Sudden stops in the euro area

Many analysts and observers have put forward that the euro crisis is a balance-of-payments crisis at least as much as a fiscal crisis. The issue has g

Many analysts and observers have put forward that the euro crisis is a balance-of-payments crisis at least as much as a fiscal crisis.[1] The issue has gained further relevance with the widening of imbalances among euro-area central banks within the Target 2 settlement system and has important implications for both the short and the long-term policy responses.

In a recent paper, we provide evidence of capital flows reversals in Greece, Ireland, Portugal, Spain and Italy and show that on the basis of the Calvo criteria, these episodes can be characterised as Sudden Stop. We discuss the implications of this finding for the Target2 discussion and the appropriate responses to the euro crisis.

Capital flows in the monetary union

The prevailing view over the first ten years of life of EMU was that among euro-area Member States balance-of-payments would become as irrelevant as among regions within a country. Indeed current-account adjustments after the crisis have been considerably slower in euro-area countries like Greece, Portugal and Spain than in non-euro-area EU countries like Bulgaria, Latvia and Estonia.

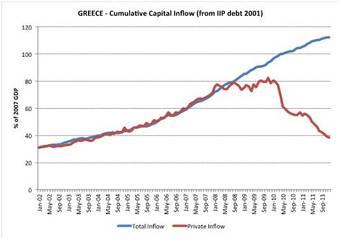

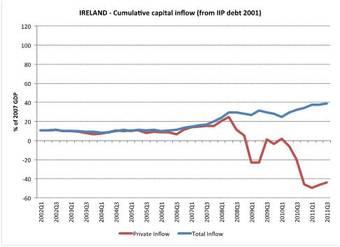

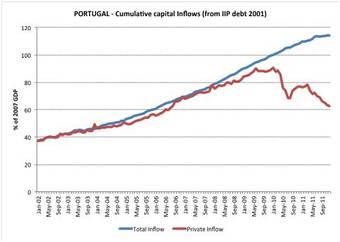

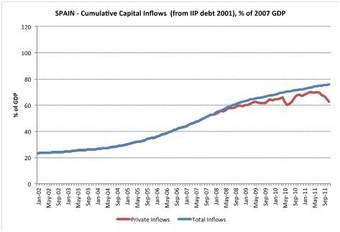

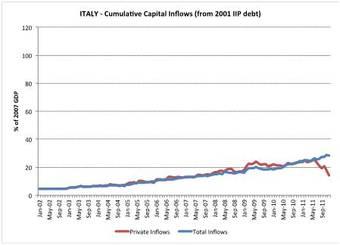

Looking at the current account to assess whether there has been a balance-of-payment crisis may however be a flawed approach if countries receive significant official capital flows. Instead, we concentrate of private capital inflows to Southern Europe, using monthly financial account data net of the changes in TARGET2 balances and of the inflow associated to disbursements under the IMF/EU Programmes (ECB’s Securities Market Programme – which represents a third component of official capital inflows – is unfortunately impossible to disaggregate). Figure 1a-1e shows the cumulated private capital inflows in proportion of the 2007 GDP, starting from the end-2001 net investment position of the country as recorded by Eurostat. All five countries experienced significant private capital inflows from 2002 to 2007-2009, followed by unambiguous and rather sudden outflows.

Figure 1: Cumulated Private Capital Inflows, 2001-2011

|

|

|

|

|

A “sudden stop”?

Sudden and sizable reversals in the pace of capital flows are a common feature of balance-of-payments crisis episodes in emerging

countries. To assess whether the outflows observed in Figure 1 qualify as a “sudden stop” in a formal sense, we use the methodology

introduced by Calvo (2004). By setting threshold for year-on-year changes in capital flows, the methodology yields a dating of episodes in which the drop in capital flows can be considered of exceptional magnitude. To avoid short-term variation, we also restrict our attention to episodes lasting at least three months.

Figure 2: Episodes of Sudden Stops, 2007-2011

Figure 2 reports for each month the countries found to be in a sudden stop according to this method. Sudden stop episodes seem to be clustered in three periods:

· The global financial crisis with private capital starting to flow out of Greece early in 2008 and leaving Ireland from October);

· Spring 2010, when the agreement of the IMF/EU programme marked the beginning of a third Greek episode that also triggered an impressive contagion effect affecting Portugal and Ireland;

· End 2011, with a third wave of sudden stops involving Italy[2] and Spain – both put under increased scrutiny and pressure by sovereign bond market during the summer – and Portugal.

The role of official financing and TARGET2 debate

The observed private capital outflows have been counteracted by equally sizable public capital inflows, which have taken three forms in the euro area: EU/IMF assistance programmes; provision by the Eurosystem of liquidity to the banking sector (captured by the development of Target balances); and ECB purchases of sovereign bonds under the Securities Market programme. Apart from Greece, in all other countries net new Target liabilities constitute the largest component of official capital inflows. They in turn result in large part from the reliance of the countries’ banking sectors on central bank liquidity provision: since 2008 the five countries have accounted for a disproportionate part of liquidity allocation by the Eurosystem (Figure 3).

Figure 3: Share of Countries Affected by Sudden Stops in Take-up of Central Bank Liquidity, 2003-2011

Substitution of private capital inflows by public ones, especially Eurosystem financing, has provided a buffer against the drying up of private liquidity and to some extent has helped accommodate persistent current-account deficits in a context where capital markets were not willing to accommodate them anymore. Reliance on Eurosystem financing primarily reflects the difficulty of euro-area banking system, which has become more and more reliant on central bank financing. Weak banks in distressed countries ended up taking up a disproportionately large part of central bank refinancing and the steady divergence of intra-Eurosystem net balances are the mirror image of such uneven redistribution of central bank liquidity.

Rather than focusing on Target 2 imbalances per se, more attention should be devoted to curing their underlying causes. The proximate cause the Eurosystem can tackle is high demand for liquidity by weak banks, against collateral of declining quality. A tightening of the quality of required collateral is likely to reduce Target imbalances without hampering the functioning of the euro area, but such option can only be contemplated if banks are adequately recapitalised and if the threat of a vicious circle of bank and sovereign insolvency is removed. This, in turn, requires that underlying factors that contribute to bank weakness are addressed: bad loans on the balance sheets of banks must be provisioned and recapitalisation must take place wherever needed; public finances must be made convincingly sustainable; and on the macro front, persistent current account deficits can also be tackled through the “Excessive Imbalances Procedure” recently adopted as part of the Six-Pack legislation. Private capital flows will only return after the disease has been addressed.

For the longer run, the evidence that the euro area has been subject to internal balance-of-payment crises should be taken as a strong signal of weakness and as an invitation to reform its structures. Contrary to common beliefs, a monetary union of this sort is closer to a fixed exchange-rate system among independent countries than to a fully integrated economy, and any action casting doubt on the willingness to let capital flow freely and unlimitedly within the area would offer a dangerous target to speculation. The fostering of a pan-European banking industry and the creation of a banking union with centralised supervision and access to resources to recapitalise weak financial institutions should feature high on the policy agenda because only a closer integration of markets and policies will preserve the euro area from the risk of further attacks.

[1] See for example Carney (2012), Giavazzi and Spaventa (2011), Sinn (2012), Wolf (2011).

[2]As in the case of Greece, the observation of October 2011 would not satisfy the criterion, but the y-on-y positive change is very small and followed by two observations below the second threshold, so we include it in the sudden stop.