UPS-TNT: the eternal struggle between harm and efficiencies

After Olympic/Aegean and Deutsche Börse/NYSE, today’s decision on UPS/TNT is Joaquin Almunia’s third merger prohibition since

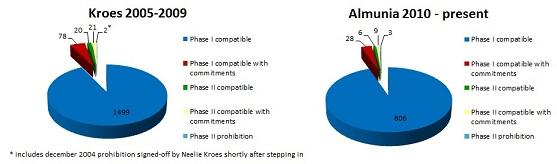

After Olympic/Aegean and Deutsche Börse/NYSE, today’s decision on UPS/TNT is Joaquin Almunia’s third merger prohibition since he became the European Union's competition chief in 2010. Mr Almunia’s predecessor as competition commissioner, Neelie Kroes, ended her five-year mandate having barred two mergers. The previous negative decisions hinged on potential harm to consumers and whether harm could be offset by increased network efficiencies. Remedies were offered but were not deemed effective enough to tilt the balance in favour of efficiencies and ensure that the merger would not have anti-competitive effects.

Dg-Comp merger activity 2005 – today

Source: DG-Competition - http://ec.europa.eu/competition/mergers/statistics.pdf.

The market: UPS, TNT, DHL and FedEx are ‘global integrators’. They combine trucks and planes and can guarantee overnight express deliveries throughout Europe. According to the Commission, local players lack the tools to offer such a service, particularly for cross-border shipments. The express business-to-business small packages delivery segment could therefore have been qualified as a de-facto self-standing market in which only four major players could significantly exert reciprocal competitive pressure.

The concern: In at least one of the markets affected by the transaction, UPS/TNT therefore would qualify as a “4-to-3” merger: after the transaction, only three players would be able to offer a quick and reliable Europe-wide service. Moreover, the four players have not been considered equally close competitors. FedEx's coverage of the EU market is less homogeneous than DHL's and FedEx would not exert enough competitive pressure on the remaining two competitors to prevent price increases, should the transaction be approved. Conversely, TNT is often considered as a low-price alternative to UPS or DHL. Eliminating such a ‘maverick’ would relax competition and, therefore, leave scope for price increases. Arguably, the growing wide spread of e-commerce would not help to mitigate the European Commission's concerns. Even if the sector is likely to experience a boom in the near future, the prospect of higher profits might not be enough to trigger timely entry. It has been widely stressed that the high "barriers to entry" characterising the integrator market would make it hard for new players that lack their own networks of hubs and warehouses to enter and efficiently compete against incumbent players. Shielded by this potential external pressure, the remaining players could find it profitable to increase their prices or reduce the quality of their services. That could occur ‘unilaterally’ i.e. each player would have a greater incentive to increase prices because that would increase their profits (less competition in the market means that fewer customers flow to competitors when prices are increased). Or for ‘coordinated effects’, i.e. with fewer competitors in the market, players would be more likely to reach a mutual (not necessarily explicit) understanding on prices that would maximise collective profits (i.e. collusive prices).

Efficiencies: Network efficiencies were put by the parties on the other side of the balance. Network efficiencies arise whenever the value of a product to its customers increases with the number of potential or actual customers of that very same product. Postal services are naturally prone to network efficiencies and it is indeed possible that, in the absence of anti-competitive effects, the merger would have had a positive effect on consumer welfare, bringing together the UPS and TNT networks. The Commission must have considered those efficiencies to be not large enough to counterbalance the likely harm caused by the loss of competition. Most interestingly, even if all but one of the affected markets would have benefited from the transaction, it would have been sufficient to warrant a prohibition decision that efficiencies would not have been enough to counterbalance harm in the one market in which concerns are particularly strong. In other words: if, for example, domestic standard deliveries’ customers would benefit overall from the bigger network offered by UPS/TNT, it would nevertheless be enough that harm in the cross-border business-to-business small parcels delivery segment is not compensated for by efficiencies. This would qualify the merger as anti-competitive. EU law and practice do not allow for the balancing of efficiencies and harm between different markets. That is understandable: balancing welfare across markets would imply expressing a value judgment, and antitrust authorities must refrain from performing ‘political’ exercises. But, broadly speaking, pursuing a more integrated European single market still begs the question: couldn’t efficient balancing mechanisms be conceived of, such that overwhelming and widespread benefits do not run the risk of being dismissed, on principle, if accompanied by comparatively small harm in minor markets in which those benefits do not arise? We do not know whether that is the case in UPS/TNT. But the principle is worth discussing.

Remedies: The parties attempted to dispel the Commission’s concern by offering a package of remedies which included the sale of part of TNT’s assets to DPD, a French parcel services supplier. In order to be considered a viable competitor in express delivery services across Europe, however, DPD would have needed access to UPS/TNT's aircraft capacity, lacking its own fleet. UPS was ready to commit to release capacity for a five-year period at a ‘competitive rate’. But most likely the Commission was unimpressed particularly by this aspect of the package. The Commission is traditionally very careful about so-called ‘behavioural remedies’, through which the parties commit to offer to abide by a set of defined rules after the transaction is adopted. Compared to ‘structural remedies’, whereby parties permanently divest part of their assets, behavioural remedies require constant monitoring (meaning: drain of public resources for a complex, rarely fully successful task) and may introduce unwanted distortions in the price-setting process (linking the commitment to benchmark prices, they may create incentives to act on the benchmarks in order to relax the constraint on the commitments).

UPS/TNT was one of the four phase II mergers under deeper investigation by the European Commission. After today’s prohibition, the remaining cases are: Ryanair-Aer Lingus (a decision is expected by March, 6); Munksjö- Ahlstrom (May, 16) and Syniverse-Mach (May, 30).