Chart of the week: Wage stickiness and painful adjustment

This blog entry studies labour cost adjustment in the euro area. We find that wages are sticky and nominal wages rarely fall except in the most severe

This article studies labour cost adjustment in the euro area. We find that wages are sticky and nominal wages rarely fall except in the most severe crisis circumstances. Second, unit labour cost (ULC) reductions are often associated with significant increases in unemployment. Third, the relative adjustment is forecast to continue and accelerate during 2012/13.

The European Commission has just published a long report on labour market developments in the EU (http://ec.europa.eu/economy_finance/publications/european_economy/2012/2012-labour-market_en.htm). It is found that “wage moderation has prevailed across the EU, with real wages often growing below productivity. Wage dynamics started more clearly reflecting different needs for adjusting labour costs to re-balance external positions, with more moderate growth rates in nominal compensations recorded in countries recording current account deficits.” It seems the Commission thinks that adjustment to external positions is really only starting. In this column, we look at some of the data.

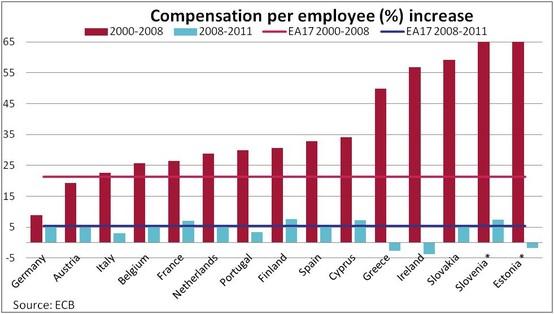

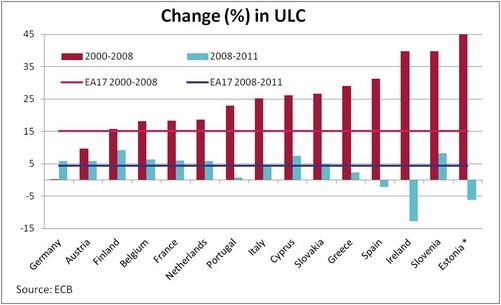

The evolution of compensations per employee had diverged dramatically between euro area countries in the run up to the crisis. While they grew by only 8.9% in Germany during 2000-2008, almost all other countries were above the average with the gap to Germany increasing by 13.7%, 17.6% and 24.0% in Italy, France and Spain. Adjustment to this divergence is proving slow.

Despite the weak economic situation in Southern European countries during the crisis years, wage adjustment in the aggregate statistics has been anemic. When looking at the compensation per employee growth, Italy, Portugal and Spain are only slightly below the euro area average during 2008-2011, while France remains above average. Greece, Ireland, and Estonia in turn have seen a significant drop in wages. In turn, German developments are only slightly above the average now with 5.7%.

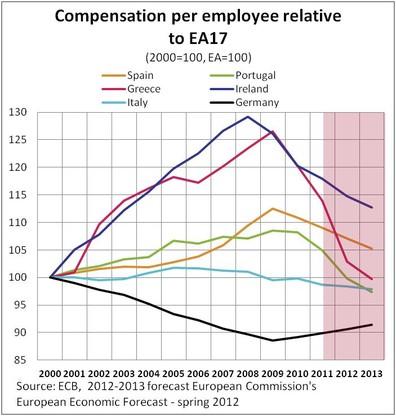

Based on the developments of this year so far, the European Commission forecasts a sharp (-8%) adjustment on labour compensations for Greece during this year, moderate ones for Ireland (-0.8%) and Portugal (-3.1%), and no adjustments at all for Spain (0.1%) or Italy (1.5%). In the next graph we can see the evolution of the relative labour compensation of these countries in comparison with the weighted average of the euro area. Overall, the main adjustment in Spain and Portugal is only starting now whereas Italy’s labour compensation has evolved similarly to the euro area average. The effects look stronger in the second graph because the average is deducted. It is important to note that the adjustment is accelerating significantly despite a drop in the average annual compensation growth going from 2.5% per year in the 2000-2008 to 1.8%. So the forecast suggest adjustment despite a significant deterioration of the average conditions.

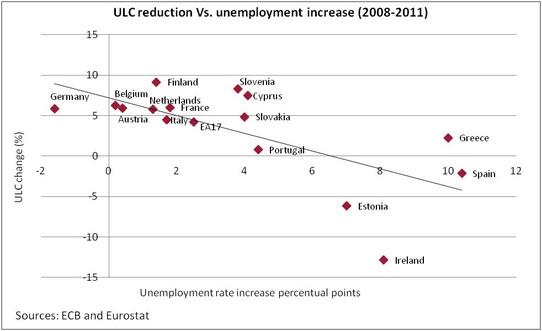

Despite the weak adjustment in labour compensation, some countries have already managed to regain some of the lost competitiveness by decreasing Unit Labour Costs (ULC). In particular, ULC adjustment has been significant in Ireland with 12.8% decline on total ULC, followed by Estonia with 6.1% and Spain with 2.1%.

So how can significant adjustments in ULC be squared with the weak adjustment in labour compensation? One explanation relates to the increase in unemployment. Figure 3 shows the relation between unemployment and ULC change. Layoffs of less skilled workers and the increased working time and pressure on those who remained employed have led to an increase in the average output per worker. This is not the entire story as the graph explains around 45% percent of the variation.