Chart of the week: GDP down by 0.2% in the euro area

August figures from Eurostat for the euro area show a decrease in GDP for the second quarter of 2012, after stagnating growth rates during the previou

Eurostat’s estimates of GDP growth for the second quarter of 2012 provide a rather gloomy picture of the current economic situation in Europe. Seasonally adjusted GDP fell by 0.2% both in the euro area and the EU27 in the second quarter of 2012, after close to zero growth rates in the previous quarter. The best performing countries are in Northern Europe; with Austria, Germany, Finland and Sweden all showing positive annual year-on-year GDP growth rates. The Baltic countries continue to perform well with respect to the rest of the EU, with an annual year-on-year increase close to 4.3% in the case of Latvia, albeit the growth of their economies are slowing down compared to the end of last year. The most noticeable contraction was in Greece, where annual real GDP fell by 6.2% between the second quarter 2012 and the same period the previous year.[1]

The United States and Japan both experienced a positive annual year-on-year growth of 2.2% and 3.6% respectively. Japan also registered its fourth consecutive quarter of positive GDP growth.

How are the recent figures situated compared to GDP levels ex ante the financial crisis?

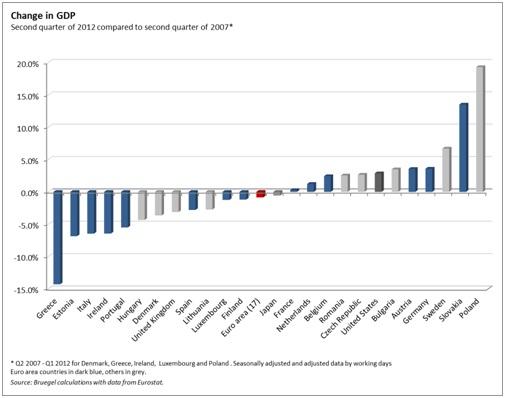

The chart above depicts variations in real GDP between the second quarter of 2007 and the second quarter of 2012. While the euro area average is close to zero, large discrepancies exist between the 17 Member States. Greece, Italy, Ireland and Portugal all experienced output drops towards the end of 2008 or beginning of 2009, and have been on a downward slope since then. In France, real GDP for the second quarter of 2012 is only back to the 2007 level. Slovakia and Poland, on the other hand, outperformed with a GDP increase close to 13.5% and 19.3% respectively over the five-year period.

While the 2012 GDP levels in the United States have come to surpass those for the same quarter in 2007, Japan still faces the challenge of catching up with pre-crisis output levels with a GDP for the second quarter of 2012 one percentage lower than the same quarter in 2007.

[1] In the case of Greece, Eurostat data for year-on year variations are calculated from non-seasonally adjusted data.