Chart of the week: the fiscal stance in the euro area

The size of the deficit reduction mandated by European fiscal rules for euro area countries currently under excessive deficit procedure will be on ave

The size of the deficit reduction mandated by European fiscal rules for euro area countries currently under excessive deficit procedure will be on average nearly 1.5 percent of GDP per year in the next two years. While such adjustment would not be overly restrictive in normal times, it is undesirable in countries that are already in recession. The risk is particularly important in Cyprus and Spain which need to undertake cumulated fiscal adjustments of more than 6 percentage points of GDP in 2012 and 2013 in order to satisfy European fiscal rules.

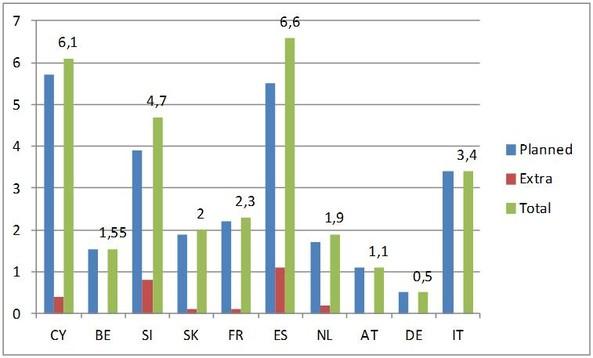

Graph 1: The cumulated size of deficit reduction over 2012-2013, % of GDP

Source: Authors’ own elaboration based on National Stability Programmes and Commission’s Spring Economic Forecast, May 2012.

There is much talk about fiscal austerity in the euro zone and concern is expressed about the fact that significant deficit reduction may produce large drops in output, which is undesirable in bad times. What is the exact size of deficit reduction over the next two years?

We calculated the size of deficit reduction in all the countries that are at present under excessive deficit procedure and need to correct excessive nominal deficits either by 2012 (Cyprus and Belgium) or by 2013 (all others, excluding Estonia, Finland, Luxembourg and the three programme countries Greece, Ireland and Portugal, which have their own timetable).

We distinguish between corrective measures that have already been envisaged in the national Stability Programmes of April 2012, which we classify as “planned”, and the extraordinary measures that are not planned but deemed necessary to obey by the agreed deadlines for correction; these are classified as “extra” and are calculated as the distance of the deficit level forecasted by the Commission from the 3%-of-GDP level in the target year. As the Commission’s forecast for 2013 does not include the fiscal policy measures that will be implemented in 2013, we assume quite optimistically that national fiscal plans perfectly anticipate fiscal policy outputs in 2013.

Over 2012-2013, the average cumulated planned fiscal contraction is 2.75 percent of GDP, thus an annual cut of 1.4 percent, which is certainly not desirable in bad times but it is not dramatic either. The average cumulated fiscal contraction (including both planned and extraordinary interventions) reaches 3 percent of GDP over the two years, leaving the annual adjustment effort at 1.5 percent of GDP.

What is but striking is the large cross-country variation with a very restrictive fiscal stance especially in Spain and Cyprus, as both should go through a cumulated deficit reduction in 2012 and 2013 that is above 6 percent of GDP.