Internal adjustment of the real exchange rate: Does it work?

The forefathers of Europe’s single currency argued that rather than devalue their currencies to restore competitiveness, countries could devalue ‘in

A version of this column was originally published in VOX.eu

The forefathers of Europe’s single currency argued that rather than devalue their currencies to restore competitiveness, countries could devalue ‘internally’. Against the current of bad press, this column presents a novel way of recording competitiveness and argues that Ireland, Spain, Latvia, and Lithuania have all managed these adjustments – but not without paying a huge toll in jobs lost.

There is an intense policy debate on ‘internal adjustment’, i.e. productivity improvements and wage cuts to restore price competitiveness, when depreciation of the nominal exchange rate is not available. The most frequently mentioned examples for internal adjustment are Ireland and the Baltic countries. But assessing internal adjustments is often blurred by compositional changes in the economy, and a key issue is if internal adjustments have been successful in preserving jobs and growth.

The impact of compositional changes

Suppose that a construction worker’s compensation is broadly similar to the total economy average, but his productivity is about half of the economy average, such as in Ireland. If a construction worker is laid off but all other workers keep their jobs, then the average wage remains broadly stable, but average productivity increases for the rest of the economy, even if there is no productivity gain in any individual sector of the economy. Changes in other sectors of the economy may have similar effects too.

These compositional changes are not ‘bad’ per se and can also reflect healthy structural changes in the economy. But quantifying these compositional changes is crucial for assessing the adjustment that countries have achieved.

Inspired by Central Bank of Ireland (2011), which assessed the importance of sectoral changes on the Irish relative unit labour, in recent research (Darvas 2012) I study 24 EU countries considering 11 main sectors of the economy and 13 manufacturing sub-sectors.

Ireland is the most extreme case – largely due to the pharmaceutical industry, which had a 40% share in manufacturing output (and about a 10% share in total economy output) in 2010 with unusual labour productivity figures: one worker generated €447,000 value added per year (more than 6-times the national average), while annual labour compensation amounted to only €29,000. Such high labour productivity is result of extraordinarily high capital intensity, i.e. “a pharma worker … basically watches over very expensive machines that produce a lot of output” (Krugman 2011). And in Ireland only the pharmaceutical industry and the small chemical industry boomed since 2008. Other manufacturing sectors and the non-manufacturing business sector have been weak since then.

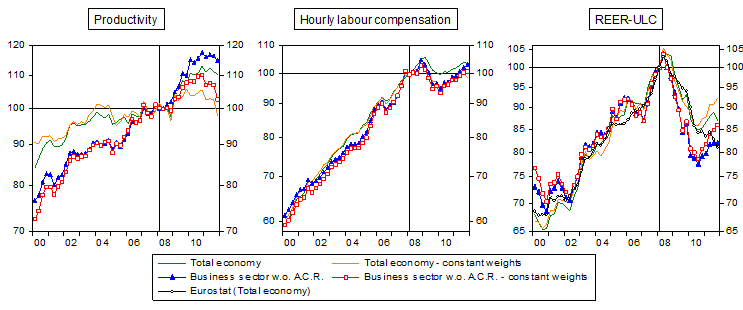

Consequently, the impact of compositional changes on Irish productivity is very large. The actual aggregate productivity of the business sector excluding agriculture, construction, and real estate activities increased by 15% from 2008Q1 to 2011Q4, but if we use constant sectoral weights, the improvement is only 3% (Figure 1). There are ten other EU countries for which the composition-adjusted productivity is also significantly lower than aggregate productivity. These findings highlight that the issue should be taken seriously when assessing the productivity achievements of a country.

Yet the overall impact of compositional changes on the unit labor costs (ULC) based real effective exchange rates (REER) is less significant, for two reasons.

First, the constant-composition average wage tends to be somewhat smaller than the actual average wage.

Second, there can be compositional changes in trading partner countries as well. In Ireland, for example, our preferred measure of real effective exchange rates (calculated for the business sector excluding agriculture, construction and real estate activities) depreciated by 14% between 2008Q1 and 2011Q4 when we use fixed weights. The real exchange rate based on actual aggregates depreciated by 18% (Figure 1).

In addition to Ireland, our preferred real effective exchange rate measure also depreciated by more than 10% since 2008 in Poland, Lithuania, Latvia, and Spain. At the same time the German exchange rate remained broadly stable, implying that at least some of the intra-euro real exchange rates started to adjust.

Figure 1. Ireland – productivity, nominal wages and ULC-REER (2008Q1=100), 2000Q1-2011Q4

Note: ACR stands for ‘agriculture, construction and real estate activities’. For calculating the REER, we consider 30 trading partners and use gross value added as the measure of output, while Eurostat considers 36 trading partners and GDP as the output measure.

Did depreciation in the real effective exchange rate help export adjustment?

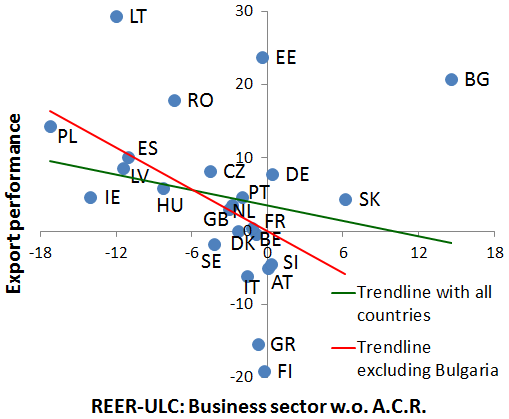

Export growth should play a major role in facilitating current account adjustments. Figure 2 suggests that export performance was better in countries that could engineer a greater fall in the ULC-REER (Bulgaria is an outlier). The correlation coefficient between export performance and real effective exchange rate is -0.21, but if we exclude Bulgaria, the correlation is -0.49.

Figure 2 also shows that the top five performers in terms of export growth are from the member states that joined the EU in 2004/07. Among the EU15 countries, Spain is the best performer, followed by Germany, Ireland, and Portugal. It is good news that the export sectors of Spain, Ireland, and Portugal – three euro countries facing significant external adjustment challenges – perform rather well among the EU15 countries. But it is worrying that Greek export performance is very poor.

Figure 2. Export performance vs the ULC-REER, 2008Q1-2011Q4

Note: Export performance is the measure of export market share – the ratio of the volume of export growth relative to the weighted average volume of import growth of 40 trading partners. The REER-ULC, which is calculated against 30 trading partners, is the average REER in 2008Q1-2011Q4 relative to its 2008Q1 value. A.C.R. stands for ‘agriculture, construction and real estate activities’.

Which countries were more successful?

The ultimate goals of economic policy should be growth and jobs. Exports should play a strong role in delivering these goals in countries facing severe adjustment challenges and the depreciation of ULC-REER is a tool. Consequently, we do not measure success by the downward real effective exchange rate adjustment, but rather the components of the real effective exchange rate (of the business sector excluding agriculture, construction and real estate activates) that relate to the ultimate goals. We consider those countries successful that have:

- increased production;

- improved productivity;

- kept people employed;

- reduced hourly labour compensation and cut working time instead of laying-off people;

- and increased export market share (exports relative to the weighted average of trading partners’ imports).

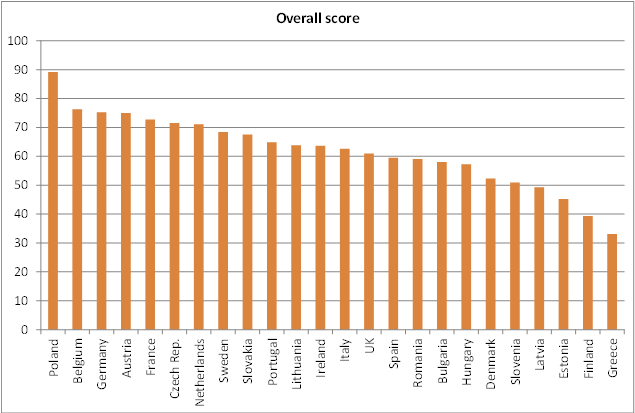

For each of the five indicators we rank the 24 countries according to both stability (the magnitude of the maximum fall in the indicator after 2008Q1) and growth (growth of the indicator from 2008Q1 to 2011Q4). We average the five scores of the individual indicators in order to determine an overall score, which is shown in Figure 3.

Figure 3. Success – ranking of countries according to stability and growth of five indicators

Note: The scores for the five individual indicators can be interpreted as the closeness to the best performer, whereby the best performer’s score is 100 and the worst performer’s score is 0. The score for each indicator is the average of the scores for stability and growth. The overall score is the average of the five scores for the individual indicators. See more details in Darvas (2012).

Poland is clearly the top performer, followed by some usual suspects, such as Belgium, Germany, and Austria. Among the ten countries that faced the most severe external adjustment challenge, Portugal, Lithuania, and Ireland score the highest ranks of 10-12. The laggards are Latvia, Estonia, and Greece at 21, 22, and 24 respectively. The remaining four countries are in between: Spain (15), Romania (16), Bulgaria (17) and Hungary (18).

It is also instructive to look at downward wage flexibility and if it helped to keep people employed. There are six countries in which hourly labour compensation fell by more than 4% (Estonia, Greece, Ireland, Latvia, Lithuania, and Romania). However, these wage falls have corrected just a small fraction of pre-crisis wage rises, they were accompanied by massive employment losses, and they were temporary and were largely or even fully reversed by 2011Q4.

For example, even if Latvian private sector wages fell by about 17% from peak to trough, it has just restored the wage level of mid-2007 and the employment loss has been enormous – 17% in the private sector (excluding construction, real estate and agriculture), pushing down employment to its level in 2003/04. Total economy employment fell below the employment level in 2000. The good news is that the Latvian economy is growing fast from its depressed level. We shall never know what would have happened had the exchange rate been devalued in 2009, as argued in a balanced assessment by Blanchard (2012). Yet Iceland, an even smaller country with a much larger banking sector that allowed the exchange rate to depreciate was much more successful in preserving output and jobs (Darvas 2011).

Turning to the other southern European countries facing severe adjustment challenges, in Spain wages did not decline despite the huge employment loss, and in Portugal wages have actually increased by about a cumulative 8% since 2008Q1.

Conclusions

- Compositional changes in the economy can have very significant effects on average productivity, and can also matter for the assessment of the real exchange rate developments.

- Export performance is related to real effective exchange rate changes. A depreciation of the real effective exchange rate can be fostered by productivity improvements and nominal wage reductions (or at least slower wage increases than in trading partners) and the good news is that some countries, such as Ireland, Lithuania, Latvia, and Spain, could achieve sizeable internal adjustments.

- Another piece of good news is that among the EU15 countries, Spain, Ireland, and Portugal rank first, third and fourth, respectively, for export performance between 2008Q1 and 2011Q4. This suggests that their external rebalancing process is not hopeless. And yet they outperform the Eurozone core countries by just a small margin so further adjustment is needed. Unfortunately, Greek export performance has been very poor since 2008.

- The bad news is that internal adjustments, even when they were accompanied by nominal wage falls, have led to a huge number of jobs lost. In a number of adjusting countries nominal wages proved to be rigid downward, a finding that augments the literature on downward wage rigidity.1

- Altogether, our findings suggest that internal adjustment can work, but is a very painful process. In the Eurozone, these findings call for unit labour cost increases and a slower pace of fiscal consolidation in the ‘core’ countries and a weaker exchange rate of the euro.

References

Bergin, Adele, Elish Kelly, and Seamus McGuinness (2012), “Explaining changes in earnings and labour costs during the recession”, Renewal Series, 9, The Economic and Social Research Institute, Dublin.

Blanchard, Olivier (2012), “Lessons from Latvia”, iMFdirect, 11 June.

Central Bank of Ireland (2011), “Compositional effects in recent trends in Irish unit labour costs”, Box A on pages 22-24 in Quarterly Bulletin 01, January 2011, prepared by Derry O’Brien.

Darvas, Zsolt (2011), “A tale of three countries: recovery after banking crises”, Bruegel Policy Contribution 2011/19, December.

Darvas, Zsolt (2012), “Compositional effects on productivity, labour cost and export adjustments”, Bruegel Policy Contribution 2012/11, June.

Krugman, Paul (2011), “Irish Competitiveness (Wonkish)”, 19 December.