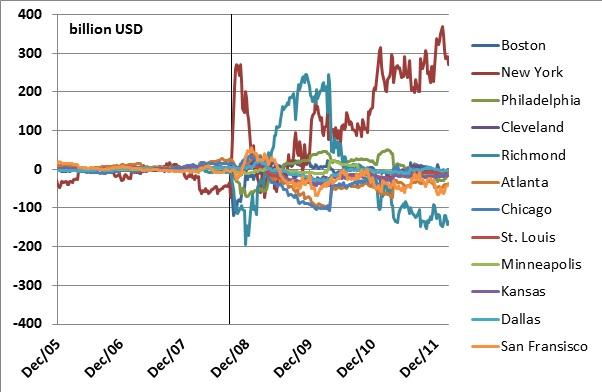

Target 2 of the ECB vs. Interdistrict Settlement Account of the Federal Reserve

The Target 2 discussion is still going strong in Europe especially after the president of the German Bundesbank has expressed his concern as regards t

The Target 2 discussion is still going strong in Europe especially after the president of the German Bundesbank has expressed his concern as regards the quality of the collateral held by the ECB and National Central Banks. Observers such as Hans-Werner Sinn have claimed that the US Federal Reserve had a fundamentally different (and presumably better and more stable) set up.

We revisit this argument with this interesting graph concerning the US Federal Reserve Interdistrict Settlement Accounts (ISA). It turns out the US also has its Target 2 imbalances.

Source: St. Louis FRED

But how can this be? The Federal Reserve accounting manual (p 136) stipulates how ISA balances should be settled: Every year in April the average ISA balance over the past 12 months (April 1st – March 31st) is calculated and netted via transfer of gold certificates between reserve banks.

Apparently the rules of the accounting manual have not been followed. Since the beginning of the FEDs liquidity operations (22-9-2008, the vertical bar in the graph) the New York Fed has accumulated a large positive ISA account, while the Richmond and SF FED have accumulated a negative ISA account. These positions were not settled in April 2009, 2010 or 2011, although we see a jump -albeit insufficiently large - in April 2010. Of course, the amount netted in April should be the average ISA balance over the past 12 months, which will not be equal to the balance in April.

Why was ISA was not settled in April? The Federal Reserve Board is required by law to maintain par between dollars issued by the reserve banks, but not to net out ISA settlements. In order to achieve the former, it has the authority to set settlement and clearing laws. According to Koning in this recent blog post on the history of the ISA the Federal Reserve Board might have decided not to net in order to prevent problems in Richmond or SF.

To give a perspective, Richmond Fed total assets are currently 210 billion USD, while its ISA liabilities are 134 billion USD. In relative size this is comparable to the Target 2liabilities of some Euro area members. Interesting to note is that the Richmond and SF accounts are dominated by Bank of America and Wells Fargo. Bank of America is the largest commercial US bank. Its assets are 2,200 billion USD which is about the size of total assets of banks registered in Richmond Fed. Wells Fargo is the fourth largest bank in the US with total assets 1,258 billion USD. Total assets of banks registered at the SF Fed are 2,000 billion USD. There is also a precedent for this operation. Between 1917 and 1921 and in 1933 interdistrict claims were discounted.

The important difference between Target 2 and ISA, however, is that in the US all Reserve Banks are owned by the federal government. This means that in the US it is possible to safeguard the integrity of the system by changing the settlement rules. This is as exciting as a game of monopoly among friends. As all Federal Reserve banks are owned by the federal government, a loss in Richmond is irrelevant when there is an equal gain in New York. In the Eurozone, however, the ECB is owned by the national governments via the national central banks, not by the European Union as a whole. When one would change the settlement rules here – for example by discounting claims – this means a transfer across countries.