Energy across the Mediterranean: a call for realism

After almost two decades of unproductive regional cooperation attempts, the EU should reshape its energy cooperation efforts in the Mediterranean thro

The issue

This paper was produced within the framework of the Bruegel- OCP PC joint conference.

Political instability in the southern Mediterranean countries have highlighted the unsustainability of their economic models. Widespread economic discontent, and in particular very high youth unemployment, underpinned the Arab Spring uprisings. As the refugee crisis shows, this is also Europe’s problem and Euro-Mediterranean economic cooperation needs to be reviewed. Energy is a key part of the cooperation framework.

Policy challenge

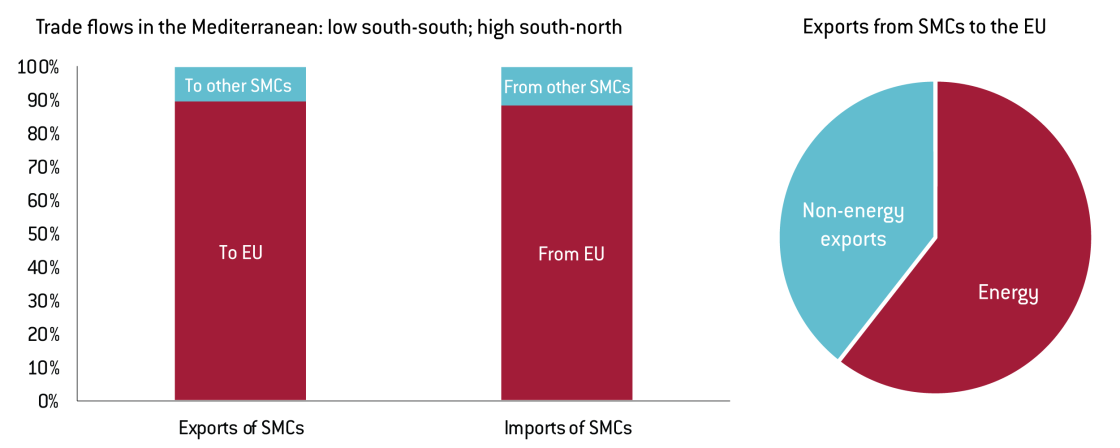

Trade links between southern Mediterranean countries (SMCs) are very limited and they trade mainly with the European Union. Energy represents more than half of SMC exports to the EU. While the regional energy relationships were developed on a bilateral basis, the EU’s Mediterranean energy policy has followed a regional approach, aimed at harmonising energy policies and regulatory frameworks in the region on the path to a Euro-Mediterranean energy market. This approach has proved unproductive and should change. The EU should pursue bilateral energy policies through public-private partnerships involving the European Bank for Reconstruction and Development (EBRD), EU companies and selected SMCs. This would allow support to be provided for sustainable energy in partner countries, improving their economic stability and safeguarding the EU’s gas security of supply. It might also represent a business opportunity for EU energy firms in the context of the sluggish EU energy outlook.

Sustainable energy funds for SMCs

Source: Bruegel

For full references and footnotes, please see the PDF version.

Euro-Mediterranean energy cooperation is on the European Union’s agenda in the context of creating an EU Energy Union and of revising the EU Neighbourhood Policy (ENP)1. While until 2014 the EU’s relationship with the southern Mediterranean countries (SMCs) was mainly seen as an issue for France, Italy and Spain (and to some extent the United Kingdom), the migration crisis and energy security concerns during the Ukraine crisis have underlined that developments in SMCs are relevant for the EU as a whole. Defining the strategy at EU level is logical because the interests of member states are quite well aligned and they will achieve significant economic and political leverage if they act together. An aim of EU energy policy is "to develop access to alternative gas suppliers, including [...] from the Mediterranean" (European Commission, 2015). The intention is to reduce the reliance on existing suppliers. In terms of foreign and neighbourhood policy, the EU’s primary objective is to stabilise the region in order to reduce the migration pressure and reverse the spread of radical Islam.

Despite the significant changes that have taken place in the southern Mediterranean, the EU has been slow to adapt its energy and neighbourhood policies. The EU’s policies towards the region continue to be grounded on a multilateral approach, underpinned by the vision of integrating the regional energy markets into a sort of unique Euro-Mediterranean energy community.

The multilateral approach is highlighted in the intergovernmental Union for the Mediterranean (UfM) initiative2. The High Representative of the Union for Foreign Affairs stressed in 2015 that the role of the UfM should be enhanced for "supporting cooperation between southern neighbours"3. Accordingly, it was decided in 20154 to create three energy cooperation platforms: the UfM Gas Platform, UfM Regional Electricity Market Platform5 and the UfM Renewable Energy and Energy Efficiency Platform6 (which will start up during 2016). The aim of these platforms is to facilitate "partnerships based on mutual trust and transparency between UfM member states as well as with the relevant energy stakeholders in the region"7.

Even though increased regional energy cooperation certainly has economic and political merits, the prospects for these new initiatives are at best limited, for at least five reasons:

- Real energy cooperation in the region has always been, and continues to be, bilateral rather than multilateral or regional8.

- Previously tried regional energy initiatives did not deliver.

- The level of intra-regional trade in the southern Mediterranean is among the lowest in the world (Figure 1). This not because of a lack of economic complementarity, but rather because of a lack of political trust among the SMCs.

- The geopolitical situation has massively deteriorated in recent years, further limiting the potential for regional cooperation.

- The EU viewed energy cooperation as a core pillar of its neighbourhood policy that ‘offered’ individual SMCs a complex policy package to increase cooperation. The whole package was perceived by the SMCs as ‘second class membership’ – and the SMCs thus never took ownership of the entire approach.

Figure 1: The EU’s predominant position in Euro-Mediterranean trade

Source: Bruegel based on UN Comtrade and Eurostat databases (accessed March 2016).

In this context, the EU should rethink its energy policy towards the southern Mediterranean, particularly on renewable energy and energy efficiency, for at least two reasons:

- Political stability in the southern Mediterranean is of paramount important for the EU, and in the longer term, there is no political stability without economic development. But the economic development of the region is jeopardised by unsustainable energy sectors, characterised by growing demand and rising costs at a time when investment and production are declining.

- Energy in the SMCs is a challenge, but also a great opportunity. Energy demand in the region is growing strongly and there is also significant energy production potential. This represents a business opportunity for European energy companies, and should be particularly welcome given the sluggish energy outlook within Europe. Supporting the sustainable energy transition in SMCs might thus also be an avenue for the European energy industry to expand into an emerging market that is also on the radar of others, such as China and Russia. The expansion opportunity should be welcomed by European electric utilities, companies specialised in manufacturing renewable energy and energy efficiency solutions and also by European oil and gas companies that are willing to diversify their portfolios in the framework of the broader global energy transition. Furthermore, the SMCs could be a stepping stone to engage in other parts of Africa, where there is also a growing need for reliable and clean energy.

A regional policy approach... without a region?

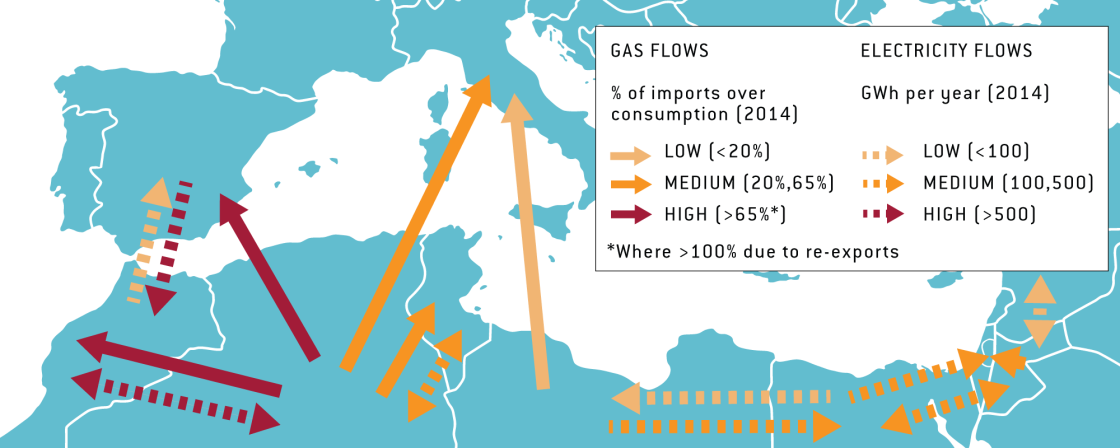

The Euro-Mediterranean energy relationship dates back to the 1970s, when work started on the first large-scale energy infrastructure project – a gas pipeline connecting Algeria to Italy via Tunisia. Since then, more than 7,000 kilometres of gas pipelines have been laid across the region, to connect Algeria with Spain and Italy, Libya with Italy, and Egypt with Israel, Jordan, Lebanon and Syria.

Large-scale oil and liquefied natural gas (LNG) infrastructure has been constructed all around the Mediterranean, as have some electricity interconnections. Successful projects, especially in the gas sector, have been built on bilateral state-to-state and company-to-company relationships between producers in the SMCs and importers in the north.

The Euro-Mediterranean energy relationship has never switched from this bilateral approach to a more regional approach (Figure 2), although some large-scale regional energy projects have been attempted over the last two decades, particularly in the renewable energy sector.

Figure 2: Euro-Mediterranean energy relationships: bilateral and fragmented

Source: Bruegel based on MEDREG (2015) and Eurostat (accessed March 2016).

In 2003 the Trans-Mediterranean Renewable Energy Cooperation (TREC) initiative9 was started, with the aim of unlocking the renewable energy potential of the region through cooperation "as if there were no borders"10. Between 2007 and 2009, this initiative evolved into the Desertec project, which was specifically focused on tapping into the potential of North African and Middle Eastern deserts to supply clean power (solar and wind) to those regions and to Europe. Desertec was politically backed by the EU11, and also gathered support from European companies and banks. However, Desertec failed to deliver. By 2014, 47 of the 50 initial Desertec shareholders had left the consortium, de facto marking the end of the project.

The Mediterranean Solar Plan (MSP) initiative suffered the same fate. Started in 2008 as a UfM flagship initiative, this project also aimed to export solar and wind power to Europe. The MSP was supported by the European Commission, which also promoted cooperation between this project and Desertec. In 2013, the UfM secretariat elaborated a new MSP master plan . However, the UfM energy ministers ultimately did not endorse the master plan, de facto dissolving the MSP project13.

Desertec and the MSP both failed because of lack of realism. On the commercial side, the business model based on the export to the EU of solar and wind electricity produced in SMCs was simply not viable because of: i) high electricity generation costs; ii) lack of electricity interconnections between SMCs and between the northern and southern Mediterranean shores; and iii) the lack of a clear need on the EU side for additional renewable energy capacity. Politically, both initiatives proved unrealistic because they sought to take an unviable one-size-fits-all approach in the region, and because they did not properly take into account the essential priority for the SMCs: to ensure they could meet their own future energy demand, not the EU’s. On top of these weaknesses, the combined effect of the economic crisis and of the uprisings in Arab countries delivered the coup de grace to the projects14.

A key pillar of the EU’s energy policy in the neighbourhood was to promote the take-up of EU energy policy principles, in particular liberalisation, and EU energy legislation. In the Balkans and eastern Europe, participation in the Energy Community committed countries to adopt the acquis communitaire into their national energy legislation. This was supposed to create a stable legal environment, which would be conducive to the much-needed private investment. The partner countries also used their Energy Community membership as a signal that they are interested in EU accession. Without a prospect of accession, SMCs were not asked for, and did not offer, full harmonisation with EU energy rules. Nevertheless, the Action Plans that are a backbone of European Neighbourhood Policy foresee gradual convergence towards European rules. In 2003, for example, a ‘Memorandum of Understanding for the progressive integration of electricity markets of Algeria, Morocco and Tunisia and in the EU electricity internal market’ was signed14. The creation of Mediterranean associations of regulators15 and transmission system operators16 in 2007 and 2012 also somewhat followed the blueprint of EU internal market integration. But, apart from sharing best practices, the implications have been limited. It is thus time to question whether the export of EU energy rules to the SMCs serves the purposes of either side.

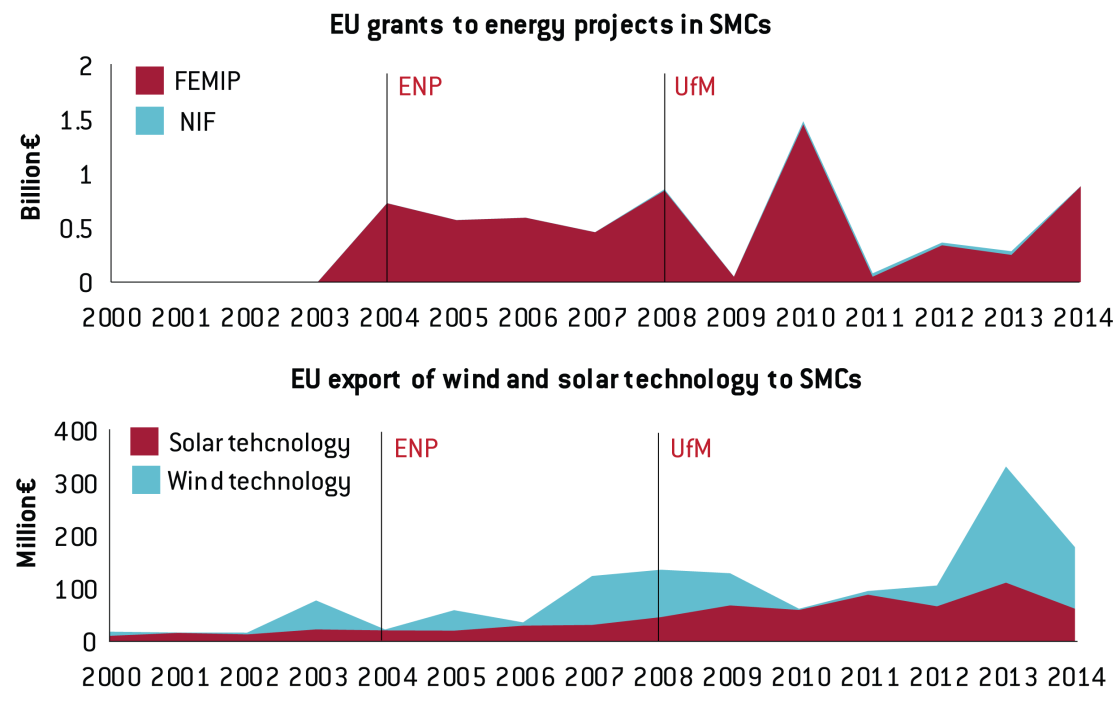

Also from a wider perspective the regionalist approach had no concrete impact on the evolution of energy cooperation in the region. The history of EU grants to energy projects in SMCs and EU exports of solar and wind technologies to SMCs (Figure 3) indicates the lack of concrete impact in the context of either ENP or the UfM.

Figure 3: EU grants to energy projects and export of solar and wind technologies to SMCs

Source: Bruegel based on European Investment Bank and UN Comtrade database (accessed March 2016). Note: FEMIP = Facility for Euro-Mediterranean Investment and Partnership; NIF = Neighborhood Investment Facility.

While the regional approach did not deliver in the past, it has become close to impossible today. The civil war in Syria, the implosion of Libya, the controversial political situation in Egypt, the uncertain political outlook in Algeria and rise of radical Islam indicate an increasing level of geopolitical fragmentation on the southern shore of the Mediterranean. A homogeneous region does not exist.

Back to basics: what aims for Euro-mediterranean energy cooperation?

How could the Euro-Mediterranean energy relationship be better structured? Structuring cooperation starts with identifying common goals. We identify three main aims for Euro-Mediterranean energy cooperation:

- Supporting the SMCs in meeting their energy challenges for the stake of stability and growth;

- Supporting a transition to sustainable energy in SMCs for climate change mitigation and also for macroeconomic sustainability;

- ensuring the sustainability of current gas exports from SMCs to the EU.

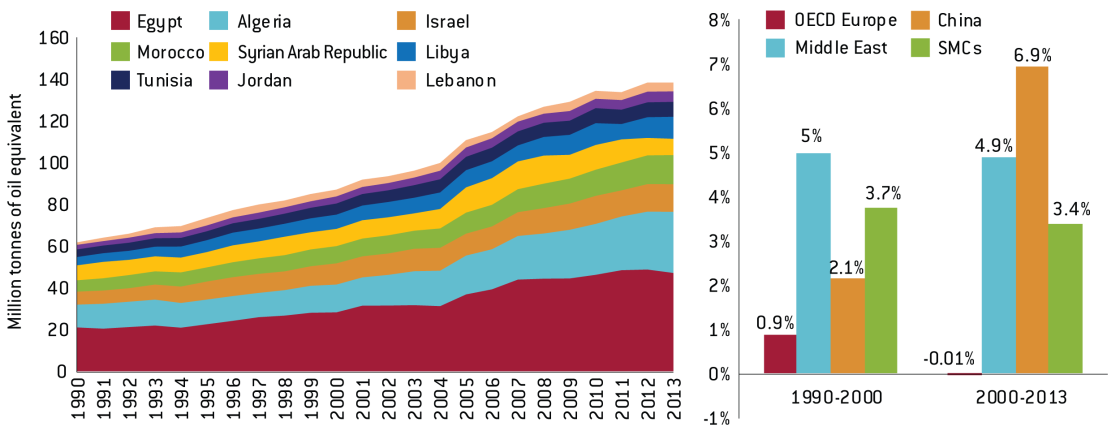

First, it should be noted that the key energy challenge for SMCs will be to meet their own rapidly growing energy demand in a secure and competitive way. As Figure 4 shows, the total final energy consumption of SMCs has continuously grown over the last few decades. Up to 2000, this growth occurred at an even greater pace than China. Between 2000 and 2013, the SMCs maintained their growth rate at a level of about 3.4 percent, compared to 0 percent in OECD Europe.

Figure 4: Total final energy consumption in SMCs and international comparison of average growth rates

Source: Bruegel based on International Energy Agency database (accessed March 2016)

Energy demand in SMCs will continue to grow in the future, mainly in response to population and GDP growth. The challenge of rising energy demand will have to be tackled in a sustainable manner by SMCs, not primarily to mitigate climate change but to ensure macroeconomic stability. Between 2008 and 2014 the net energy exports of SMCs dropped – despite similar oil prices in both years – by more than 30 percent in US dollar terms. The decline in net exports represents about 3 percent of the current GDP of SMCs. Consequently, for SMCs simply burning more fossil fuels does not seem to be a sustainable, long-run answer. At the same time countries including Egypt, Algeria, Libya and Lebanon devote about 10 percent of their GDP to energy subsidies. In 2015, energy subsidies constituted a burden of $35 billion on Egypt's public finances, and this number could quickly rise if oil prices increase again. In 2013 – before oil prices dropped by 65 percent – subsidies in Egypt were $45 billion (Coady et al, 2015). Thus, fossil fuel subsidy schemes in several SMCs will have to be reformed17 to reduce wasteful energy consumption and to improve fiscal sustainability18.

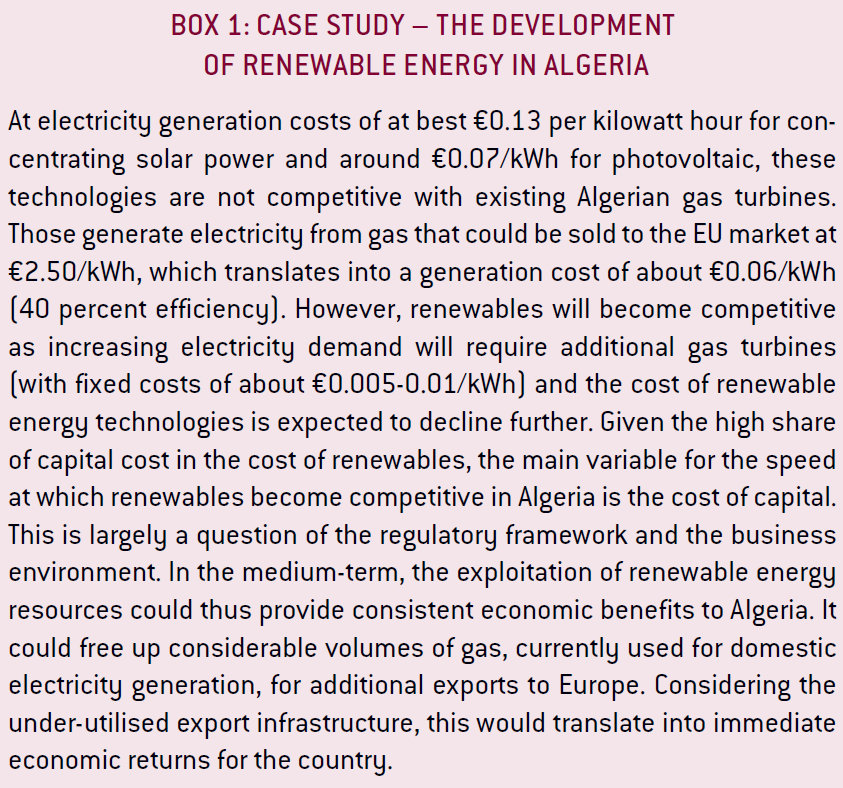

Eliminating energy subsidies will improve the competitiveness of renewable energy and energy efficient solutions. This will be crucial not only to meet the SMCs' growing energy demand, but also to maintain gas exports to Europe. Egypt recently showed how a traditional gas exporter could suddenly turn into an importer because of rapidly growing domestic demand. In order to continue to supply their gas to Europe, Algeria, Libya and Egypt (which might again become an exporter in the future), will have to tap into their renewable energy and energy efficiency potentials (see Box 1).

Maintaining gas exports would be beneficial for the countries because it would ensure a stable stream of revenues that could be used for investment in renewables and efficiency. It would also be beneficial for the EU because it would guarantee the stability of imports from the southern Mediterranean region, which are an important element of the EU’s gas security-of-supply architecture20.

How to support the regional sustainable energy transition

Given the fragmentation of the regional energy landscape in the southern Mediterranean, there is no sensible one-size-fits-all approach for structuring cooperation. Rather than the new UfM Renewable Energy and Energy Efficiency Platform, solid bilateral partnerships between the EU and selected countries in the region are needed to reinvigorate the Euro-Mediterranean energy relationship.

This also means that not all the countries need to be engaged in such an exercise. For instance, given their current geopolitical situations, neither Syria nor Libya could easily be involved. Meanwhile, Israel is not in need of EU support and there is limited scope for special cooperation. For the other seven SMCs, barriers preventing the development of renewable energy and energy efficiency projects differ greatly, so a tailored approach should be adopted instead of a region-wide, one-size-fits-all, approach.

The Energy Union Communication proposed the establishment of 'Strategic Energy Partnerships' (European Commission, 2015) to enhance energy cooperation with key producing and transit countries, and in the southern Mediterranean this exercise is already being carried out with Algeria. However, such an approach might not be effective in SMCs, as it might be, for instance, with Turkey, where a strategic partnership might allow the EU and Turkey to use their complementary leverages in potential gas-supplying regions and transit countries to enable new projects (Tagliapietra and Zachmann, 2015). In short, such clear-cut cases seem to be less evident in SMCs. Furthermore, this approach entails the risk of over-politicising the process. In practice, bringing the top policymakers from both sides around a table to discuss energy cooperation might entail a level of abstraction that is not useful for the development of concrete projects. Moreover, this kind of approach might even jeopardise the energy discussion because of interference from other political dossiers on the table.

From our perspective, a better approach to support the sustainable energy transition of SMCs would be to focus the cooperation on the rising financial player in the region: the European Bank for Reconstruction and Development (EBRD).

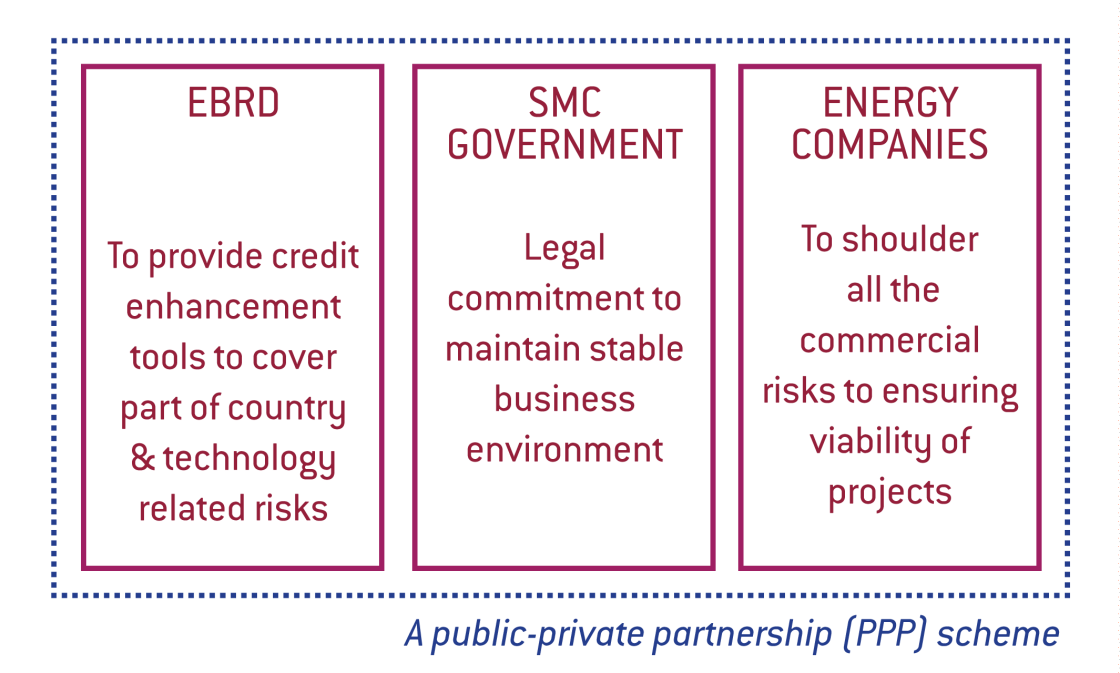

The EBRD could establish new ‘Sustainable Energy Funds’ with selected SMCs. This mechanism would be a public-private partnership (PPP) involving the bank, the government of the selected country, international energy companies operating in the country and institutional investors willing to make a long-term investment. The scheme would work as follows:

- The EBRD would provide risk-mitigation and credit-enhancement tools to cover the country risk faced by international energy companies and institutional investors. This risk might change over time, as the political situation in a country evolves. Reducing the risk can enable the country to attract more investment because of lower interest rates, in effect providing an investment insurance mechanism;

- International energy companies and institutional investors would take on the commercial risk, to ensure the commercial viability of the projects proposed;

- The government of the selected country would contribute by legally committing to maintain stable regulatory conditions for the given project. Should they fail to do so, the banks will discontinue lending – and the EU will exercise some political and economic leverage to ensure repayment of existing obligations.

This PPP mechanism should be able to provide a solid response to the evidence that investors might jump into the SMCs' sustainable energy sector only if a proper risk-adjusted return is considered as guaranteed.

Considering its experience in transition countries and reputation, the EBRD seems to be the institution best placed to promote these new 'Sustainable Energy Funds'.

Conclusions

After almost two decades of unproductive regional cooperation attempts, the EU should reshape its energy cooperation efforts in the Mediterranean through new bilateral approaches. In concrete terms, we propose the establishment of Sustainable Energy Funds with selected SMCs. This would allow support to be provided to sustainable energy projects in partner countries, making them more economically stable and safeguarding the EU’s gas security of supply. This might also represent a significant business opportunity for the EU energy industry, especially in the context of the sluggish EU energy outlook.

The authors thank Domenico Favoino for excellent research assistance.