Chart of the week - The consequences of financial disintegration

The recent ECB report on "Financial Integration in Europe" has exposed in detail the deterioration in European financial market integration caused by the crisis. Banks located in the weakest countries find it more and more difficult to access liquidity, and this translates into segmented funding conditions for the private sector as a whole and forces the ECB to play an ever bigger role as financial intermediary of last resort in lieu of a structurally malfunctioning interbank market.

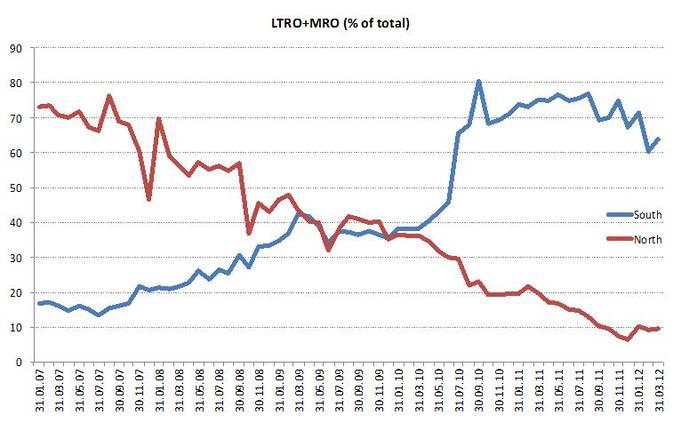

Figure 1: Financial disintegration and the mediating role fo the ECB

Source: National Central Banks; ECB. South = Greece, Ireland, Portugal, Spain, Italy; North = Germany, Luxembourg, Finland, Belgium.

Figure 1 shows that countries in the South of the Euro Area have been taking up an increasing share of Eurosystem liquidity since the start of the crisis, while the share of North has been declining. During 2011, Greece, Ireland, Portugal, Italy and Spain accounted for about 70% of the entire Eurosystem liquidity, which has been key in replacing outflows of private capital and sheltering countries from the consequences of a sudden stop in capital flows (see our recent Policy Contribution on this question).

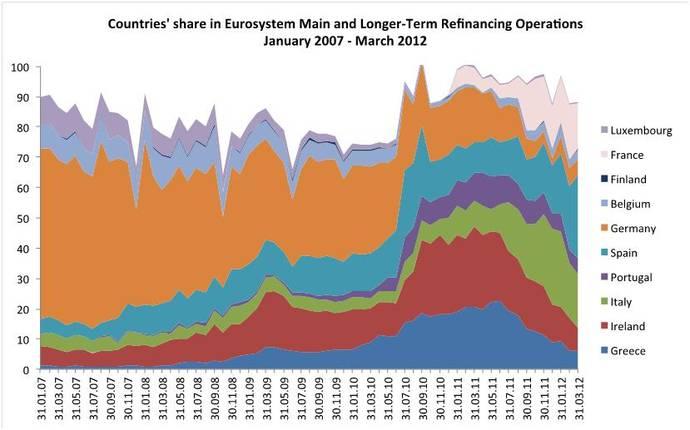

But our reconstruction on a country by country of the use of the LTRO in figure 2 illustrates interesting divergence even within the aforementioned groups of countries. This data is not straightforward to gather. The ECB only publishes the aggregate volume of Marginal and Longer Term refinancing Operations (MRO and LTRO), without any country breakdown. To reconstruct each country’s share, we merged data provided by National Central Banks but the aggregation sometimes may require some assumption due to the different periodicity of data publication or level of details. For example, we had to keep the shares of Greece and Italy in March fixed at the same level as they were in February, because the latest data have not been released yet. Data for France only cover the period of 2011, because a monthly breakdown is not available for previous years.

Figure 2: Country breakdown of ECB liquidity provision

Source: National Central Banks, ECB. Note: the Bank of Greece has not published the disaggregation of Central Banks’ lending into MRO and LTRO since December. Data for January and February are therefore proxied with the general series “Claims on Domestic MFIs” on the Bank of Greece’s balance sheet assets. Over the past, the series however is very consistent with the numbers that we would obtain by summing LTRO and MRO figures.