How to read the EU budget deal? I

Now that the European Council has approved the MFF 2014-2020 commentators are indulging on an evaluation of “who wins, who losses”, whether at stake a

How to read the EU budget deal?

How to read the EU budget deal? II

Now that the European Council has approved the MFF 2014-2020 commentators are indulging on an evaluation of “who wins, who loses”, whether at stake are policy objectives or countries. The variety of opinions is disorienting at best.

The new figures are typically juxtaposed to those of the MFF 2007-2013. Any comparison that uses billions of Euro should be done in constant prices and be adjusted for latest economic forecasts. However, even when all the technicalities are being sorted, the comparison of updated 2007-2013 figures with those contained in the deal of 8 February is misleading because the figures initially agreed at the beginning of the current financial perspective have been successively inflated by unexpected expenditures and a disappointing evolution in the EU GNI.

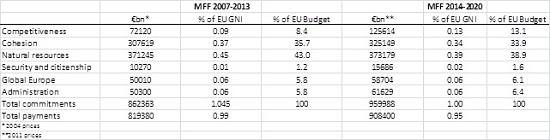

For a comparative assessment of the political deal underpinning the MFF 2014-2020 one should NOT look at how the 2007-2013 EU budget looks now but at how it looked at the time it was agreed during the European Council of December 2005, with a focus on what each heading represented then as a share of total EU expenditures and in proportion to what the EU was able to pay. Table 1 shows figures in i) billions euros (constant prices), ii) as a percentage of the total size of the EU budget, and iii) as a share of EU GNI (data available at the time of the deal). The following is worth noting.

First, the composition of the EU budget has not been dramatically altered: one can hardly talk of a new EU budget! Still, it is noteworthy that spending for agriculture fell to 34 from 43 percent of total expenditures, whilst the growth-related chapters, competitiveness and cohesion, have gone from 44 up to 47 percent of the total budget, an improvement, yet not really a revolution.

Second, when looking at the EU’s availability to pay as a proportion of her means, less is spent now on agriculture, more on security and citizenship, and the same amount on Europe’s relations with third countries and on administration. The resources dedicated to what are being portrayed as the most growth-enhancing chapters are roughly the same as in 2007-2013, up to 0.47 from 0.46 percent of EU GNI.

True, the so-called competitiveness chapter has being brought up to 0.13 from 0.9 percent of EU GNI, mostly as a result of the new money added through the Connecting Europe Facility, but this is only a qualified success. It is difficult to argue that the competitiveness heading is by definition more growth-enhancing than the cohesion chapter. The latter has been rebranded “investment for growth and jobs” and a minimum share of the received funds must be used to support EU2020 objectives. It would be artificial to treat the two chapters as separate entities. Moreover, some of the expenditures under the competitiveness heading may not ever materialize. In 2011, for example, of all unused funds, the EU de-committed 2.3% belonging to the competitiveness chapter and just 0.6% from the cohesion chapter.

The political interpretation of the deal is that national governments are just as (un)willing to invest in economic growth as they were in 2005 in spite of the fact that the growth challenge is much more pressing now than it was back then.

Table 1: The MFF 2014-2020 versus MFF 2007-2013

Source: Bruegel based on official European Council conclusions