Chart of the Week - Competitiveness adjustment in euro-area periphery

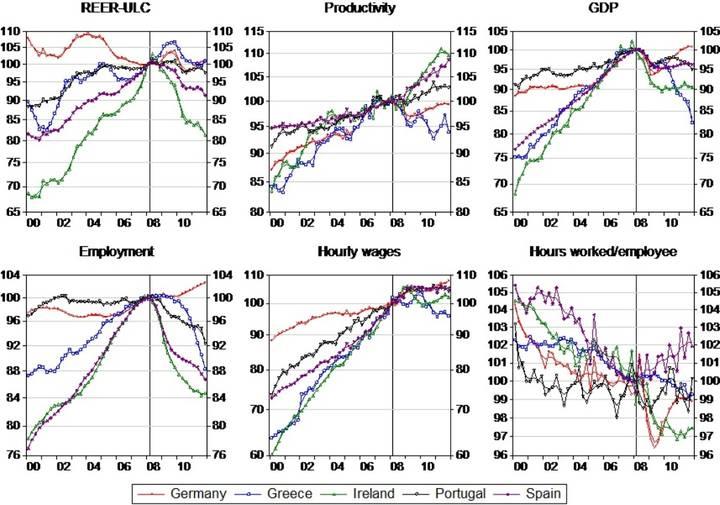

A lot of the discussions surrounding competitiveness and rebalancing have focused on divergent unit labour costs. But in reality, competiveness is not simply a question of prices and it could be improved through non-price factors as well. The latter typically takes a long time. Progress in price competitiveness is shown by the figure below.

Unit labour cost (ULC) based real effective exchange rate (REER) index and its main components (2008Q1=100), 2000Q1-2011Q4

Click here FILE to download a .gif version of the chart above.

Note: The ULC-REER, which is calculated against 36 trading partners, is available at the Eurostat website till 2011Q3 and therefore the 2011Q4 values were calculated by the author using domestic ULC from the Eurostat, the nominal effective exchange rates from a recent paper of mine, with the assumption that foreign ULC has not changed from 2011Q3 to 2011Q4. Greek data is available in a non-seasonally adjusted form from the Eurostat and therefore I adjusted the data using X12. Productivity is measured as real GDP per hours worked.

The good news is that the ULC-REER started to adjust significantly in Ireland and Spain and moderately in Greece. Adjustment in Portugal is quite limited so far (top-left panel). Another good news is that productivity improved significantly since 2008 in Ireland and Spain; Portugal also outperforms Germany in this respect (top-middle panel). A little hope is also provided by Germany by not depreciating further its ULC-REER since 2008.

But there are many bad news. The productivity increase in Ireland and Spain was the result of a greater fall in employment than the fall in output, with harmful social consequences. Employment is also collapsing in Greece and the trajectory is extremely worrying (bottom-left panel). Despite the tough labour market conditions nominal wages have hardly adjusted, though some downward adjustment can be observed in Ireland and Greece (bottom-middle panel). Downward wage rigidity also characterised another country, which is sometimes regarded as having achieved a successful internal devaluation of the real exchange rate: while public sector wages declined significantly in Latvia, private sector wages hardly changed. Since 2008 hourly wage inflation was just slightly faster in Germany than in the other countries, which did not bring much relief so far to the ailing countries in the periphery. Shortening work-time, which played an important role in Germany in supporting employment, helped somewhat Ireland, but not the other adjusting countries. In Spain working hours were even lengthened since 2008 (bottom-right panel).

A possible compositional effect further darkens the picture, as highlighted by Paul Krugman. The reason is that if eg low-productivity construction workers are laid off massively while high-productivity manufacturing workers keep their jobs, then average productivity goes up, even if there is no productivity gain in any individual sector of the economy. This leads to an overestimation of the fall in ULC.

Yet there is another compositional effect as well, which works exactly the opposite way. If eg low-wage construction workers are laid off massively while higher-wage earners keep their job, then the average nominal wage of the economy increases, even if there is no wage increase in any individual sector of the economy. This leads to an underestimation of the fall in ULC. I shall soon publish a working paper assessing these compositional issues in detail.