European champion-ships: industrial champions and competition policy

This blog post investigates the debate on whether European competition rules should foster European industrial champions, or allow national champions

I. Introduction

The European Commission’s prohibition of the Siemens-Alstom tie-up in February 2019 re-invigorated the debate on whether European competition rules should foster European industrial champions, or allow national champions to grow to a European scale. More recently, Bruno Le Maire, the French minister of the economy and finance, noted in a recent speech at Bruegel that competition policy was vital to allow European companies to grow and be world leaders and that one of the major tasks of the new Commission would be to adapt European competition rules to address new economic realities.

Strange (1990)[1] refers to champions as “firms given favourable treatment by the state to help them maintain a dominant presence in the home market and a competitive share in the world market”. While there may be a consensus that champions seek favourable treatment, there is no clear definition of what constitutes a ‘champion’ in the first place (Maincent & Navarro). While the term “champion” may be politically expedient, there is no accepted definition of what makes a company qualify as a “champion”. This is not a semantic debate; without an effective definition, state intervention to assist a Champion may be based on purely public choice criteria or special interest pleading and therefore be a significant drag on the economy.

In this post, we explore criteria that one would intuitively ascribe to industrial champions. We illustrate the difficulties in defining either ‘European’ or ‘Champion’. We also briefly look into whether EU Merger decisions have impeded the formation of ‘European Champions’.

II. What are the intuitive criteria for ‘Champions’?

As a starting point, for criteria to classify a company as a ‘champion’, we look at some classic indicators of economic footprint or economic ‘scale’. These are market capitalization, total revenues or sales, fixed assets, employee numbers and R&D expenditure.

Below we list the 20 EU28-domiciled companies that have the lowest aggregate rank when looking at market capitalization, total revenues, fixed assets, employee numbers and R&D investment in 2017. Some divergence in the ranks per category becomes apparent:

Taking a broader dataset of the top 500 companies domiciled in Europe (excluding R&D investment) reveals a large number of companies ticking most these core boxes, but not all. Not all ‘leading’ companies qualify equally in each category.Note: Rank for market cap, revenue, total fixed assets and number of employees based on data from Bloomberg for the calendar year 2017. R&D Expenditure based on the JRC R&D Scoreboard for 2017. The 20 companies listed are those whose sum of ranking is the lowest. Purely financial companies have been excluded.

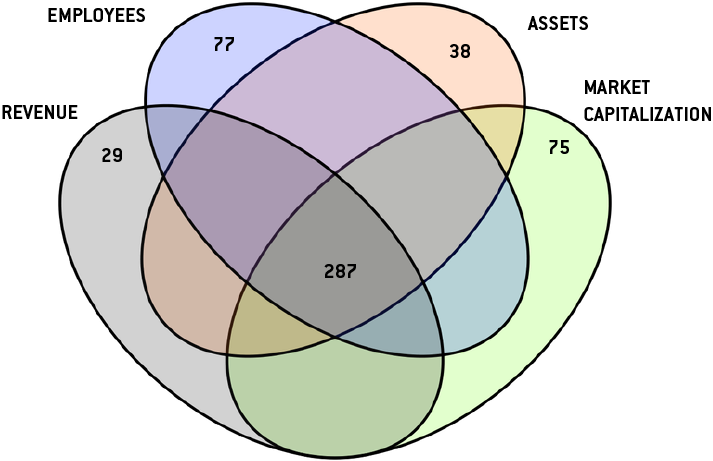

One immediate question, therefore, is whether some of these criteria are more important than others. For example, there are 77 companies, domiciled in Europe, which are in the TOP500 employers but are not in the TOP500 as measured by market capitalisation, revenue, or even assets, as observable in Figure 1.

Fig.1 Top 500 companies domiciled in Europe by Revenue, Market Cap, Employees and Total Fixed Assets (excludes financial companies)

Note: The Venn Diagram shows, in the centre, how many companies belong to the TOP500 by the 4 criteria considered, and, in the 4 edges, how many companies belong to the TOP500 only by the criteria adjacent to the ellipse. The remaining intersections are not depicted for the sake of readability.

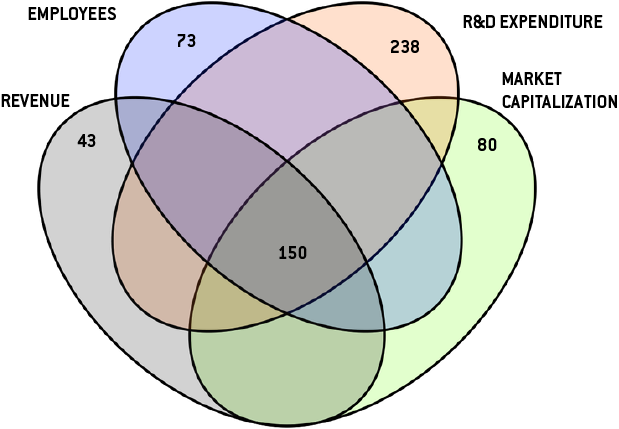

Given the importance of R&D to leadership, one would expect to see R&D-intensive companies amongst the core group of ‘champions’. However, when replacing fixed assets criteria with R&D Expenditure criteria, approximately 50% of the 500 TOP R&D investors in Europe are not part of the TOP500 by any other criteria. For instance, the third biggest R&D spender in Europe in 2017, Robert Bosch, is not in the TOP500 by any other criteria.

Fig. 2 Top 500 companies domiciled in Europe by Revenue, Market Cap, Employees and R&D Expenditure (excludes financial companies)

Note: The Venn Diagram shows, in the centre, how many companies belong to the TOP500 by the 4 criteria considered, and, in the 4 edges, how many companies belong to the TOP500 only by the criteria adjacent to the ellipse. The remaining intersections are not depicted for the sake of readability.

These figures are not dispositive, but they show that classic indicators of economic footprint are not always present in leading companies and that rankings vary significantly. Therefore, it becomes difficult to set out a rigorous set of essential indicators to assess ‘championship’.

We must assume that a leading R&D intensive firm, even if small, could still be considered a ‘champion’, given that innovation is often determinant to effectively compete. Competition Commissioner Vestager has indicated as much, noting that “We have already many examples of companies that are flying high in global markets” namely Dopplemayr, an Austria cable car company and Sygic, a Slovak GPS navigation applications developer, both highly innovative companies.

Many of the companies considered above are leaders worldwide. 48 of the 287 companies identified in the centre of the Venn Diagram of Figure 1, that is, that are in TOP500 of EU-domiciled companies by the 4 criteria used, are in their sectors’ TOP25 by market capitalisation worldwide, even when using broad sector classifications. This is the case for numerous energy companies such as Shell, BP or Total; but also for Louis Vuitton, Sanofi or Volkswagen[2]. More concerning, therefore, is the absence of European leaders in certain R&D-intensive sectors, such as ICT and health-related sectors, which have been expanding rapidly (Maincent & Navarro, Mosconi). A look at the sectoral breakdown of the 287 EU28 ‘champions’, versus the equivalent 260 US ‘champions’, confirms this reality endures – only 2.8% of EU28 champions operate in Healthcare related industries (14th most represented sector), against 8.8% in the US (3rd biggest sector). Meanwhile, the EU has relative strength in ‘traditional’ sectors, with 6.6% of top companies operating in the Automobiles & Components sector, versus only 2.7% in the US.

We have used the TOP500 as a proxy, but of course this wouldn’t mean that a company not in the TOP500 is excluded from the accolade of “champion”. We did not seek to investigate what the threshold of critical assets would need to be reached for a company to ‘qualify’ as champion. Nor have we considered qualitative elements, say, quality of employment.

In addition, while scale may help in a company claiming “champion-ship”, scale is relative to the size of the market(s) in which they are active. A ‘champion’ could be relatively small, but large in relation to their sector. As Commissioner Vestager noted, small and medium sized companies which provide specialised products or services could qualify, where they lead in their niche markets – especially if they successfully export outside the EU.

What is more, even these classic indicators of economic footprint are open to criticism. In considering European champions, the European Political Studies Centre (2019)[3] noted that, in the digital economy, market value no longer corresponds merely to physical assets or employment numbers but rather to intangible assets such as data, online user-base, intangible property (software, design, patents, business secrets) and other ingredients that are key to modern-day success. Were these elements added to the mix, further heterogeneity would transpire amongst European companies with a significant economic footprint.

III. What does it mean to be ‘European’?

Domicile

Classically, ‘European-ness’ may stem from where corporate decisions are taken. In the analysis above, only companies domiciled in Europe have been considered. Ensuring proximity between where significant investment decisions are taken and the political centre can be an important factor in choosing where to locate corporate headquarter. However, Reich (1990)[4] notes that where the headquarters are or who ‘controls’ a company is actually less relevant to the impact on economic future, than where production occurs or where investments are made. Indeed, he notes that in any event companies are not in a position to put national interest ahead of company or shareholder interests. And while political focus on particular companies may occur for a certain period, at some stage the interests of the company may well diverge.

In fact, in a modern global context, supply chains, corporate tax considerations and the need to be present in multiple markets means that revenues and employees of international companies are spread across the world (Veron (2006)) so that domicile is generally a legal and tax matter, unrelated to ‘nationality’ per se.

Ownership

Ownership would logically be one of the most important criteria of ‘European-ness’. Yet, in a modern economy, ownership of firms is diffuse, spread amongst thousands of ever-shifting shareholders, many of the most important of which will be institutional investors.

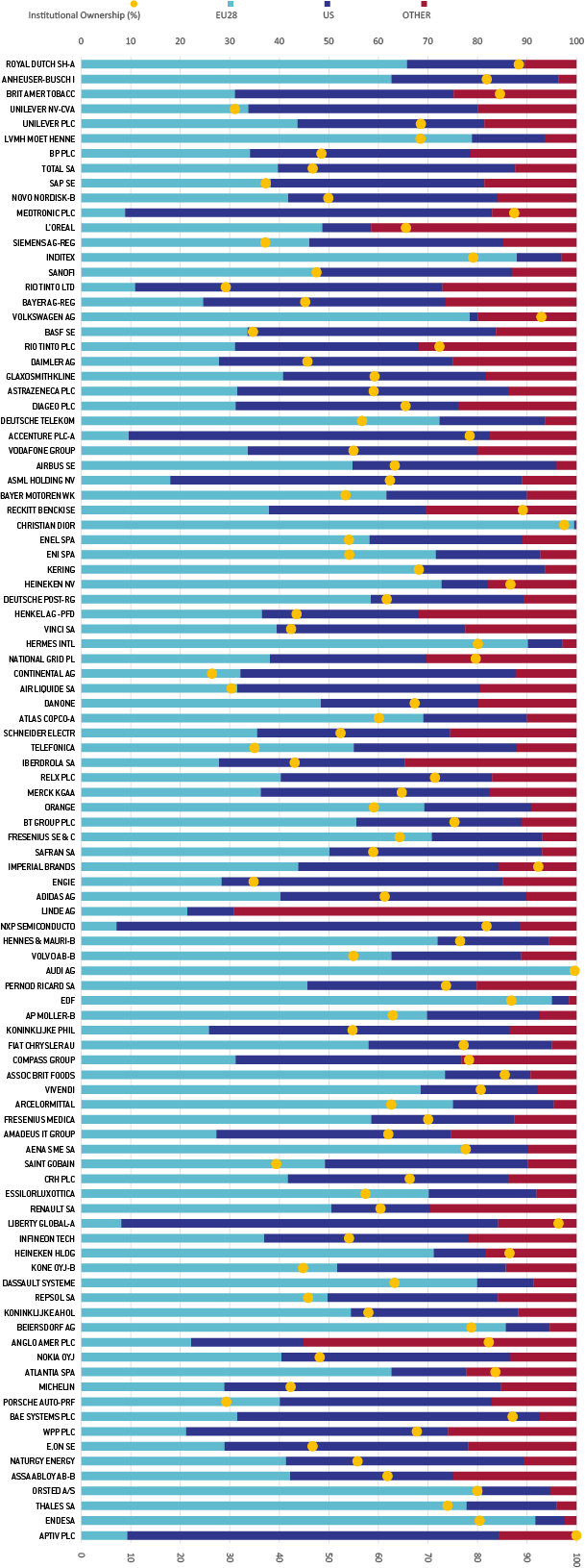

When looking into institutional ownership, it comes as no surprise to see that a great share of companies domiciled in Europe are significantly owned by holding companies and financial institutions, often from outside Europe – and often from the US. On average, only 46% of institutional ownership of the top 100 companies domiciled in the EU28 sits in EU28 institutions. The graph below illustrates the institutional ownership paradigm:

Fig.3 Institutional Ownership of TOP100 EU28 (by domicile) companies by market capitalisation

Note: Companies from the Financial Sector are excluded. The yellow markers signal what percentage of the company is institutionally owned. The stacked bars represent, out of that percentage of institutional ownership, what proportion sits in EU28 institutions, in US institutions, or elsewhere. Not all companies’ names depicted for readability. Bruegel analysis based on Bloomberg data.

It would seem therefore that ownership does not help in identifying what is ‘European’ to any level of certainty. Nor would there be a logic in excluding European domiciled companies merely because they are majorly owned by foreign shareholders.

IV. Is the EU Merger Policy impeding the formation of Champions?

One of the questions raised is whether the European Commission is impeding the proliferation of European Champions through its application of the merger rules. However, out of 4680 transactions notified to the Commission under the EU Merger Control Regulation (Council Regulation 139/2004), i.e., those transactions scrutinised by the European Commission, only 11 notifications were prohibited (out of 106 reviewed in Phase 2) with 17 notifications aborted/withdrawn before a final decision was taken[5]. The Commission has imposed remedies on 60 mergers as a condition of clearance at Phase 2[6].

If we look at which companies were involved in Phase 2 merger investigations since 2005, 49 EU-domiciled companies belonged to the TOP1000 R&D European spenders. Of these, 43 always saw their transactions approved after Phase 2 investigations and only 6 (12.2%) saw them prohibited at least once (i.e. Siemens, Alstom, Deutsche Börse, HeidelbergCement, TelefonicaUK and ThyssenKrupp). This number is not statistically different (and is actually smaller) than the 12.6% of non-TOP EU R&D spenders involved in Phase 2 investigated transactions which saw them blocked (i.e. 13 out of 103 EU-domiciled companies involved in mergers which were not in the top R&D spenders had their transactions blocked) [8]. Source: EC Merger Cases Search Page[7].

When breaking down the number according to the other economic footprint criteria ‘champions’ do not appear to be discriminated against. From the EU-domiciled companies involved in mergers, 41 were in the TOP500 by market capitalisation and of these, 36 always saw their transactions approved in Phase 2. In other words, out of 41 ‘market-capitalisation’ champions, 36 always saw their transactions approved in Phase 2. Out of 40 ‘revenue-champions’, 35 had their mergers approved. So did 33 out of 37 ‘employment-champions’ and 37 out of 42 ‘asset-champions’[9]. These amount to negligible differences between ‘champions’ and ‘non-champions’ in terms of probability of transaction approval[10].

In terms of remedies, the scenario is different. Under every criteria, ‘champions’ are more likely to see remedies imposed. The difference is most striking when considering assets: 71% of companies (30/42) which qualified as ‘champions’ under the asset criteria saw, at least once, remedies imposed by the EC or their transactions blocked, a statistically higher percentage than for non ‘asset-champions’ (55%). Companies which are champions according to market capitalisation are also more likely to see remedies imposed (statistically significant)[11]. ‘Champions’ are typically able to design remedies in a way which the Commission considers satisfactory for regulatory clearance.

Examples of companies which saw their transactions approved include KLM (with its acquisition of Martinair); Bayer, with its acquisition of Monsanto; or Gemalto and Thales. Others saw their mergers approved without any need for a Phase 2 investigations, for instance, Lafarge/Holcim (approved in Phase 1 in 2014), or without any remedies in Phase 2 – e.g. Essilor/Luxottica (in 2018).

Many of these companies are worldwide leaders, such as the BASF/Solvay 2019 transaction, where the Commission allowed a large(r) European player to sprout from a German and a Belgian company, respectively, the 8th and 93rd largest materials producers worldwide. Siemens itself saw its acquisition of Dresser Rand unconditionally cleared in 2015 and its takeover of VA Tech cleared with conditions in 2019.

It therefore appears that the accusation that the Commission is actively preventing ‘European Champions’ from consolidating or targeting specific companies is not supported by evidence.

V. Conclusion

Establishing a robust, consistent criteria or threshold to enshrine a ‘European Champions’ policy, that would permit derogation from competition law, is plagued with difficulties. If not clearly defined, the denomination of ‘champion’ would effectively be arbitrary and open to abuse. The more vague statutory mandates or rules are, the more likely they are to be abused and make the decision maker less accountable[12].

It also does not appear that EC merger control is more likely to block mergers by ‘larger’ EU players, as long as appropriate remedies are put in place. It might be argued, too, that the EU is not lacking in ‘Champions’, but more accurately, is lacking champions in particular sectors.

There can be no objection to industrial champions emerging, provided that their status is achieved as a result of the operation of free-market competition (OECD 2009[13]). However, if firms are not able to compete because they are inefficient, industrial policy should rather look to the root of the inefficiency, not compensate for it. Globalisation and inter-dependency has ended the old trope of countries competing against each other; industrial champions being a reflection of that (Riess & Välilä 2006)[14]. The current discussion on industrial champions is related to growing mercantilist trends; the meshing of geo-political strategies of states straying into economic and technological struggles (Pisani-Ferry & Wolff 2019)[15].

A bold investment programme and a strategic focus would address many of the concerns of defenders of an EU champions policy in the following ways: (a) in certain industries infant companies need specialized knowledge, experience, and support in relation to start-up costs; (b) subsidies can attract internationally mobile researcher talent; (c) the promotion of agglomeration of clusters can help participants to become more innovative and competitive; (d) government investments can supplement large companies investments in plants and equipment, thereby enhancing their productivity. As put by Wolff and Petropoulos (2019) [16], looser merger rules are unlikely to be the answer to concerns about EU long-term competitiveness. Rather than focusing on derogations from competition rules, it is R&D and education investments, targeted to the high-innovation sectors, where the EU is falling behind, alongside deepening the single market through promoting ecosystems and value chains, which can help the EU industrial sectors triumph.

[1] Susan Strange,'The Retreat of the State: The Diffusion of Power in the World Economy’ (1996).

[2] When considering the highest-level of the Global Industry Classification Standard (GCIS).

[3] European Political Strategy Centre (EPSC), EU Industrial Policy After Siemens-Alstom: Finding a new balance between openness and protection, 18 March 2019. Available at: https://ec.europa.eu/epsc/publications/other-publications/eu-industrial-policy-after-siemens-alstom_en

[4] Reich R., ‘Who is Us?’, 1990, Harvard Business Review, Jan-Feb

[5] 4680 refers to transactions which were cleared without further investigation – under Article 6 (2) -, or which were decided on the basis of articles 8(1), 8(2) or 8(3). Transactions notified without falling within the scope of the regulation (under article 6 (1) (a)) have not been counted.

[6] Phase 2 relates to merger decisions under Article 8 of the Council Regulation 139/2004, of which 11 have been blocked - Article 8(3) -, 60 have been cleared under conditions - Article 8 (2) - and 35 have been cleared without conditions – Article 8(1).

[7] http://ec.europa.eu/competition/elojade/isef/

[8] A company was in this comparison considered a TOP1000 R&D European spenders if it was ever listed in the JRC R&D Scoreboard (2003 to 2017 editions). Financial companies were considered.

[9] A company was in this comparison considered a ‘champion’ according to each criterion if it ranked in the TOP500 EU-domiciled companies by such criterion, as in Figure 1. Financial companies were excluded.

[10] Regardless of the criteria considered, ‘champions’ do not have statistically higher probabilities of seeing their mergers blocked as evaluated by one-sided z-tests (and no different probabilities as evaluated by chi-square tests).

[11] It was tested whether the proportion of ‘champions’ ever having transactions blocked or remedies imposed was higher than for ‘non-champions’ through one-sided z-tests.

[12] Dorsey E., Rybnicek J. and Wright J., ‘Hipster Antitrust Meets Public Choice Economics: The Consumer Welfare Standard, Rule of Law, And Rent Seeking’, 2018, CPI Antitrust Chronicle, April 2018.

[13] “To reduce the potential for conflict between industrial policy and competition policy one can adopt an industrial policy that promotes national champions only in those sectors where it is justified and necessary for enhancing the competitiveness of the economy in question”. OECD Competition Committee Global Forum Roundtable on Competition Policy, Industrial Policy and National Champions (2009). Available at https://www.oecd.org/daf/competition/44548025.pdf

[14] Armin R. and Timo V.,’Industrial policy: a tale of innovators, champions, and B52s’, 2006, EIB Papers, European Investment Bank, Economics Department, No 1/2006.

[15] Pisani-Ferry J. and Wolff G., ‘The threats to the European Union’s economic sovereignty’, Bruegel Policy Brief, 4 July 2019.

[16] Petropoulos G. and Wolff G., ‘What can the EU do to keep its firm globally relevant?’, 2019, Bruegel blogpost, available at https://bruegel.org/2019/02/what-can-the-eu-do-to-keep-its-firms-global…