Blogs review: A bird’s eye view on Bruegel’s research in the crisis

What’s at stake: On 22 January 2003, the idea of setting up what would become Bruegel had been given a strong impetus by the Chirac-Schröder declarati

What’s at stake: On 22 January 2003, the idea of setting up what would become Bruegel had been given a strong impetus by the Chirac-Schröder declaration issued on the occasion of the 40th anniversary of the Elysée Treaty. Ten years after that first impulse, Bruegel has been ranked as 1st think-tank in Western Europe, 2nd outside the US, and 1st worldwide in International Economic Policy in the 2012 Global Go To Think Tanks Report. In the spirit of the Stability and Growth Pact, we decided to grant an exception the rules governing our blogs review and survey some of our very own publications for those of you (especially in the blogosphere since we were pretty late at joining the dance) who may have missed these.

Macroeconomic imbalances and adjustments

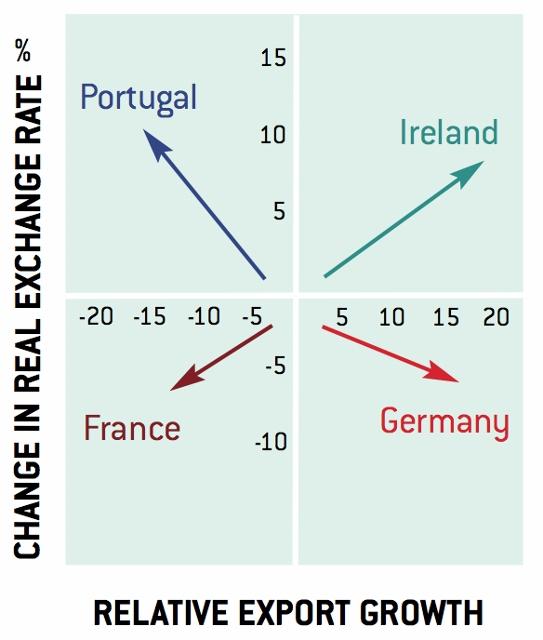

Although we missed the Greek mess that was in the making and were certainly too optimistic in our assessment of the progress that the euro had made in our 2008 report, we’ve been ahead of the curve at identifying some important economic divergences within the euro area. In January 2006, Alan Ahearne and Jean Pisani-Ferry, for example, pointed out that divergences in growth and inflation had not been given sufficient attention in the policy brief “The Euro: Only for the Agile”. The authors underlined that policy discussions had almost exclusively been focused on fiscal developments, while economic divergences – in GDP, inflation and real exchange rates – between existing members had been significant.

Note: for more on that diagram and how it evolved over time, see here.

In May 2012, Guntram Wolff also pointed out a striking disconnect between unit labour costs (ULC) and inflation (CPI) developments in the euro area, which significantly hampers effective external adjustments. The falls in ULC that are observed in Greece, Spain and Portugal have not translated into gains in terms of prices as measured by the CPI. The only exception is Ireland.

Zsolt Darvas also wrote several contributions to the debate on the efficacy of internal devaluations. In December 2011, Darvas looked at three small, open European economies — Iceland, Ireland and Latvia – that had experienced similar developments in the years ahead of the crisis, in particular rapid increases in banks’ balance sheets and the expansion of the construction sector, but were hit differently by the global crisis. In June 2012, Darvas discussed the importance of the impact of sectoral changes on average labour productivity considering 11 main sectors and 13 manufacturing sub-sectors. And in June 2011, Darvas assessed the case for a debt restructuring in Greece.

The macroeconomic policy response

In terms of macroeconomic policy responses, our contributions have certainly lacked precise assessments of the policy response by the ECB. But we were really quick at delivering a specific proposal for coordinating the fiscal policy response that internalizes spillover effects. In November 2008, Jean Pisani-Ferry, Andre Sapir and Jakob von Weizsacker proposed an EU wide temporary VAT cut of one percentage point to provide a timely, substantial and coordinated fiscal boost to the European economy. The use of VAT is not without shortcomings. But there was a significant premium in a coordinated and transparent move. Also, a temporary VAT cut would have provided a substantial incentive to bring spending forward given the subsequent return to the previous, higher VAT rates.

In February 2011, Benedicta Marzinotto also identified that significant volumes of Structural and Cohesion Funds, which had been pre-allocated had remained undisbursed. In Portugal, unused funds amount to 9.3 percent of GDP, in Greece close to 7 percent, and in central and eastern European countries about 15 percent. Marzinotto argued for these funds to be part of a temporary European Fund for Economic Revival (EFER) for 2011-13, which would promote economic growth in crisis-hit countries and facilitate structural reforms.

Governance and integration of the euro area: the principles

It seems fair to say that we’ve given justice to the important governance issues of the euro area early on: First, by providing analytical frameworks to clarify these issues at stake; and second, by providing specific policy proposals designed to overcome some of the euro area’s inherent weaknesses.

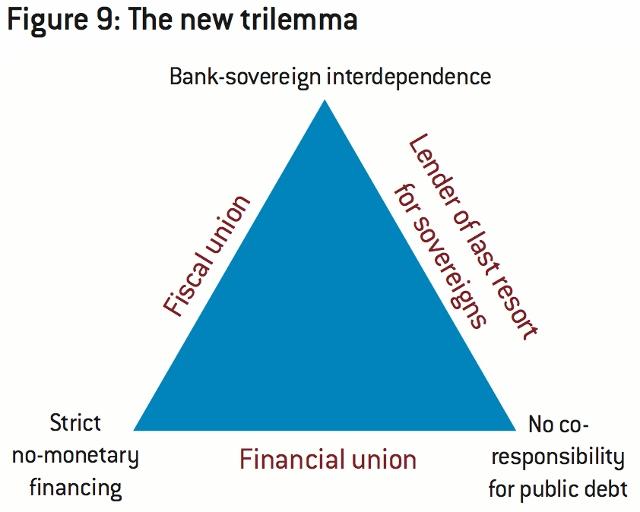

In January 2012, Jean Pisani-Ferry argued that at the core of euro-area vulnerability is an impossible trinity of strict no-monetary financing, bank-sovereign interdependence and no co-responsibility for public debt and assessed the corresponding three options for reform: a broader European Central Bank (ECB) mandate, the building of a banking federation, and fiscal union with common bonds.

In his testimony to the US Senate in September 2011, Nicolas Veron argued that a successful crisis resolution needs to include fiscal federalism; banking federalism; a profound overhaul of EU/euro-area institutions; as well as short-term arrangements that chart a path towards the completion of the previous three points.

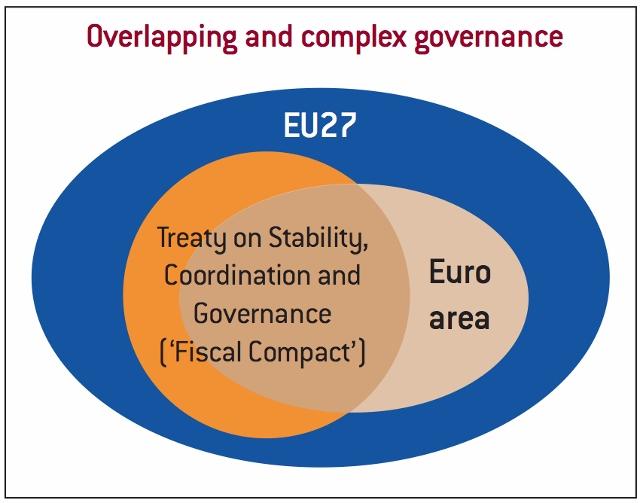

In their presentation to the March 2012 ECOFIN, Jean Pisani-Ferry, André Sapir, Guntram B. Wolff argued that policy action should be based on the need to:

· Make room for deeper integration within the euro area, beyond the limited remit envisaged in the Lisbon treaty

· Preserve the integrity of the EU27 and its essential governance arrangements

· Ensure equal treatment in the application of common rules

· Ensure that candidates for euro-area membership have a voice in the definition of its rules

· Balance the requirements of legal clarity, accountability and efficiency with the desirability of experimentation through variable geometry

Governance and integration: specific proposals

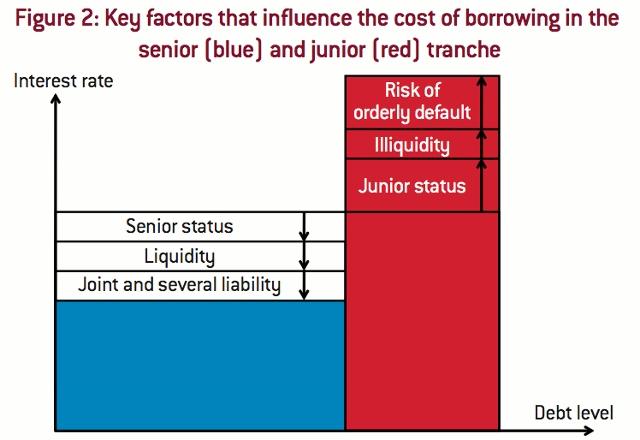

In May 2010, Jacques Delpla and Jakob von Weizsäcker unveiled the Blue Bond / Red Bond proposal. Here is how it would work. Blue Bonds: EU countries should pool up to 60 percent of GDP of their national debt under joint and several liability as senior sovereign debt, thereby reducing the borrowing cost for that part of the debt. Red debt: any national debt beyond a country’s Blue Bond allocation should be issued as national and junior debt with sound procedures for an orderly default, thus increasing the marginal cost of public borrowing and helping to enhance fiscal discipline. Since then, other proposals such as Eurobills and ESbies have been suggested. Shahin Vallee coauthored a working paper with IMF economists discussing the pros and cons of these different options for common euro area sovereign securities and proposed a specific path towards a gradual adoption.

In June 2012, Jean Pisani-Ferry, Andre Sapir, Nicolas Veron and Guntram Wolff proposed a path towards a European banking union. This step would not only help to address directly the negative feedback loop between sovereigns and banks. It would also demonstrate that the euro area has the political will to draw the lessons from the crisis and to move towards a stronger framework that preserves the full integrity of the current monetary union.

In September 2012, and following some harsh criticisms about the inadequate fiscal consolidation in Europe, Benedicta Marzinotto and André Sapir argued that the EU fiscal framework has come under attack more because of the timing of the application of the new rules than because of shortcomings of the rules. There is, in particular, scope within the current framework to decide that slow growth at member state and EU levels is a constraint on fiscal consolidation. To address this issue, they proposed a one-year extension for all euro-area countries to be granted by the Commission before 2013 national budgets are finalized.

Financial stability

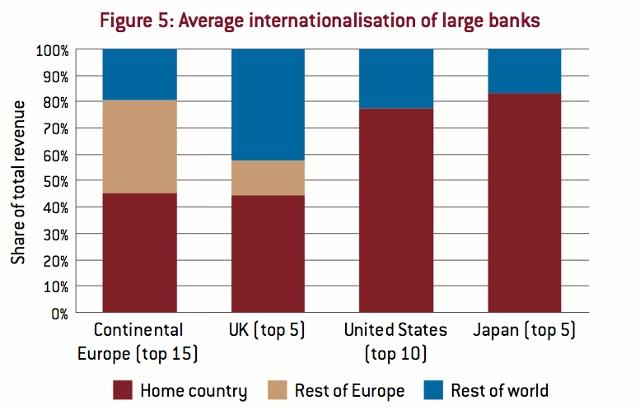

While we certainly missed some of the domestic developments in the banking sector, we were ahead of the curve at pointing to some of the tensions induced by the Europeanization of banking activities. In August 2007, Nicolas Veron, for example, argued that Europe‘s arrangements for financial stability had been rendered inadequate by the emergence of ‘pan-European banks‘, whose activities now span several EU countries. Veron illustrated the speed with which the distribution of the assets of Europe’s main banks had evolved towards more geographical diversification inside the EU, amounting for a quarter of their assets against 11% a decade earlier.

In June 2008, Adam Posen and Nicolas Veron argued that a lesson from major past crises is that the drag on growth will persist until the most fragile banks are openly identified and fixed. This is particularly true for Europe given the predominance of traditional banking in corporate finance and household savings on the continent. The authors proposed a centralized triage and restructuring process of bad European banks lead by a new temporary European Institution, a European Bank Support Authority (EBSA).

And much much more…

As you can guess, this is a very incomplete selection of papers. We have blueprints that discuss competitiveness issues based on firms data (the so-called EFIGE project), recent books on climate change and various transatlantic challenges, essays on the history of American fiscal federalism, past globalizations and why Germany fell out in love with Europe, external publications on identifying discretionary fiscal policy reactions with real-time data (JMCB), many policy briefs, policy contributions (namely on the EU budget, euro-area fiscal capacity) and working papers on a wide range of issues including completion, innovation and growth (by Philippe Aghion and Reinhilde Veugelers among others).

We’ve also produced Datasets on sectorial holdings of government debt for 12 countries, Eurosystem refinancing operations across countries and LTRO/MRO, Real effective exchange rates for 178 (!!!) countries, and a representative sample (at the country level for the manufacturing industry) of almost 15,000 surveyed firms (above 10 employees) in seven European economies.

And we have a very cool euro-crisis timeline.