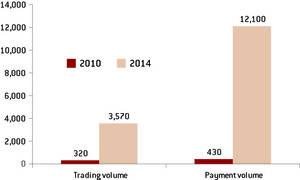

Development of the mobile payments market in Korea

Figure 1: Use of mobile banking in Korea

Source: Bank of Korea.

Improved mobile communications, and links to credit card providers, along with the smartphone boom, has encouraged growth in Korea's domestic mobile payments market. In February 2010, SK Telecom secured a 49 percent share of the Hana SK Card to become the first limited partnership offering a form of 'communication-card'. Then, in June 2011, KT Capital acquired 38.86 percent of BC Card, becoming the largest shareholder. As of March 2011, the number of smartphone subscribers in Korea had already exceeded 10 million, while the use of mobile banking has expanded strongly since late 2009. Recently, NFC (Near Field Communication) technology has been added to USIM (Universal Subscriber Identity Module) cards. The latest combined features might increase demand for making payments via mobile devices. NFC allows for two-way communication within 10 centimetres. Currently, an electronic reader can read information held on a mobile credit card (one-way), but when a NFC chip is installed, the mobile device itself acts as the reader, and exchanging information (both ways) becomes possible.

Figure 2: Expected use of mobile payments using NFC

Source: Gartner, Report on Industry Analysis from Shinyoung Securities. * Near-field communication.

Mobile payments using USIM chips ensure convenience and security, and offer a new business model. USIM allows security through encryption and reduces the data volumes transmitted. By installing USIM, an e-wallet can be created, where information on credit cards, discount cards, coupons and identification cards can be kept. This makes shopping with mobile devices convenient. Mobile cards are normally downloaded through a wireless network (OTA: over-the-air), which reduces costs related to card issuance.

However, a lack of understanding between the finance and communication industries has so far held up the development of the mobile payments market. Therefore, it may be necessary to consider establishing TSMs (Trusted Service Managers) in which financial companies, mobile communication companies and VANs (Value-added Networks) participate as shareholders. Despite the high potential for development, the mobile payments market is having difficulty resolving issues of competition between sectors.

Figure 3: Roles of TSM and its participants

It is strongly recommended that an intermediary intervene in the market. On 13 June 2011, the representatives of credit card companies, mobile communication providers and VANs came together to sign a memorandum of understanding. However, problems relating to costs and income distribution remain. The TSM is a business model (eg credit bureau) that plays many roles in managing USIM chips, distributing payment applications, defining policies on dongle services, distributing income and so on. To foster better understanding between industries, it may also be necessary to have a director who represents the position of the TSM.