry (2012) on sudden stops. This data extends now until 2012Q4 for Ireland and January 2013 for Italy, Spain, Greece and Portugal. Private inflows have rebounded in Italy, Spain and Portugal, where cumulated inflows are now higher than in June 2012. Nevertheless, Greece and Ireland have continued to experience private capital outflows since last June although these seem to have stabilized in recent months.

Our final metric, the share of foreign holdings of southern European sovereign bonds, has been updated only for Ireland and Italy since our last post. In Ireland, the share of non-residents had dropped slightly from 72.6 % in September 2012 to 71.7 % in January 2013.[1] In Italy, foreign holdings dipped from 40.6 % in September 2012 to 39.7 % and then rose slightly to reach 40.3% at the end of the year.

All in all, the data suggests that recent bad economic news have not so far resulted in resurgent capital outflows from southern Europe. Nevertheless, the wider release of early 2013 data could yet overturn this conclusion if sentiment has recently deteriorated, for instance after the clumsy Cyprus rescue. Additionally, future challenges await – especially so in Italy, where the formation of a solid government is still dependent on overcoming many institutional and electoral hurdles. Finally, if analyzed from the opposite direction, the pace of normalization is clearly not fast enough to bring along a speedy recovery.

[1] In February, the share dropped to 55.4 % but this was because the Irish central bank acquired 25 bn in new bonds as part of the promissory note deal. Without it, the non-resident share would have stayed at around 71 %.