Blogs review: Markets without a price

What’s at stake: Lloyd Shapley and Alvin Roth have won the Nobel Prize in economics “for the theory of stable allocations and the practice o

What’s at stake: Lloyd Shapley and Alvin Roth have won the Nobel Prize in economics “for the theory of stable allocations and the practice of market design”, which relate to the study of social allocation problems where money as a medium of exchange is ruled out or at least constrained. Roth has built on the insight of Gale and Shapley to come-up with precise conditions under which market design can achieve efficient allocations and has applied these lessons to a variety of real world matching problems such as organ exchange, college admissions and the design of the economics Job Market.

Welfare gains in priceless allocations and the future of repugnance

Greg Ip writes that money is a handy way of denominating prices and economists love prices because they are so efficient at allocating supply and demand so as to maximize welfare. Yet markets do not have to have money or prices to serve that welfare-maximizing function. That distinction lies at the heart of the work that won this year’s Nobel Prize in economics.

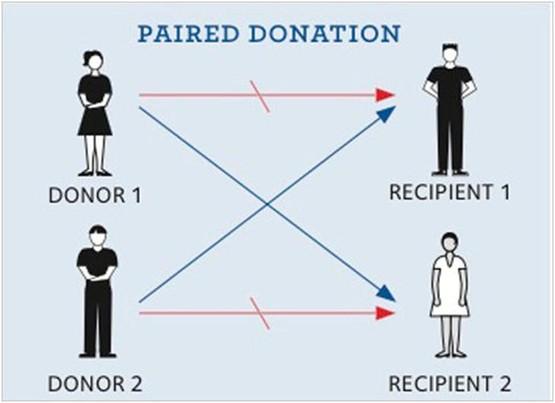

Arindrajit Dube (HT Mark Thoma) writes that the concrete applications that are discussed as ways of "improving the performance of many markets" – such as matching residents to hospitals, matching donors to organs, and students to schools – are not really "markets." At least not if we think of markets as institutions where prices help clear supply and demand. Instead, they involve non-market interactions, where the matches are actually formed by centralized exchanges.

In a recent essay (HT Stephen Dubner), Al Roth argues that an important constraint for the existence of a clearing price is repugnance – the distaste for certain kinds of transactions – which acts as a real constraint, every bit as real as the constraints imposed by technology or by the requirements of incentives and efficiency. Roth points in JEP paper that repugnance borders do shift over time, although quite slowly. The author considers a range of examples from lending money for interest to bans on eating horse meat in California to bans on dwarf tossing in France.

The Gale-Shapley deferred choice algorithm and the “socialist calculation” debate

Alex Tabarrok writes that the field of matching may be said to start with the Gale-Shapley deferred choice algorithm. Here is how it works, applied to men and women and marriage. Each man proposes to his first ranked choice. Each woman rejects any unacceptable proposals but defers accepting her remaining suitors. Each rejected man proposes to his second ranked choice. Each woman now rejects again any unacceptable proposals, which may include previous suitors who have now become unacceptable. The process repeats until no further proposals are made; each woman then accepts her most preferred suitors and the matches are made.

Timothy Taylor writes that another key insight is that although the deferred-acceptance procedure is usually explained as a step-by-step process, where parties make one offer at a time, an equivalent process can be run by a clearinghouse, if the parties submit sufficient information. And this is where Alvin Roth enters the picture, bringing in detailed practical implications for analysis. As one might expect, these real-world cases raise various practical problems. Are there ways of gaming the system by not listing your first choice, which you are perhaps unlikely to get anyway, and pretending great enthusiasm for your fifth choice, which you are more likely to get? Such outcomes are sometimes possible in practical settings, but it proves much harder to game these mechanisms than one might think. Usually, you're better off just giving your true preferences and seeing how the mechanism plays itself out.

Source: Super Freakonomics Illustrated

To implement the Gale-Shapley algorithm for the marriage market yourself, you can visit UC Berkeley’s Mathsite.

Arindrajit Dube writes that mathematically speaking, the Gale-Shapley algorithm is part of a class of optimal matching algorithms, which is equivalent to the Monge-Kantorovich optimal transport solution, a signature accomplishment of Soviet mathematics. A popular view today is that it is not possible to implement an efficient allocation using planning because people don't have the incentives to reveal their true preferences to begin with, which makes this whole exercise rather pointless. A variant of this position was originally articulated by Austrian economists, including Ludwig von Mises, during the so called "socialist calculation" debate of the early 20th century. And in many cases this criticism rings true. However, it does not follow that the truthful revelation problem is ubiquitous. For example, it is interesting to note that Alvin Roth and Elliott Peranson show that when implementing optimal matching, this problem may be smaller than one might imagine: when each applicant only interviews a small number of positions overall, the gains from strategic manipulation of preferences are small. This, too, has important implications for the "socialist calculation" debate, as it suggests that for a range of cases, a centralized exchange implementing planning without using prices can (and indeed does) implement relatively efficient allocations.

Joshua Gans writes that Roth has set down a set of principles for market designers. Basically, market design works when you can find rules that encourage thickness (lots of buyers and sellers), avoid congestion and are safe (that people think transactions will actually take place on the terms agreed). Put those things together and you are a good way to having yourself a well-functioning market.

The design of the Economics Job Market… and that of the NFL

Al Roth is also the chair of the AEA’s Ad Hoc Committee on the Job Market. The first of the Committee’s recommendations to be put in practice was the Economics Job Scamble, a web page on which applicants and employers could indicate their continued availability as of late March. The second, which went online November 20, 2006, is that the AEA will facilitate Signaling for Interviews in the Economics Job Market, to allow applicants to send up to two signals to employers with whom they would like to interview. In a email to Greg Mankiw, Al Roth explains that just as the idea of the scramble was to add some thickness to the late (March-April) part of the market, the idea of signaling is to reduce some of the congestion in the thick, January interviews part of the market.

Real Time Economics write that now that Roth and Shapley have won the Nobel, the NFL will finally listen to what they have to say. In 2010 article, three Harvard University researchers who studied market design under Roth argues that the National Football League has one of the worst systems in all of industry for matching talented workers with the right employers. They then helped create a new system for the NFL’s draft. But the NFL did NOT take the Nobel-worthy advice.

The Shapley value

Joshua Gans writes at Digitopoly that Lloyd Shapley is best known in economics for the Shapley value, which is a way of thinking about who might capture value in a multi-lateral negotiation. Henrik Jensen writes that the concept was applied to political decision making together with Martin Shubik in 1954, as the Shapley-Shubik index. It is a simple index that measures the voting power of parties, and, in particular, shows that number of seats in a committee or parliament is not the same as power. It is the power of the coalitions in which a party can be decisive, i.e., pivotal, that matters.