World Wide Rates

In a recent Bruegel Working Paper I calculated trade-weighted real effective exchange rates (REERs) for 178 countries – many more than in any other

In a recent Bruegel Working Paper I calculated trade-weighted real effective exchange rates (REERs) for 178 countries – many more than in any other publicly available database – plus an external REER for the euro area. My main motivation was that for a particular research project I looked for REERs for all countries of the world, but in available datasets data was missing for a large number of countries.

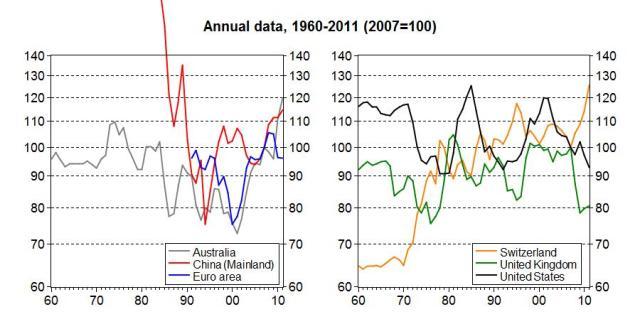

The WP details the methodology and compares my calculations to data included in World Bank, Eurostat, BIS and OECD databases, so here let me just show and briefly discuss the figures for the euro area and some major countries: Australia, China, Switzerland, UK and US.

Australian dollar: The Aussie suffered significantly after Lehman, due to the winding-up of carry trade positions, but recovered quickly and now is at a historical high since 1960; yet the Australian economy is doing well. But the high value of the Aussie will not help reducing the current account deficit.

Chinese Renminbi: Despite the accelerating inflation and the moderate nominal appreciation of the renminbi against the US dollar, its value in real effective terms has not increased too much. Compared to 2000, for example, the REER is only about 10/15 percent higher. The estimated magnitude of renminbi undervaluation typically found much higher numbers, though the issue is contested. One explanation for the limited real appreciation could be is that the renminbi is linked to the US dollar and the US dollar has been going down since 2001. Another is that consumer prices in China are mis-measured (ie actual inflation is higher than reported). While in July 2011 we argued with several colleagues from Bruegel and CEPII in a comprehensive report on the international monetary system that exchange rate appreciation of the renminbi in itself is not sufficient for global rebalancing, some observers recently argued that high inflation in China will help this, which does not really seem to be the case according to my REERs.

Euro: The euro has weakened somewhat in real effective terms compared to the peak in 2008, but not much, and continues to be reasonably strong. In a column, I wrote in October 2010, I argued that the strength of the euro likely reflects market recognition that its dissolution is unlikely, even in the probable event of a Greek default or debt restructuring. The latter was not that difficult prediction, I acknowledge, yet it still seems that markets do not expect the dissolution of the euro.

Swiss franc: The franc has indeed risen to a record high level in real effective terms before the Swiss National Bank (SNB) decided to keep its rate weaker than 1.2 against the euro. Since then, the REER came back to the previous peak of 1995 (visible only in the chart showing monthly data), yet it still looks quite strong. Probably the economic performance of Switzerland, compared to her trading partners, will determine the willingness of the SNB to consider more actions.

UK pound sterling: The pound sterling depreciated by more than 20 percent during the global financial and economic crisis, yet inflation has not really accelerated, signalling low exchange-rate pass-through, which was also observed after several big devaluations in the past. Recently, the depreciation has just marginally corrected, but the current real effective value is close to the historical law of the mid-1970ies. This should benefit economic growth.

US dollar: Finally, the US dollar is also close to historical lows. It is interesting to observe the large swings in the dollar, ie the historical peaks of the 1960ies, 1985 and 2001 had broadly the same level as well as the historical troughs of 1979, 1992 and 2011. The weak dollar may help correcting the US current account deficit, and at the same time improves the net investment position of the US, as argues by eg Philip Lane and Jay C. Shambaugh in 2007. Lane and Shambaugh (2007) also developed an interesting alternative to trade-weighted REERs that they called the financially-weighted exchange rate index, which operates through the valuation channel. The importance of the valuation channel is secularly increasing, in line with the rapid growth in the gross levels of foreign assets and liabilities. See also a March 2012 paper of Maurice Obstfeld in which he asks the question: “Do global current account imbalances still matter in a world of deep international financial markets where gross two-way financial flows often dwarf the net flows measured in the current account?”