Dynamic scoring and budget forecasting

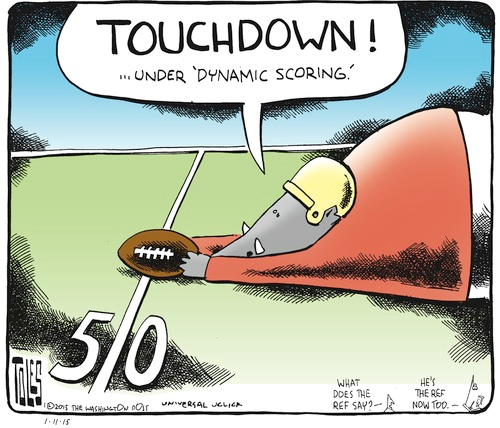

What’s at stake: In January, House Republicans formally adopted a budgeting rule known as “dynamic scoring”, which aims to account for the macroeconomic effects of major legislations. While the move from static to dynamic scoring makes economic sense, some worry that it will invite politicized scorekeeping.

Source: Econbrowser

Gregory Mankiw writes that the new appointed CBO director, Keith Hall, will face a big challenge. Until now, conventional budget analysis has used a process called static scoring, which assumes that the path of gross domestic product remains the same when the government changes taxes or spending. This procedure has the virtues of simplicity and transparency. Yet the assumption of unchanged G.D.P. has one notable drawback: It is patently false. House Republicans have recently changed the rules: The Congressional Budget Office and Joint Committee on Taxation are now required to use “dynamic scoring” when evaluating major changes in tax and spending policy.

Alan Auerbach writes that working together, CBO and JCT provide two types of revenue and expenditure projections for Congress: (1) forecasts of expenditures and revenues based on assumptions about what `current’ policy is, and (2) forecasts of the changes in expenditures and revenues that would result from proposed legislation. The first type of forecast is known as a baseline. The second type is called scoring. The two types of forecasts are interdependent. Projected effects of legislation depend on the starting point, so the baseline affects scoring. Updates of the baseline reflect the estimated impact of legislation, so scoring affects the baseline.

Alan Auerbach writes that in a sense, the debate over dynamic scoring may be traced to an inconsistency in the way that legislative changes are handled by the two agencies. Under standard scoring procedures, JCT scores proposed legislation taking the macroeconomic forecast underlying the CBO baseline – including nominal GDP and other aggregates – as given. Macroeconomic feedback effects are ultimately incorporated in CBO’s baseline, but are not attributed by JCT to any source when the proposals are scored.

Donald Marron writes that for more than a decade, CBO and JCT have published dynamic analyses using multiple models and a range of assumptions. The big step in dynamic scoring will be winnowing such multiple estimates into the single set of projections required for official scores. Chye-Ching Huang writes that the new rule indeed asks for an official cost estimate that reflects only a single estimate of a bill’s supposed impact on the economy and the resulting revenue impact.

Pros and cons

Gregory Mankiw writes that the case for dynamic over static scoring is strong in theory. Alan Auerbach writes that arguments in favor of dynamic scoring generally emphasize its consistency with the principles of economic and statistical analysis.

1. Dynamic scoring makes use of all available information.

2. The lack of dynamic scoring biases the legislative process against tax cuts.

3. Current methods impose constraints on scoring that are at odds with economic evidence.

4. Advances in technology and economics strengthen the case for dynamic scoring.

Gregory Mankiw writes that the task is difficult in practice. First, any attempt to estimate the impact of a policy change on G.D.P. requires an economic model. Because reasonable people can disagree about what model, and what parameters of that model, are best, the results from dynamic scoring will always be controversial. Second, accurate dynamic scoring requires more information than congressional proposals typically provide. The impact of the initial tax cut depends crucially on how future Congresses will deal with the revenue shortfall, but budget analysts usually have little to go on but speculation.

Ezra Klein writes that it’s not just Congress whose behavior the CBO will now have to predict. It's also the Federal Reserve. If Congress passed a massive deficit-reduction bill and, in response, the Federal Reserve decided to lower interest rates a bit, that would have a huge effect on the cost of the bill under dynamic scoring. But how is the CBO supposed to read Janet Yellen's mind three years from now?

Alan Auerbach writes that arguments against dynamic scoring point to the technical difficulties of doing it correctly and the political reality of the context in which scoring is done.

1. Dynamic scoring must rely more on assumptions and is susceptible to political pressure.

2. Dynamic scoring would require an impractical integration with the baseline process.

3. Dynamic scoring would have to account for all channels and expenditure-side changes.

4. Dynamic scoring requires assumptions about monetary and fiscal policy reactions.

CBO and JCT credibility

Ezra Klein writes that the trust the CBO and JCT have won is a rare and fragile thing. By adding complexity, it adds more opportunities for political manipulation and partisan skepticism. The CBO isn't particularly transparent in how its models work now. But in a dynamic scoring world, the assumptions built into those models become much more important — and much more contestable. Which study the CBO and JCT end up using on the elasticity of labor in the face of higher marginal tax rates can decide whether a tax hike looks like a great idea or a disaster. If you want to get really sinister about it, as the models require more assumptions, there's more opportunity for tampering. But you don't even need to go that far. More complex, assumption-dependent models increase the importance of sincere disagreements over which research to believe.

Donald Marron writes that cherry picking model assumptions to favor the majority’s policy goals runs against the DNA of both organizations. Even if it didn’t, the discipline of twice-yearly budget baselines discourages cherry picking. Neither agency wants to publish rosy dynamic scenarios that are inconsistent with how they construct their budget baselines. You don’t want to forecast higher GDP when scoring a tax bill enacted in October, and have that GDP disappear in the January baseline.

Jared Bernstein writes that CBO’s estimates should always be delivered to the public with explicit confidence intervals, to better convey to the public the uncertainty of their guesstimates. I was reminded of the need for this approach in their recent report on the impact of the Senate immigration bill on the economy. They reported the following: “CBO’s central estimates also show that average wages for the entire labor force would be 0.1 percent lower in 2023 and 0.5 percent higher in 2033 under the legislation than under current law.” Given the uncertainty of such an estimate—10 and 20 years away!–it seems inconceivable that we could measure such a small change with any degree of accuracy that would distinguish 0.1 percent from good old 0 percent.

Selective Voodoo

Paul Krugman writes that we’re not just looking at a possible mandate for using voodoo in budget estimates, we’re talking about selective voodoo, which incorporates some supposed dynamic effects while ignoring others for which there is if anything stronger evidence. Although we don’t know how CBO will embrace supply-side fantasies, one thing is fairly certain: CBO won’t be applying dynamic scoring to the positive effects of government spending, even though there’s a lot of evidence for such effects. Neither will dynamic scoring be applied to the damage to potential output caused by cutting spending in a depressed economy.

Peter Orszag (HT Econbrowser) writes that dynamically scoring tax proposals but not expenditure programs would create an even larger incentive to transform spending programs into tax incentives, even if that involves unnecessary administrative and economic costs.

Keith Hennessey writes that it’s a little hard to see how one would practically expand the new rule to apply to discretionary spending. The House rule would only apply dynamic scoring to big fiscal policy changes, those with an aggregate static budget impact bigger than 0.25% of GDP (>$45 B per year in 2015). That high de minimis threshold is a smart practical limitation so that CBO doesn’t have to worry about the growth impacts of the cars-for-crushers program or a $50M increase in spending for pet project X. But since nobody is proposing adding >$45B/year to discretionary spending, this limitation in the new rule has no practical impact. But the House rule doesn’t create a bias for tax cuts. It eliminates a pre-existing bias against very large policy changes that would expand the supply side of the economy, including but not limited to broad-based reductions in tax rates.