Are wages too high in the French automobile industry?

Following the announcement of 8,000 job cuts by PSA Peugeot Citroën chief executive Philippe Varin, citing the high cost of French labour as a main reason, an intense debate emerged. Referring to a study by INSEE (National Institute of Statistics and Economic Studies), the blog of Monde.fr "Les Décodeurs" reported that hourly labour cost in Germany is 29 percent higher than in France. Several politicians expressed disapproval of the layoffs and the high labour cost argument.

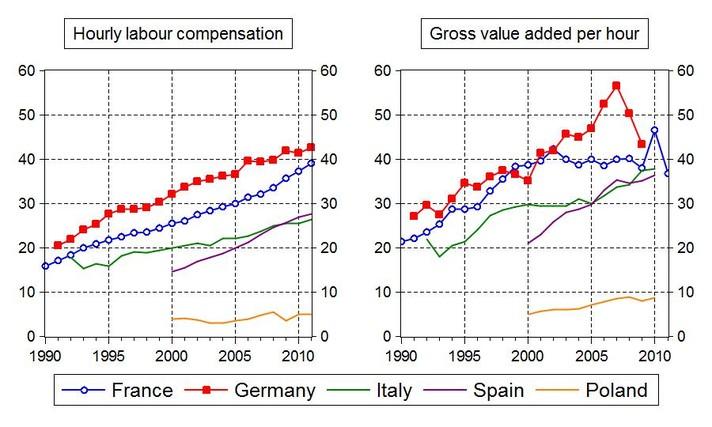

How do French hourly labour costs compare with other countries? The left hand-panel of Figure 1 shows that hourly labour costs in the automobile industry are indeed higher in Germany than in France. However, the gap has narrowed recently, and French labour costs increasingly exceeded the costs of the Italian and Spanish manufacturers, not to mention the Polish ones.

Figure 1: Hourly labour compensation and current-price value added in the automobile industry (€/hour), 1990-2011

Automobile industry = C29 and C30 industries of the NACE 2.0 classification: “Manufacture of motor vehicles, trailers, semi-trailers and of other transport equipment”. Note: official data from Eurostat is available till 2009 for Germany, till 2011 for France (concerning gross value added) and till 2010 for the other three countries. The missing data for 2010-11 for labour compensation and hours worked was calculated by me as described here. Total labour compensation is reported, which consists of: (a) gross wages and salaries paid in cash; (b) direct remuneration (pay) and bonuses; and (c) wages and salaries in kind (company products, housing, company cars, meal vouchers, crèches, etc.).

The right-hand panel shows value added generated by one work-hour, ie a measure of labour productivity[1]. Interestingly, while French and German workers generated almost as much before 2002, after 2002 the productivity of German workers continued to increase, while the productivity of French workers stayed constant (except the year 2010, which seems to be an outlier). Unfortunately, German data ends in 2009 when the global crisis hit the industry hard and German value added per hours worked dropped significantly. But Germany was one of the most successful countries in keeping workers employed during the crisis and therefore the drop in labour productivity may prove to be temporary.

Also, the right-hand panel indicates that the productivity of Italian and Spanish carmakers almost caught up with France’s productivity, in contrast to their much lower hourly labour compensation.

Therefore, Figure 1 does suggest that labour cost relative to labour productivity is indeed a major issue in France compared to some main competitor countries.

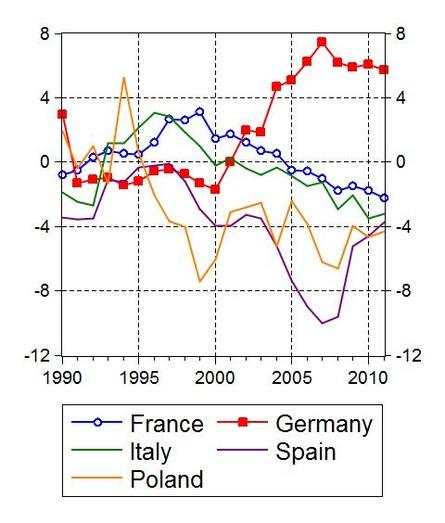

The picture at the macroeconomic level also suggests that price (or labour cost) competitiveness of France may not be strong. Figure 2 shows that the current account deficit, which was primarily driven by the trade deficit, deteriorated continuously starting in the late 1990ies. This applies to Italy as well. A number of studies, including my recent paper, found relationship between relative labour costs and export performance. While the French and the Italian current account deficits are not that high and the international investment positions of the two countries are reasonable (i.e. their figures are not at all comparable to the positions of Greece, Spain and Portugal), the deteriorating trend in the current account is worrying and suggests that cost competitiveness should be a major issue to be considered by policymakers.

Figure 2: Current account balance (percent of GDP), 1990-2011

[1] Labour productivity is usually defined as constant price output per hours worked. Here I use current price output per hours worked.