(Slowly) back to normal in the Eurozone?

Private capital is returning to the distressed Eurozone countries and sovereign bonds. 2012 might be remembered as the year in which two “ends of the

Private capital is returning to the distressed Eurozone countries and sovereign bonds.

2012 might be remembered as the year in which two “ends of the world” were luckily averted: one, thanks to the wrong intuition of a Mayan forecaster; the other one, thanks to the right intuition of a European central banker.

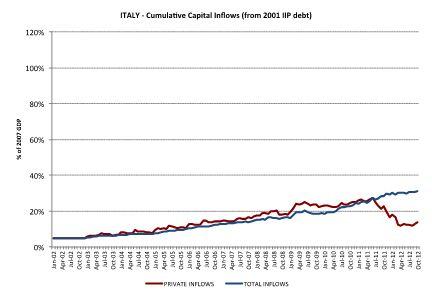

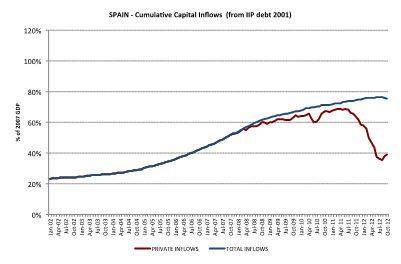

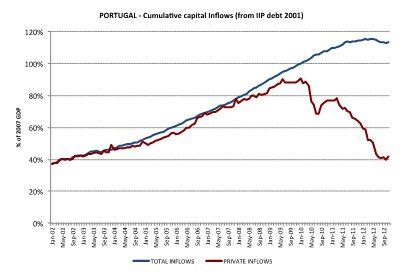

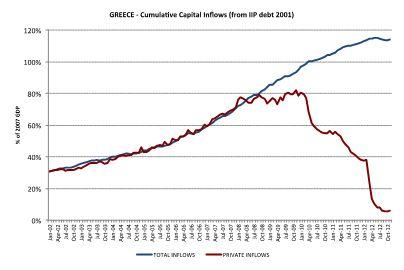

Back in 2012, the capital flight from the weaker Eurozone countries reached maximum intensity. In terms of magnitude, the capital outflows were massive, as the capital inflows that preceded the crisis had been. Between the April 2010 and August 2012, net private capital outflows totalled 167bn in Greece, 118bn in Ireland and 99bn in Portugal. In terms of pre-crisis GDP, these figures amount to about 75%, 62% and 59% respectively. Starting in summer 2011, private investors started to leave also Italy and Spain, which between May 2011 and August 2012 recorded outflows of 303bn (19% of pre-crisis GDP) and 364bn (35% of pre-crisis GDP). The gap was filled by the liquidity provided through the Eurosystem, which banks made extensive use of and which sheltered countries from the consequences of a full-fledged sudden stop in external financing.

Things started to change after the ECB unveiled the OMT programme and plans for the creation of a banking union were announced. Both Spain and Portugal posted in September the first net private capital inflow since one year. After that, private capital has continued flowing back into the Southern countries. Financial account data and the evolution of the TARGET2 balances suggest that between September 2012 and the end of the year, net private inflows amounted to about 100bn, which is in the order of 10% of the total outflows mentioned earlier. The effect of private capital inflows is visible in the evolution of TARGET2 balances, whose divergence has also stopped and started to reverse.

|

|

|

|

|

|

|

NOTE: data up to November 2012 for Greece and Portugal, October 2012 for Italy and Spain.

Importantly, foreign investors are returning also to the particularly distressed sovereign bond markets where the outflows had been sizable. Mario Draghi’s pledge to do ‘whatever it takes’ to preserve the monetary union coincided with the start of a decline in yields of troubled Eurozone sovereigns. Before the announcement a larger and larger share of Greek, Irish, Italian and Spanish bonds had been off-loaded by foreign investors and acquired by domestic banks, which reinforced the sovereign-bank loop that was partly responsible for the elevated yields originally. Therefore, a crucial test of the credibility of Draghi’s pledge was whether foreigners would regain faith in distressed bonds. According to the newest update of Bruegel dataset on sovereign bond holdings[2] there are tentative signs that this is happening.

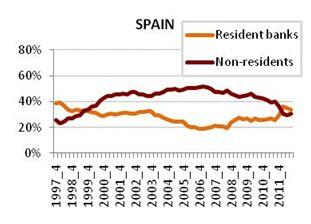

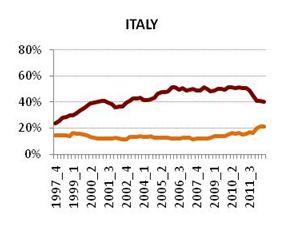

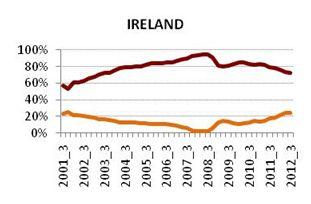

Share of bonds held by resident banks and non-residents up to Q3/2012.

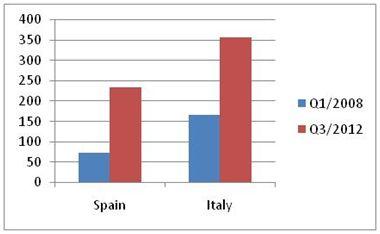

In Spain the share of bonds held by non-residents increased from 29.6 % in Q2/2012 to 30.8 % in Q3/2012. In Italy and Ireland the non-resident share seemed to stabilize after having dropped by 10 and 9.3 %-points respectively during the preceding year (Q2/2011-Q2/2012). Symmetrically, the share of resident banks declined by 1.7 %-points from Q2/2012 in Spain and stabilized in Italy and Ireland. Nevertheless, banks in these countries are still much more exposed to their sovereigns than before the crisis as the examples of Italy and Spain show.

Holdings of sovereign bonds by domestic banks (euro bn).

The recent healthy developments can be considered a further indication of the enhanced faith in the resilience of the euro by international investors. However, only a few data points should not be overinterpreted. As the data only extends until Q3/2012, it will be informative to see if the increased optimism during the last quarter of 2012 was reflected in further normalization of bond holding shares.[3]

Risk-aversion is more difficult to reverse than risk-enthusiasm, but the data presented in this post point to the right direction and suggest that the situation is (slowly) improving in the Eurozone financial markets. Maintaining and reinforcing this positive momentum over the coming months will be essential.

[1] Many thanks are due to Silvia Merler for excellent collaboration on this post.

[2] (Merler, S. and Jean Pisani-Ferry (2012), “Who’s afraid of sovereign bonds?”, Bruegel policy contribution 2012|2, February),

[3] We do not cover Greece here because its central bank changed their accounting method for bond holdings in 2012, which renders analysis unreliable. Portugal only publishes yearly data on bond holdings by sector and has not yet released it for 2012.