Chart of the week: Emergency on funding costs for sovereigns, financial and non-financial corporations

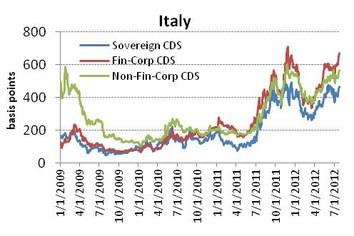

The funding cost of Spain and Italy are high and continue to rise. Yet, how does this increase in sovereign riskiness affect the riskiness of corporate bonds as measured by CDS? We look at the 5 largest financial and non-financial corporations in Italy, Spain, France and Germany. In Italy, risk premia for financial and non-financial corporations exceed 600 respectively 500 basis points. They also significantly exceed Italian sovereign risk. This contrasts with Spain, where the large non-financial corporations are considered less risky than the government and pay a risk premium of “only” 300 basis points, or 200 basis point more than French and German corporations. Italian government risk may look less dramatic than Spanish, but a continuation of such high risk premia in the normal corporations will prevent growth and investment with dramatic consequences.

In Italy, risk has risen very strongly for all three, the government, the financial and the non-financial corporations. As in Germany, sovereign risk sets the floor while financial corporations have the highest risk. This contrasts very much with Spain, CDS risk premia on government bonds have increased similarly but the non-financial corporate stay significantly below while banks are much more risky than governments.

Source: Bruegel calculation with data from Datastream.

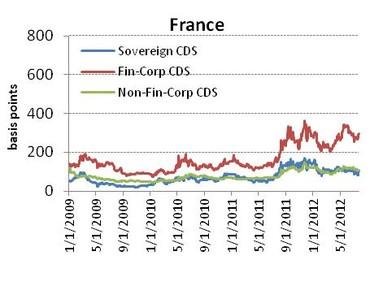

We plot the CDS risk premia on 5 year sovereign bonds along the CDS premia for the financial and non-financial corporate bonds of the five largests corporations in Spain, Italy, Germany and France[1]. We build an unweighted average across the five financial and the five non-financial corporations. The corporations included are listed in the table below.

In Germany, risk is very low for the sovereign bonds, slightly higher for the non-financial corporates and it amounts to around 200 basis points for the 5 largest banks. In France, the large non-financial corporations and the government are priced almost identically while French banks pay a significant premium over German banks with CDS risk almost at 300 basis points.

Source: Bruegel calculation with data from Datastream.

Overall, if risk and therefore funding costs remain as elevated as currently, growth, investment and economic activity will slow down even further. This has strong consequences on the debt dynamics of the euro area and increases the odds of further restructuring but also the break-up of the euro area.

TABLE

|

|

Italy |

Spain |

France |

Germany |

|

Non-Financial Corporations |

Eni; Enel; Fiat; Finmeccanica; Telecom Italia |

Telefonica ; Iberdrola ; Altadis ; Repsol YPF; Endesa |

Total SA ; Electricite De France ; GDF Suez ; France Telecom ; L'Oreal |

E.On ; Volkswagen Group; Siemens ; DeutscheTelekom ; Daimler |

|

Financial Corporations |

UniCredit ; Intesa Sanpaolo ; Banca Monte dei Paschi di Siena ; Banco Popolare ; Unione di Banche Italiane |

Banco Santander ; Banco Bilbao Vizcaya Argentaria ; Banco Popular Espanol ; Caja de Ahorros y Pension de Barcelona ; Banco de Sabadell |

BNP Paribas ; Credit Agricole; Societe Generale; Natixis |

Deutsche Bank; Commerzbank; Landesbank Baden Wurttemberg (LBBW); Bayerische Landesbank ; Norddeutsche Landesbank (NORD LB |

[1] For financial corporations, the sample includes the top five financial institutions ranked according to its value of total assets at the end of 2011. Non-financial corporations have been selected according to the Financial Times' Global 500 list, where ranking is based on prices and market values from 30 March 2012. If data from one of the top-five ranked institutions was not available (financial and non-financial), the next highest ranked institution with data was considered.