The European Semester Timeline

EU economic policy coordination is now supported by a process known as European Semester, which provides a common timetable for EU policy guidance and the monitoring of national actions. This blog entry summarizes the main steps in the European Semester and the role each EU Institution plays in the process. For an extensive analysis of the European Semester and its operation, see An Assessment of the European Semester.

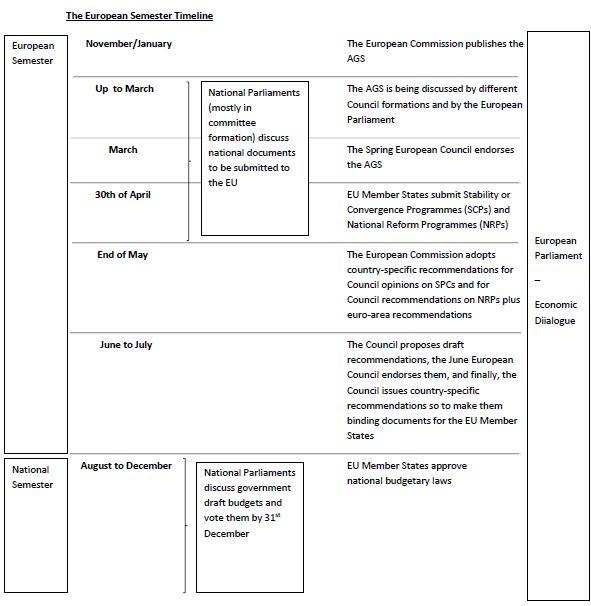

The European Commission launches the European Semester with the publication of the so-called Annual Growth Survey (AGS), a list of general policy priorities for the EU. The AGS is based on the progress report on EU2020 strategy, the Macroeconomic Report and the Joint Employment Report. In the first Semester cycle, the European Commission published the AGS in January 2011. This year, the European Commission anticipated the publication of the AGS for 2012 to November 2011, de facto extending the length of the Semester cycle.

The Council of Ministers (regrouped under different formations) and the European Parliament have the opportunity to debate the AGS up to March, when the Spring European Council formally endorses it. The second European Semester cycle has brought in a novelty in this regard. The European Parliament is now involved in the discussion in a formal fashion through the Economic Dialogue, having for example the right to invite the President of the European Commission to discuss the AGS.[1]

Following the endorsement by the Spring European Council, EU Member States are under the obligation of taking EU policy guidance into account when drafting their Stability or Convergence Programmes (SCPs) and National Reform Programmes (NRPs), which they have to submit simultaneously to the EU by 30th April every year.[2]

The European Commission evaluates national plans to assure that proposed measures respect the priorities and objectives identified by the AGS. Around the end of May the European Commission publishes its own assessment of national fiscal and structural plans and releases country-specific recommendations as well as euro-area recommendations.

After that, the Council of Ministers approves draft recommendations, the June European Council endorses them and finally the Council of Ministers issues the country-specific recommendations, which become thus “binding” documents for EU Member States.

Contrary to the other European institutions, the contribution of the European Parliament to the European Semester is not characterised by precise deadlines. The European Parliament can participate to the European Semester at almost any point in time of the cycle. The six-pack, in fact, has allowed the European Parliament to make use of the Economic Dialogue instrument throughout the whole official Semester process for engaging in a discussion with the other EU Institutions as well as in an exchange of views with national representatives.

The figure below summarises the European Semester timeline.

[1] It should be noted that the Economic Dialogue may be initiated at different points in time in the Semester procedure.

[2] The two-pack legislative proposal suggests that the submission of national documents is anticipated to 15 April in the case of euro area countries.