An inexorable spiral?

Some market participants seem to consider financial support from the euro area governments, either in bilateral form or in the EFSF (and tomorrow ESM) guise, as the first step in an inexorable spiral, in which yields get higher and higher and market access is pushed further and further into the future. In short, the European cure (financial support-plus-macro-structural-adjustment) does not work (whatever its precise calibration with more or less fiscal adjustment) and there is only one possibility: more and more cases of PSI, soon for Ireland and Portugal, somewhat later for Spain and Italy. Greece’s case is generalized into a universal rule.

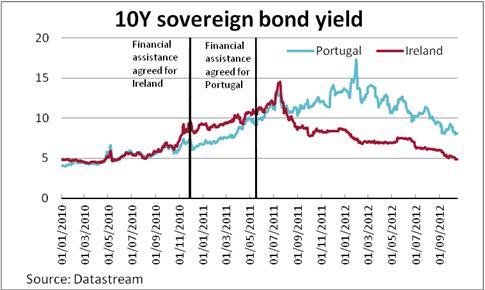

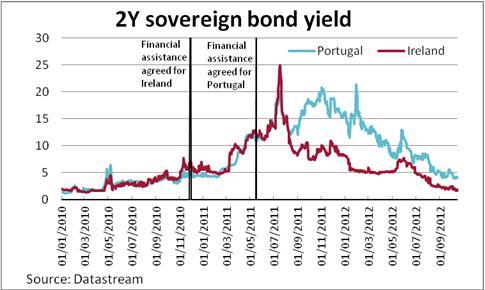

There is one important indicator which tells a very different story: two of the three countries that have taken for a sufficiently long period the European cure, i.e. Ireland and Portugal, show dramatic and sustained improvements in the yield on their government securities. For the 10 year maturity, this has gone from a peak above 17% at the end of January 2012 to the current level just above 8% in the case of Portugal. In the case of Ireland the improvement has been even more dramatic: from a peak of about 14.5% in mid July 2011 to the current level below 5% (about the same as Italy and lower than Spain).

Even more drastic developments can be found in 2 year yields (IE peak level higher than 24% on 18/07/2011, below 2% now, lower than both Italy and Spain, and PT peak level higher than 20% also on 18/07/2011 and close to 4% now). It is not easy to find assets that have recorded a higher rate of return than Irish and Portuguese securities over the last 12 months. In addition, in all cases, yields are now well below the level prevailing when the relative program was started.

Of course, the liquidity of Irish and Portuguese government bonds is hesitant and the prices generated in the relevant markets have to be taken with a pinch of salt. It is therefore reassuring that the price improvement is confirmed on the quantity side by the fact that both Portugal and Ireland managed recently to regain access to the bond market, albeit not yet systematically.

Of course, the yield is just an indicator and a more thorough analysis is needed to ascertain whether macroeconomic convergence is taking place in Portugal and Ireland. Evidence relating to labour costs is contained in a recent Bruegel piece by Guntram Wolff and Carlos de Sousa which show that, in these two countries, unit labour costs indices are indeed significantly moving down with respect to the euro-area average, also under the pressure of growing unemployment. However, the assessment whether more generalized macroeconomic convergence is taking place is another story, deserving another treatment.