Is struggling Europe on the right track?

The latest European Commission outlook forecasts 2014 unemployment rates above 25 per cent in Greece and Spain, in the vicinity of 15 per cent in Irel

The latest European Commission outlook forecasts 2014 unemployment rates above 25 per cent in Greece and Spain, in the vicinity of 15 per cent in Ireland and Portugal, but close to 5 per cent in Austria, Germany and the Netherlands. In the same year it expects GDP per capita to be almost 7 per cent above the pre-crisis level in Germany, but about 7 percent below in Ireland, Portugal and Spain, and a terrifying 24 per cent below in Greece. So the deep economic and social divide that as emerged within the euro area is expected to linger.

Such a gulf within a monetary union cannot be sustained for very long. The same monetary policy cannot possibly fit the needs of a country in depression and another one that is at, or close to full employment. Therefore the single most important issue for the future of the euro area is whether the gap within it between a still-prosperous half and a struggling half is in the process of being corrected.

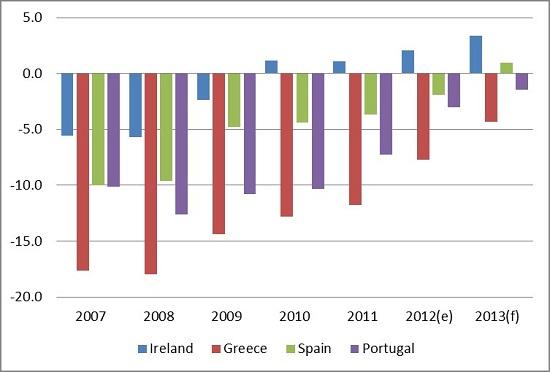

The optimistic reading is that although there is no improvement in sight on the labour market front, things have in fact started to go better and that an adjustment process is under way. The proof, it is often argued, is that external deficits have contracted substantially (Figure 1)

Figure 1: Current-account balances in percentage of GDP

Source: AMECO, Winter European Commission forecast

It is true that the external account matters, as it reflects the balance between domestic saving and investment. Up until 2007, imbalances within the euro area had largely resulted from too low savings and/or excessive real estate investment, resulting in debt accumulation. The contraction of external deficits is a sign that a correction is under way. Second, the rebalancing is genuine: in Spain, Portugal, and Greece the deficit has been reduced by more than 7 percentage points of GDP since 2007, and in Ireland it has been turned into a surplus.

The problem, however, is that the collapse in domestic demand accounts for a large part of this improvement. Since 2007 it has dropped by about one-fourth in Greece and Ireland, and by one-eighth in Spain and Portugal. Investment in equipment – which is key to ensuring the build-up of productive capital in the tradable-gods sector – has generally suffered even more. For sure demand contraction was inevitable as these countries were living far beyond their means. No economy can permanently sustain demand growth above the growth of GDP. But what we have seen since 2007 is an overshooting of demand and domestic investment contraction. This cannot be regarded as a success.

Table 1: Change in the volume of domestic demand

|

2002-2007 |

2007-2012 |

|

|

Euro area |

10.8% |

-3.0% |

|

Germany |

4.1% |

4.3% |

|

Ireland |

32.2% |

-22.7% |

|

Greece |

25.6% |

-27.6% |

|

Spain |

25.2% |

-12.7% |

|

Portugal |

4.7% |

-12.4% |

Source: AMECO, Winter European Commission forecast

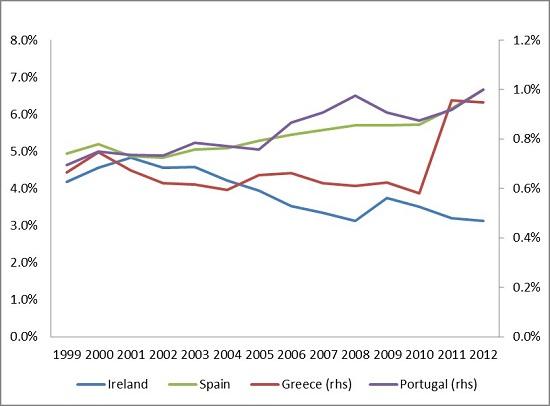

News are better on the export side. In spite of a grim environment, exports-to GDP ratios have noticeably increased in all four economies. Ireland was known to be a very reactive, outward-oriented economy. But it’s not only Ireland. Confronted to a collapse of the domestic economy and a stagnant European environment, firms in Greece, Spain Portugal have turned to overseas markets and significantly increased their countries’ shares of euro-area exports to the rest of the world (Figure 2). Spain’s performance on foreign markets is especially impressive. On the eve of the euro its exports outside the EU were one-fourth of those of the French ones. They now represent almost one-half of them.

Figure 2: Shares of euro-area exports to non-EU countries

Source: AMECO, Winter European Commission forecast

The question, to which it is difficult to give a firm answer, is which part of these exports is for-survival and which is for-profit and whether, therefore, their performance can be considered lasting. This brings us to the issue of price and cost adjustment. During the euro’s first decade, the countries that are now struggling recorded persistently higher wage and price inflation than those of the North. To recover and return to both internal and external balance they must not only close the cost gap, but actually reverse it as they have accumulated foreign debt in the meantime, and will have to record trade surpluses to repay it.

News on this front are mixed. Since 2007 labour costs have roughly stagnated in Greece, Spain and Portugal (though the mix between wage cuts and productivity gain varies from country to country) and they have contracted by 8% in Ireland, whereas they have increased by more than 10 per cent in Germany. So a rebalancing is under way. Contrary to stereotypes, for example, real wages in Greece have declined by 6 per cent per year over the last three years. The problem, however, is that prices have generally proved much more rigid. Only Ireland stands out as a country where they have declined. In the rest of struggling Europe their adjustment is barely noticeable. Firms, especially in the sectors sheltered from international competition, have kept market power and they have also increased prices in response to the rising cost of capital (Table 2).

Table 2: Evolution of GDP price deflator, 2007-2012

|

Germany |

5.1% |

|

Ireland |

-7.9% |

|

Greece |

8.7% |

|

Spain |

3.8% |

|

Portugal |

3.6% |

Source: AMECO, Winter European Commission forecast

The result is that the process of internal devaluation, as economists call it, is seriously hampered. Employees have suffered wage cuts but prices have not declined accordingly, so their loss of purchasing power is bigger than it should be, and economies have not recovered lost competitiveness, so employment, especially in the traded-goods sector, is lower than it should be.

Austerity and reforms were supposed to deliver rebalancing within the euro area. They have, as far as external balances are concerned. But in spite of visible progress on the export front and noticeable labour cost reductions, this rebalancing is mostly the effect of the same collapse in domestic demand that is creating mass unemployment. Ultimately perhaps, it will pay off. But societies may lose patience in the meantime. This should be enough to prompt a reassessment. The issue is not whether fiscal consolidation and external rebalancing are necessary – they are. It is how to make them politically and socially sustainable.