Inequality and adjustment in Europe

Inequality differs across Europe. Some countries in major economic adjustment have been hit hard by an increase in inequality together with an increas

Inequality differs across Europe. Some countries in major economic adjustment have been hit hard by an increase in inequality together with an increase in unemployment in the last couple of years. Especially France and Spain saw strong increases. At the same time, Germany has seen a significant fall in inequality and in unemployment during the last 5 years. Yet, this story cannot be generalized: Inequality has fallen in Greece, Italy and Portugal despite their major macroeconomic adjustments. More research is needed to uncover the factors behind these differences so as to reduce the repercussions of adjustment processes on inequality.

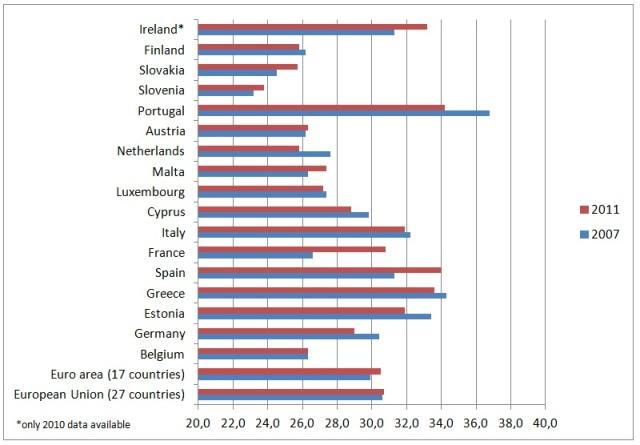

Inequality changes very differently in different European countries. Data show a small rise of inequality for the EU as a whole measured in terms of the Gini coefficient of disposable income (see graph). At the same time, there are striking differences across EU countries with some countries seeing rising inequality and others falling inequality. Most notably, inequality in Germany, the Netherlands, and Estonia has been falling significantly, while it has increased very substantially in France and Spain.

Note: Gini coefficient - relationship of cumulative shares of the population arranged according to the level of equalized disposable income, to the cumulative share of the equalized total disposable income received by them. The equalized disposable income is defined as the total income of a household, after tax and other deductions, that is available for spending or saving, divided by the number of household members converted into equalized adults; household members are equalized or made equivalent by weighting each according to their age, using the so-called modified OECD equivalence scale.

Source: Eurostat, 2013

So what could explain the differences across countries? A simple hypothesis would be that all countries adjusting large current account deficits in the course of the eurozone crisis would exhibit a large increase in inequality while the opposite is true for the countries of the North. However, a simple look at the data shows that this is not the case. Among the programme countries, inequality has actually fallen in Greece and Portugal. It has also fallen in Italy. Adjustment therefore does not necessarily mean an increase in inequality.

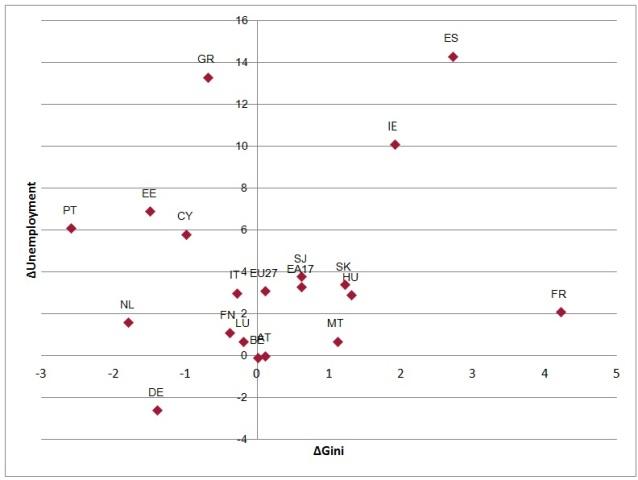

A second hypothesis relates the increase in inequality to an increase in unemployment. More unemployment increases in the low to middle income ranges would imply an increase in inequality of disposable incomes. A simple scatter plot relating the increase in unemployment to the increase in inequality during 2007-11 however does not confirm this general hypothesis.

Note: Differences in Unemployment and Gini-coefficient 2007-2011; Gini-coefficient Ireland only 2010 data.

Source: Eurostat, 2013.

Looking at four major countries in the Eurozone, it becomes apparent that some countries that have been hit hard by the financial crises are subject to a steep rise in inequality, resulting from increases in income inequality as well as unemployment. Spain and France both suffer from rises in income inequality and unemployment, respectively. On the other side, Germany experienced significant decreases in both income inequality and unemployment. Yet, this is not a general rule: Greece, Italy and Portugal had sharp increases in the unemployment rates while inequality actually decreased.

More research is needed to uncover the complicated link between adjustment and inequality in the EU. The topic is certainly central to the well being of our societies and the future of the EU.

|

2007 |

2011 |

||

|

Germany |

Gini |

30.4 |

29.0 |

|

Unemployment |

8.2 |

5.6 |

|

|

France |

Gini |

26.6 |

30.8 |

|

Unemployment |

7.7 |

9.8 |

|

|

Italy |

Gini |

32.2 |

31.9 |

|

Unemployment |

6.5 |

9.5 |

|

|

Spain |

Gini |

31.3 |

34.0 |

|

Unemployment |

8.8 |

23.1 |

Source: Eurostat, 2013