What comes after finance in Cyprus?

The prominent role of Cyprus's financial services is probably over anyway, irrespective of the actual content of the forthcoming agreement between the

The prominent role of Cyprus's financial services is probably over anyway, irrespective of the actual content of the forthcoming agreement between the troika and Cyprus. I put together some simple tables showing the structure of the economy in Cyprus and in three other countries that suffered from massive banking crises during the past few years: Ireland, Iceland and Latvia (see a December 2011 policy contribution of mine comparing the adjustments of these three countries). Here are some observations.

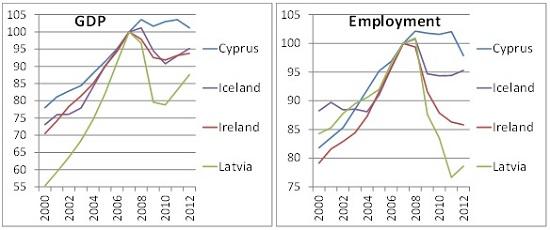

1. Changes in output and employment

Let’s start with a comparison of constant price GDP and employment development in the four countries. GDP fell massively in Latvia and output loss was also sizeable in Ireland and Iceland. Note also that GNP fell much more in Ireland than GDP, as highlighted in a recent blogpost by André Sapir. Latvia and Ireland also suffered from massive employment losses. This is a bad omen for Cyprus. Iceland’s employment did not fall that much, but the significant exchange rate deprecation has likely contributed to this (see my policy contribution mentioned above).

GDP (at 2005 prices) and employment (2007=100)

Sources: Employment: Annual national accounts database of Eurostat for EU countries and the February 2013 update of AMECO for Iceland; GDP: AMECO for all four countries.

2. Structural changes in the economy

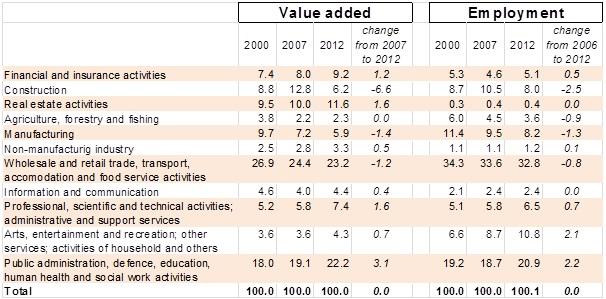

Keeping in mind the major collapses in Latvia and Ireland, let’s compare the changes in the structure of the economy (see the tables at the end of this post).

Cyprus: In 2012, the share of finance and insurance (of which about 90% is finance) was 9.2 percent in output and 5.1 percent in employment. Most likely these numbers are not as large as many people would expect. There were already major changes in the economy: the oversized construction sector (12.8% share in output in 2006) has already halved, and employment has also shrunken in this sector.

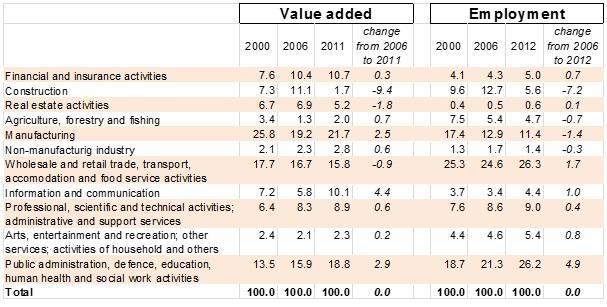

Ireland: Quite interestingly, the share of finance has not declined in output from 2006 to 2011, but remained broadly stable at about 10%. The employment share of the sector has even increased from 4.3% to 5.0% (there were 88 thousand employees in 2006, 99 thousand in 2009 and 92 thousand in 2012 in finance and insurance activities). Here too, construction has dramatically collapsed: its share in output was 11.1% in 2006, but a mere 1.7% in 2011. The shares of manufacturing and various services, including public services, increased in output from 2006 to 2011, while employment fell in manufacturing and increased in services. (Note: manufacturing is dominated by the pharma industry in Ireland; a sector using a lot of capital but few people, as I studied in a policy contribution in July 2012.)

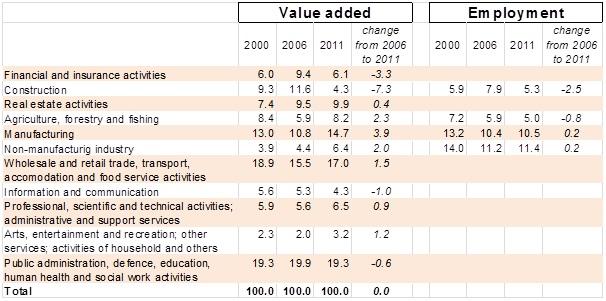

Iceland: The share of finance has declined from 9.4% in 2006 to 6.1% in 2011 in output (employment data is not available). The shrinkage of the oversized construction sector was dramatic here as well (from 11.6% in 2006 to 4.3% in 2011). Manufacturing, fishing and certain services gained in terms of output share.

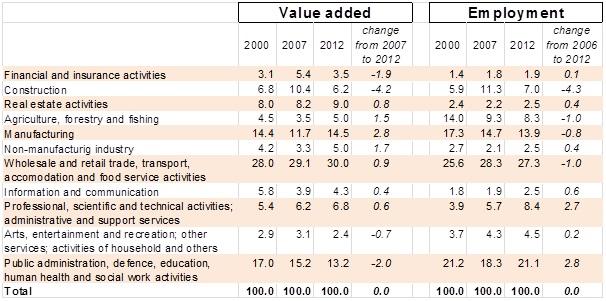

Latvia: The share of finance was not that high in 2007 (5.4% in output and 1.8% in employment), yet its output share has declined to 3.5% by 2012, while its employment share remained broadly stable. The share of construction has shrunken significantly both in output and employment. Industry and various services took up the lost share of construction and finance.

3. Summary

- The role of financial services in Cyprus is not as high as perhaps commonly thought.

- The experience of the three countries that went thought banking crises during the past few years suggest that major suffering may come in Cyprus as well, yet the output and employment shares of finance may not decline that much. (The latter observation would deserve further analysis.)

- Construction contracted dramatically in the three crisis countries, and this process has also started in Cyprus.

- Manufacturing and various services took up the lost share of construction in the three crisis countries.

- The share of manufacturing is Cyprus is very low, 5.8% in 2012 output, while it was between 11% and 19% in the other three countries before the collapse. This suggests that the manufacturing sector is unlikely to be the driver of growth in Cyprus and therefore the island should hope for a not too-large decline in finance and an expansion of market services. Gas may come to the rescue in some years.

Cyprus: structure of the economy (% of total)

Source: Annual national accounts database of Eurostat.

Ireland: structure of the economy (% of total)

Source: Annual national accounts database of Eurostat.

Iceland: structure of the economy (% of total)

Source: Annual national accounts database of Eurostat.

Latvia: structure of the economy (% of total)

Source: Annual national accounts database of Eurostat.