Effects of austerity revisited – how GDP surprised and why?

The debate about appropriate fiscal policy has been fluctuating since the onset of the financial crisis.

The debate about appropriate fiscal policy has been fluctuating since the onset of the financial crisis. In 2009 the emphasis was on coordinated stimulus but since the beginning of the euro crisis voices calling for consolidation have been louder and arguably also more influential than those who favour continued fiscal support. Lately, however, the pendulum has swung back to some degree in favour of the fiscal doves as austerity fatigue has set in and because the supposed resumption of growth as a result of increased confidence arising from improved public finances has failed to materialize. This change in the discussion has been influenced by a Blanchard and Leigh study (2013) arguing that fiscal multipliers are larger than previously thought. Furthermore in a recent piece De Grauwe’s and Ji’s (2013) questioned the wisdom of austerity in the form it has been conducted so far in Europe.

The issue is analyzed here using past European Commission forecasts for GDP growth in 2012. Firstly we look at the macroeconomic forecasts under which governments made their fiscal plans. Secondly, if growth differed from forecast, we study which demand components were responsible for this and to what degree the shortfall in growth is attributable to austerity.

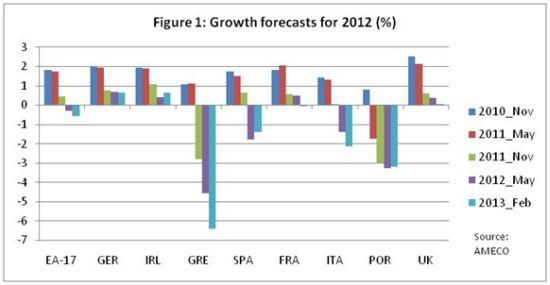

Figure 1 presents growth past growth forecasts for selected countries.

Until May 2011, all countries except Portugal were forecast to exhibit positive growth in 2012, i.e. fiscal consolidation was estimated compatible with growth. Although the rate of expansion was projected low, the forecasts could have been used to justify the argument that instead of trying to accelerate growth, emphasis should be on putting public finances on a sustainable footing. Had forecasts been more pessimistic, arguments for relaxing austerity to avoid depressing output further might have been more numerous.

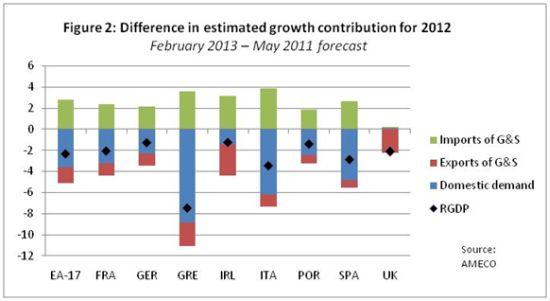

Figure 2 portrays how accurate the forecasts were.[1] It breaks down the GDP growth surprise to its components.[2]

Growth surprised negatively in all selected countries (this remains true if we use the November 2010 or November 2011 forecasts as the base). Forecasts for Greece and Italy missed the most, by -7.5 and -3.5 % respectively. A second common feature is that imports grew slower or decreased faster than expected in all countries except the UK, which reflects the widespread demand compression.

In other respects the economies can be divided broadly into three groups.

- In Greece, Italy, Portugal and Spain, growth was slower than forecast mainly because of a decrease in domestic demand (particularly private consumption and investment)

- For Ireland and the UK, slow export growth was the main factor

- For France, Germany and the euro area 17 (EA-17), the decline was quite evenly spread between investment, private consumption, inventories and exports

What to make of these numbers? The stronger than expected decline in domestic demand in the Mediterranean countries could be interpreted as an underestimation of the negative effects of public consolidation. Nevertheless, this lesson does not seem to apply universally. In Ireland and the UK, two other countries with major consolidation programmes, domestic demand was secondary to slow export growth in explaining the growth shortfall.

The digression is difficult to explain by differently sized consolidation programmes as measured (admittedly narrowly) by the level of contribution of public consumption to GDP growth. Although consolidation by this measure was indeed non-existent in the UK (+0.6 %), the negative growth contribution of public consumption in Ireland (-0.7 %) was comparable to that in Portugal (-0.8 %) and Spain (-0.9 %) and larger than in Italy (-0.2 %). The ripple effects on other demand components, however, differed considerably. This analysis is only partial though because consolidation packages also included tax increases and reductions in benefits and public investment, which public consumption does not take into account.

Assuming that initial forecasts were unbiased, the data supports Giles’ (2013) thesis that disappointing growth in the UK was caused mainly by underperformance of the export sector.[3] Nevertheless, Wolf (2013) and other fiscal doves can still consistently argue that the external shocks should have been counteracted with a slower pace of fiscal consolidation.

The fact that the source of the shortfall in demand differs across countries points to more than one explanatory factor. Different private sector expectations, the structure of fiscal consolidation and idiosyncratic shocks, to name a few, arguably contributed to the heterogeneous forecast errors.

References

Blanchard, Olivier and Daniel Leigh, 2013. "Growth Forecast Errors and Fiscal Multipliers," NBER Working Papers 18779, National Bureau of Economic Research, Inc.

Giles, Chris, 2013, ”Osborne is too timid, not too austere”, Financial Times, March 13th

http://www.ft.com/intl/cms/s/0/e5e476e4-8b24-11e2-8fcf-00144feabdc0.html#axzz2NsVq0AD4

De Grauwe, Paul and Yuemei Ji. 2013, “Panic driven austerity in the eurozone and its implications”, VoxEU

Weale, Martin, 2013, “Balance of payments”, Speech at Warwick Economics Summit, 16th February

http://www.bankofengland.co.uk/publications/Documents/speeches/2013/speech635.pdf

Wolf, Martin, 2013, “Britain’s austerity is indefensible”, Financial Times, March 12th

http://www.ft.com/intl/cms/s/0/1670a3d2-880f-11e2-8e3c-00144feabdc0.html#axzz2NsVq0AD4

[1] We use here May 2011 as the base forecast. This is arbitrary to some degree, but the qualitative analysis that follows remains broadly the same also if we would have picked a different forecast.

[2] Domestic demand= private consumption + public consumption + investment + change in inventories.

[3] See Weale (2013) for an analysis of the disappointing UK export performance.