Is LTRO QE in disguise?

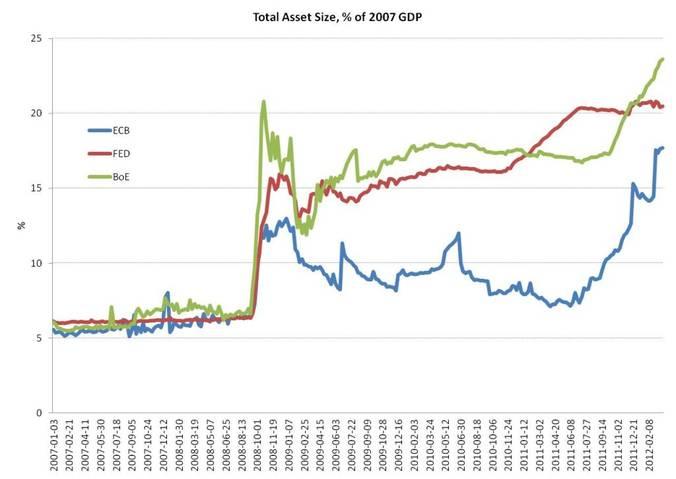

With the launching of the three-year LTRO in December 2011, the Eurosystem has entered new territory. Its balance sheet (stripped out of foreign exchange reserves and assets that have no relevance for monetary policy such as legacy assets of the national central banks) has jumped from about 5 per cent of GDP before the crisis to about 10 in 2009-2010 and now close to 18. This is only marginally lower than the levels reached by the balance sheets of the Bank of England and the Fed (respectively 23 and 20 per cent, again without FX reserves and other assets of no relevance)[1]. On the face of it, Mario Draghi seems to be emulating Mervyn King and Ben Bernanke, but with a lag (Figure 1).

Figure 1

The ECB’s language is ambiguous. On the one hand its explicit separation principle states that whereas quantitative easing à la Fed is a substitute for conventional easing once the policy rate has reached the zero bound, the ECB’s non-conventional operations only aim at ensuring a proper transmission of monetary policy and could conceptually be undertaken at any level of interest rate (Fahr et al., 2011). On the other hand the ECB emphasises that it is doing much to prop up the economy.

To find out what central banks have actually done, we have decomposed the asset side of their balance sheets into five categories:

- Lending to financial institutions, mainly through repos;

- Government securities held within the framework of asset purchase programmes;

- Non-government securities held within the framework of asset purchase programmes;

- Foreign exchange swaps with other central banks (for the Fed)/foreign currency lending to domestic institutions (for the Bank of England and the ECB)

- Other assets.

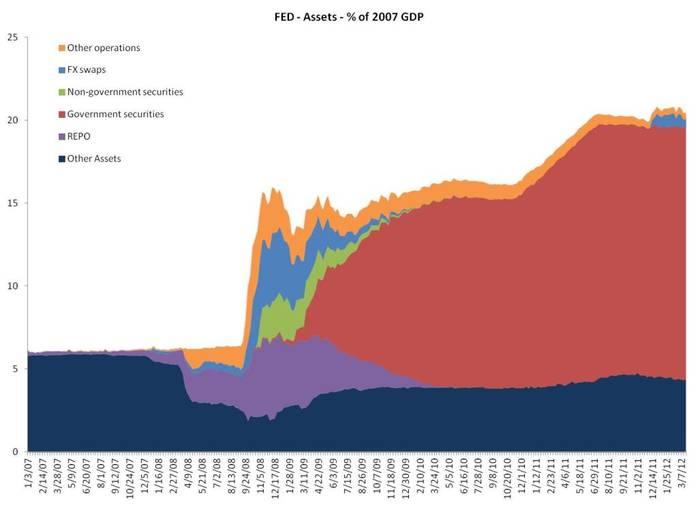

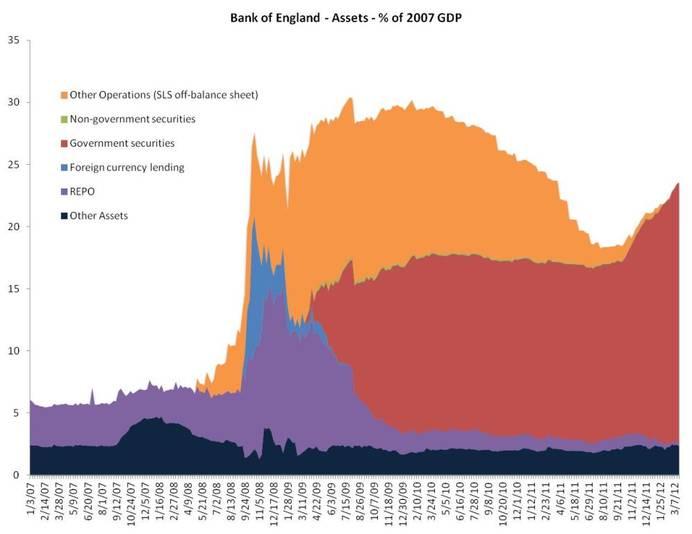

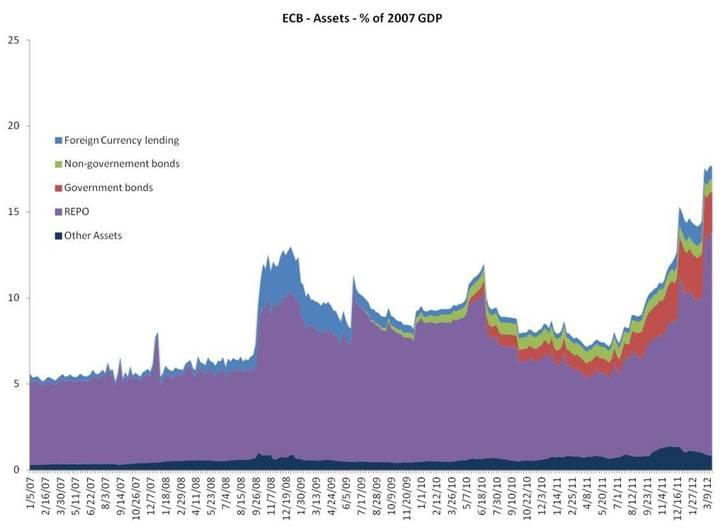

Figures 2 to 4 give the results. It is apparent that in both the US and the UK, the surge of repo lending to financial institutions was short-lived. It took place in response to the disruption of the interbank market following the Lehman shock and was unwound during 2009. The BoE undertook a special off-balance sheet liquidity scheme, which took more than 2 years to be unwound until basically the end of 2011[2]. By the beginning of 2010 the surge of repo lending had either disappeared entirely (Fed) or been reduced to traditional proportions (Bank of England), and did not resume afterward. In the case of the ECB, however, there were repeated spikes of repo lending, with a resumption on a massive scale in December 2011.

Figures 2 – FED Balance Sheet (% of 2007 GDP)

Figure 3 – Bank of England Balance Sheet (% of 2007 GDP)

Figure 6 – European Central Bank Balance Sheet (% of 2007 GDP)

In the US and the UK, government bonds purchased within the framework of credit easing or quantitative easing programmes largely substituted repo operations from 2009 onwards. At the end of February 2012, these assets accounted for 103 per cent of the increase in the overall size of the Fed balance sheet since February 2007, and 116 per cent in the UK. In the euro area, however, the bulk of the increase took the form of repos operations. These accounted for 64 percent of the increase in the size of the balance sheet between February 2007 and February 2012, against 20 percent for government bonds purchased within the framework of the Securities Market Programme and the Covered Bonds Programme.

So the three central banks have increased their balance sheets by roughly comparable amounts, but the composition of the increase is entirely different. The question is whether this difference is indicative of different goals pursued, on the one hand, by the Fed and the BoE, and on the other hand by the ECB; or of alternative ways of reaching the same goal (in the case of the ECB, of promoting bank credit to the non-financial sector and/or purchases of government bonds).

In fact a series of facts suggest that the outcome of ECB policy does not compare to those of BoE and Fed initiatives:

At end-March 2012 €700bn had been parked by commercial banks at the ECB deposit facility, indicating that it was largely substituting the interbank market;

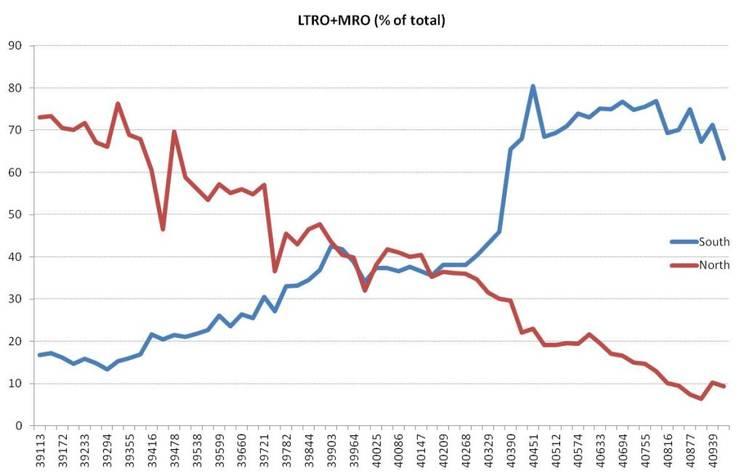

Reliance on Eurosystem refinancing is highly asymmetric across countries. Banks in Southern Europe recently accounted for 70 per cent of medium- and long-term refinancing operations against 20 per cent before the crisis (Figure 5). The Eurosystem is therefore stepping into a dysfunctional interbank market rather than propping up total bank credit;

Bank loans are growing in Northern Europe, but contracting in Southern Europe whereas the opposite applies for bank holdings of government securities;

The impact of the LTRO on the yield curve has been significant for distressed issuers, but much less so for AAA issuers.

The ECB has, with the recent LTROs, managed a massive expansion of its balance sheet. This has been called the euro-area equivalent of quantitative easing, as done by the Fed and the Bank of England. Large portions of this liquidity, however, are parked in overnight deposits at the ECB, reducing its effectiveness for the overall monetary policy stance.

The main obstacle for the ECB is not the fact that the Treaty on which it is based places tight limits on the purchase of government bonds, compared to those existing in the UK and the US. Rather, the absence of a banking and fiscal union and the strong heterogeneity within the euro area reduces the effectiveness of the instruments the ECB has.

[1] Our figures slightly differ from those quoted by ECB president Mario Draghi in his press conference on 8 March 2012, because we consider all numbers in % of 2007 (and not 2011) GDP and we include lending in foreign currency (and another marginal asset category) that the ECB does not classify as monetary policy asset but that for the purpose of the comparison we think should be included.

[2] In the breakdown of the balance sheet of the Bank of England, we also report the Special Liquidity Scheme introduced in 2008, to improve the liquidity position of the banking system. The scheme allowed banks and building societies to swap their holdings of high-quality mortgage-backed (and other) securities for UK T-bills for a period up to three years. Being securities-to-securities transactions (different from the securities-to-cash as in REPO or purchase operations) they are off-balance sheet. For a detailed discussion of the Special Liquidity Scheme’s features, design and application, see the BoE’s Quarterly Bulletin (2012 Q1).