The Weekender

Dear All,

It has been an eventful week globally. The Fed pre-announcing a more modest form of possible easing through purchases at the long end of t

Dear All,

It has been an eventful week globally. The Fed pre-announcing a more modest form of possible easing through purchases at the long end of the curve sterilized by short term borrowing, the ECB signaling that LTROs were off unless something major happened while the Reserve Bank of India and the Central Bank of Brazil accelerated their pace of easing.

Meanwhile, Greece successfully pushed through its PSI and maximized participation by activation of the CACs, expectedly triggering a credit event. This allowed the IMF MD to propose to the Board a new Extend Fund Facility program for some 28bn (in reality, there were about 10bn left in the former Stand By, so this is only about 18bn in new money).

I will try to leave Europe (a bit) this weekend and focus on:

1. Japan denuclearization’s and global rebalancing

2. The Fiscal Compact is stillborn

3. DSK's speech at Cambridge

1. Japan’s denuclearization and global rebalancing

§ We are sadly celebrating the first year anniversary of the Sendai earthquake, the ensuing tsunami and the Fukushima-Daichi reactor meltdown. Following those events, Japan has abruptly shut down its nuclear capacities across the country, which used to supply about 30% of its electricity.

§ 52 of the 54 reactors are now shut down and two more will be shut in the next couple of months. Energy has been rationed widely and there is a broad campaign of energy moderation for both households and corporates. But this summer and its usual peaks in energy demands might prove challenging.

§ As a consequence of this shift, fossil fuelled power plants (Coal, gaz and fuel mostly) have increased production substantially and cover Japan’s energy needs although peak demand times in the summer are likely to exceed production capacity. However, this shift towards fossile fuel over such a short period of time has radically changed Japan’s energy imports needs and its balance of payments.

§ There is both a structural and a cyclical explanation to the Japanese Balance of Payment’s rapid deterioration. The cyclical element is that as Japan rebuilds and emerges from the destruction of the earthquake, it will import more, its production capacity will remain impaired and so its exports hampered. The structural element is linked to a profound change in the energy production and import mix.

§ The trade data shows that this new energy demand is largely benefiting the Middle East (Saudi Arabia, Iran and Qatar) and Malaysia. But it is unclear how long this energy policy can be sustained. Further pressure on external accounts could well start to feed through the JGBs market and press interest rates higher. The Japanese PM has already called for a reactivation of a number of reactors and a gradual phase out of nuclear energy but this is still a very sensitive subject and there is a lot popular resistance to nuclear energy.

§ It could well be that, this change in Japan’s external balance could have far reaching consequences. First, it means that from a global rebalancing perspective, Asia altogether will become a smaller and smaller contributors to current account surpluses (China continues to show a declining C/A surplus), the Middle East on the other hands will become a bigger contributor which should help change the narrative about global rebalancing from which the Middle East has always been isolated. The second important change might be on the local JGBs market where if Japan sinks in structural current account deficit position, it will need to attract foreign capital to finance its fiscal deficits japan. In this case, interest rates would have to rise and this could put to test the debt sustainability picture of Japan. This is something to follow closely.

2. The Fiscal Compact is stillborn

§ There is an increasingly lively debate about the Fiscal compact, its purpose, its effectiveness and its future. I want to make the provocative point that it might never be ratified and that we should think of what should come in its place.

§ But the Treaty on Stability, Coordination and Governance (aka the fiscal compact) might be the Treaty with the shortest history because the ratification process could be more challenging than anticipated:

o Ireland has announced that it would need to ratify it through a referendum which given Ireland’s history could prove challenging (although the polls are relatively favourable at the moment).

o Germany will need a 2/3 majority in the Bundestag and in the Bundesrat to ratify it. The government already had to rely on the support of the opposition to approve the last Greek bail out and this time around, the Greens and the SPD appreciate that they don’t have much to win from backing the government.

o In France, the debate is somewhat troubled by the presidential election. In public, Hollande swears that he will renegotiate this Treaty and he probably won’t change his stance until after the general elections in June, but in fact he accepts the pact only if he can add a number of growth enhancing features to it which are not very clear.

o In Spain, the government wants to ratify the pact but also seems quite determined to refrain from applying it as it seeks exemption from its fiscal targets for 2012 and therefore also for 2013 (see Guntram Wolff’s column on the matter).

§ More importantly maybe, outside of politics, experts seem increasingly skeptical about the relevance and the purpose of this compact. It is now widely accepted that it does little more than reinforcing legally the fiscal provisions of the “6 packs” but it is not clear the extent to which it provides an appropriate framework for fiscal policy in the euro area altogether.

§ Indeed, this compact, which is presented like a substantial enhancement of governance still rests on the same old principle of rules and sanctions that proved so ineffective with the Stability and Growth Pact. The pact does little to allow anti-cyclical policies although it leaves some shady room for maneuver because member states can define themselves their potential growth and therefore can largely manipulate their structural balance.

§ But maybe more importantly, the pact doesn’t provide any guidelines for symmetric shocks when joint stimulus might be necessary, nor guidelines for dealing with asymmetric shocks and for associated and necessary fiscal transfers.

§ All in all, I find this pact intellectually underwhelming and politically challenging, I would therefore believe that in the current context, its chances of success are slim. The consequences of this “prediction”, is that Europe might well be further away than it seems from a stable, solid and secure firewall. Indeed, without fiscal compact, Germany will certainly not ratify the ESM.

3. DSK’s speech at Cambridge here

§ Dominique Strauss Kahn gave a very interesting speech in Cambridge on Friday where he presented a “tale of three trilemmas” to understand globalization challenges and how Europe fits in it.

§ It provided a quite a provocative way of looking at the international monetary system, globalization and Europe all at once and the articulation he sketched offers an interesting and thought-provoking framework that I feel compelled to share (maybe a bit parochially because some work by Bruegel is quoted in it).

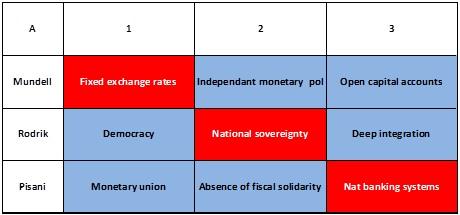

§ Essentially, DSK revisits the impossible trinity of Mundell-Flemming, explores the antagonistic triangle presented by Rodrik between deep global economic integration, democracy and national self-determination and finally explores a specifically European trilemma presented by Pisani-Ferry between monetary union, fiscal union and financial policy.

§ He concludes by suggesting that this mental framework presents policy trade-offs such as: flexible exchange rates, roll back of national sovereignty in favour of international economic cooperation and supranational arrangements and finally, in Europe, the abandon of national banking systems in favour of a mechanism that allows sovereign default and supranational banking resolution).

§ The table A highlights this state of the world but is also relatively idealistic as DSK points out.

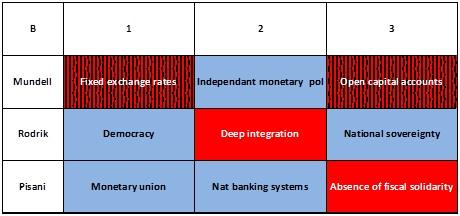

§ Table B is probably a more realistic picture of the word where tinkering with the impossible trinity is widespread (China, India), where national sovereignty is more challenging to forgo than initially thought and so international coordination and supranational efforts remain limited and finally Europe manages slowly but surely to push through a form of fiscal union.

§ Interestingly, DSK ends up conceding that given the limits of international economic policy coordination, taming financial globalization might prove not only necessary but also desirable. This is something that he had already started to push while at the Fund with a major U turn on the doctrine surrounding capital controls but he seems to take it a step further here.

§ I find these conclusions quite strong: realistic on the fact that flexible exchange rate regimes are unlikely to be imposed anywhere anytime soon, somewhat pessimistic on the future of international economic policy coordination and hopeful on the ability of Europe to push through a form of fiscal union.

§ Although, this table B is clearly a more realistic world than the table A, it is also maybe somewhat optimistic on Europe in the sense that it could be that fiscal union proves more challenging than envisaged here. In this case, the only fall back for Europe would be to use organized sovereign defaults and supranational banking resolution frameworks (or assistance) to manage the fiscal transfers that are necessary inside of a monetary union. This is in fact fairly close to what we have achieved in Greece and the framework we are laying out for ESM. The question is therefore whether Europe can use the ESM as a stepping-stone towards fiscal union or whether we are bound to settle for this secondary and disruptive way of delivering a more complete monetary union.

§ Undoubtedly, a debate to be continued… I attach the full speech for your reference.here

All in all, given the current European situation, I think there is a small time window for the IMF to pursue its fundraising exercise. I suppose that within the next 3 months, the cracks in the current European equilibrium will appear again and it would be better if the G20 had secured the IMF's expanded funding then. It might be more complicated to convince the world then that Europe has done everything that it needed to.

Happy to have your thoughts as usual,

Best Regards,

Shahin Vallee